Charitable & Religious Trust Audit

Charitable and religious trusts serve society by managing funds for philanthropic, religious, and social welfare activities. To maintain transparency, credibility, and legal compliance, these trusts must undergo periodic Charitable & Religious Trust Audits. Legal Kamkaj provides expert audit services to ensure financial accuracy, regulatory compliance, and efficient operations.

A Charitable & Religious Trust Audit helps verify financial records, track donations and expenses, and ensure compliance with statutory regulations. It prevents mismanagement, fraud, and legal issues while building trust among donors, beneficiaries, and authorities. Legal Kamkaj also offers taxation compliance, annual financial reporting, and trust registration services to help organizations meet all legal requirements.

The Charitable & Religious Trust Audit process includes checking financial statements, evaluating fund usage, ensuring legal compliance, and maintaining accountability. A proper audit enhances efficiency, meets tax exemption criteria, and supports the trust’s mission. With Legal Kamkaj’s professional audit and compliance services, trusts can manage finances smoothly and stay legally compliant.

Register Your Trust Audit ?

What is a Charitable & Religious Trust Audit?

A Charitable & Religious Trust Audit is a financial inspection and compliance review process conducted to ensure that charitable and religious trusts manage their funds transparently, legally, and efficiently. These audits help maintain financial accountability, prevent mismanagement, and ensure adherence to legal and regulatory requirements.

Key Objectives of a Charitable & Religious Trust Audit:

- Financial Transparency: Verifies that all income, donations, and expenses are recorded accurately.

- Regulatory Compliance: Ensures the trust adheres to applicable laws, including tax exemptions and reporting requirements.

- Fraud Prevention: Detects and prevents financial mismanagement, unauthorized transactions, and fund misuse.

- Donor & Stakeholder Confidence: Builds trust among donors, beneficiaries, and governing authorities by showcasing proper financial management.

- Tax Benefits & Compliance: Helps trusts qualify for tax exemptions under applicable tax laws.

Benefits of a Charitable & Religious Trust Audit

A Charitable & Religious Trust Audit is essential for maintaining transparency, accountability, and legal compliance. Here are the key benefits:

Ensures Financial Transparency

Maintains accurate financial records and builds trust.

Prevents Fraud & Mismanagement

Detects fund misuse and strengthens financial controls.

Ensures Legal & Tax Compliance

Helps meet tax laws and government regulations.

Builds Credibility

Increases donor confidence and enhances reputation.

Improves Fund Management

Ensures proper use of donations and better planning.

Simplifies Annual Reporting

Prepares financial statements and eases tax filing.

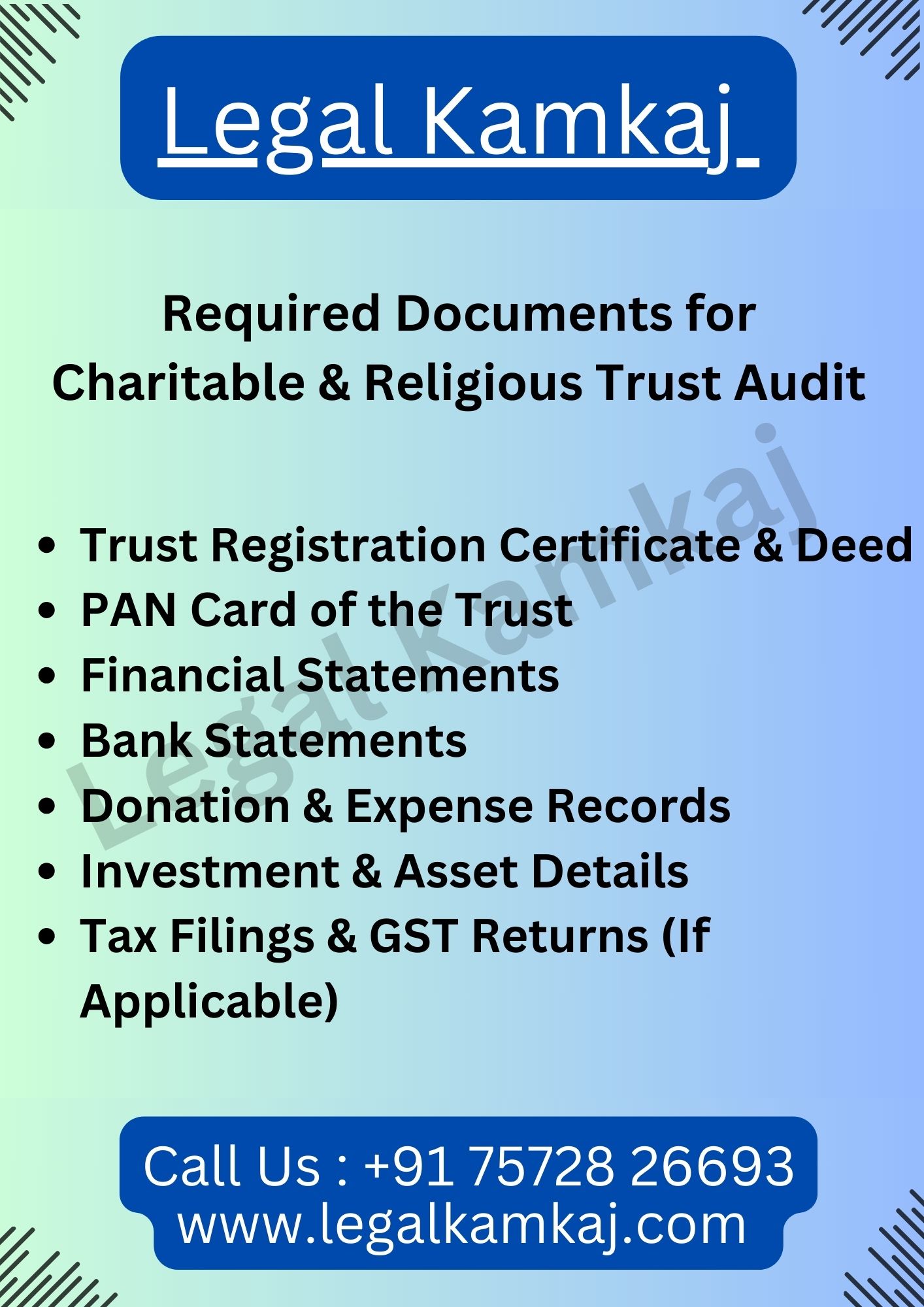

Required Documents for Charitable & Religious Trust Audit

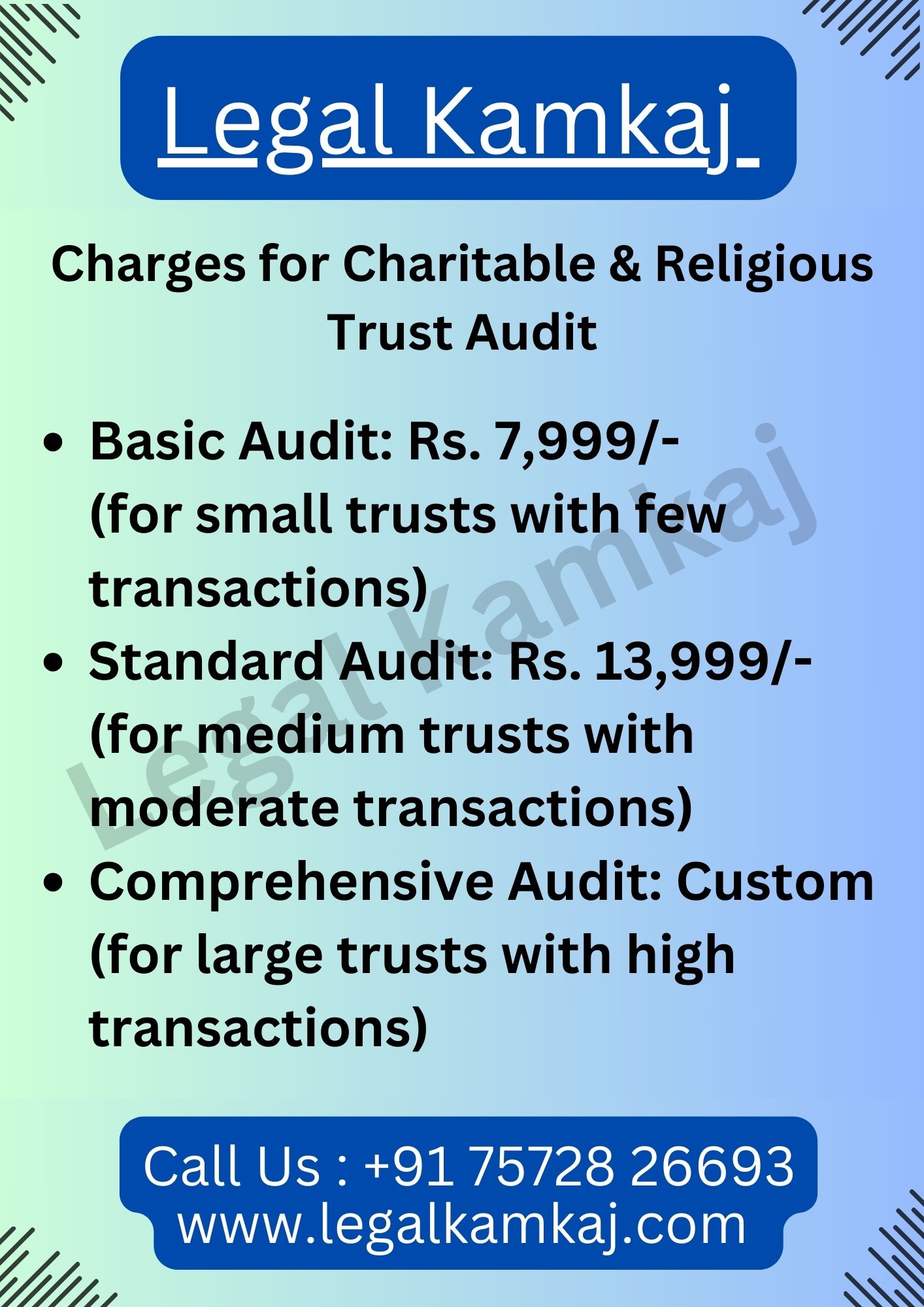

Charges for Charitable & Religious Trust Audit

The cost of a Charitable & Religious Trust Audit varies based on the trust’s size, financial transactions, and compliance needs. Legal Kamkaj offers competitive and transparent pricing.

- Basic Audit: Rs. 7,999/- (for small trusts with few transactions)

- Standard Audit: Rs. 13,999/- (for medium trusts with moderate transactions)

- Comprehensive Audit: Custom (for large trusts with high transactions)

Form 10B – Audit Report for Charitable & Religious Trusts

Form 10B is a mandatory audit report required under Section 12A/12AB of the Income Tax Act, 1961 for charitable and religious trusts seeking tax exemptions. It must be certified by a Chartered Accountant (CA) and filed electronically before the ITR deadline (31st October for audited trusts).

1. Who Needs to File Form 10B?

- Charitable & Religious Trusts registered under Section 12A/12AB

- Trusts whose gross receipts exceed ₹5 crore in a financial year

- Trusts receiving foreign or significant domestic donations

- Trusts applying for tax exemption under Section 11 & 12

- Trusts engaged in educational, medical, or social welfare activities

2. When is Form 10B Required?

- When the trust’s income (before exemption) exceeds the basic exemption limit

- Before filing Income Tax Returns (ITR) to claim exemptions

- Annually, before the due date (31st October for audited trusts)

How to File Form 10B of the Income Tax Act?

Form 10B must be filed online on the Income Tax e-filing portal and certified by a Chartered Accountant (CA). Follow these simple steps:

Step 1: Log in to the Portal

- Go to incometax.gov.in and log in with the Trust’s PAN and password.

Step 2: Select Form 10B

- Click on ‘e-File’ → ‘Income Tax Forms’, search for Form 10B, and select the correct Assessment Year.

Step 3: Fill in the Details

- Enter Trust registration details (12A/12AB), provide income, donations, expenses, and upload financial statements.

Step 4: Get CA Certification

- Assign the form to a Chartered Accountant (CA) for review and certification.

Step 5: Submit Form 10B

- Submit the form online after CA certification and verify using DSC or EVC.

Step 6: File ITR with Form 10B

- Submit ITR-7 along with Form 10B before the deadline (31st October for audited trusts)

Get Your Trust Audit & Form 10B Filing in Just 2 Days

(Fast & Reliable Trust Audit & Form 10B Filing Services Across India)

Step 1 : Submit Documents

Share trust details & financial records.

Step 2 : Trust Audit Process

CA reviews and audits trust accounts.

Step 3 : Form 10B Certification

Compliance check & approval.

Step 4 : Final Submission

Online filing & completion in 2 days.

Why Legal Kamkaj is the Best for Trust Audits?

✅ Expert Assistance : Professional support for Trust Audits & Form 10B filing.

✅ Hassle-Free Process : Quick, easy, and error-free documentation.

✅ Affordable Pricing : Cost-effective solutions for all trust sizes.

✅ 100% Compliance : Ensures legal and tax compliance.

✅ Dedicated Support : Expert guidance for smooth filing.

FAQs on Trust Audit

- A Trust Audit is a financial examination of a trust’s accounts and activities to ensure compliance with legal and regulatory requirements, especially under the Income Tax Act, 1961 and relevant trust laws.

A Trust Audit is mandatory if:

- The total income (before exemptions) exceeds ₹2.5 lakh in a financial year.

- The trust is registered under Section 12AB and claims exemption under Section 11 & 12.

- It receives foreign contributions, requiring compliance with the Foreign Contribution (Regulation) Act (FCRA), 2010.

- It is registered under the Societies Registration Act or the Indian Trusts Act and state laws mandate an audit.

- The audit report in Form 10B must be filed on or before 30th September of the assessment year.