ROC Compliance Filing Services

ROC Compliance Filing is a mandatory requirement for companies and LLPs registered under the Ministry of Corporate Affairs (MCA). Every business entity, whether a Private Limited Company, LLP, OPC, or Public Limited Company, must file its annual returns and financial statements with the Registrar of Companies (ROC) to ensure legal compliance.

At Legal Kamkaj, we provide hassle-free ROC Compliance Filing Services to help businesses meet their statutory obligations on time. Our expert team ensures that your company remains compliant with the Companies Act, 2013, avoiding penalties and legal risks.

With our ROC Compliance Filing Services, you can streamline the filing process and focus on business growth while we handle the complexities of regulatory requirements. Our dedicated professionals assist in timely submissions, ensuring complete compliance.

Choose Legal Kamkaj for ROC Compliance Filing Services and stay ahead with seamless and efficient compliance solutions.

Register Your ROC Compliance Filing ?

What is ROC Compliance Filing?

ROC Compliance Filing refers to the mandatory submission of financial statements, annual returns, and other regulatory documents to the Registrar of Companies (ROC) under the Ministry of Corporate Affairs (MCA). Every registered company, LLP, or OPC in India must comply with these filings to maintain legal status and avoid penalties.

Why is ROC Compliance Important?

- Ensures legal standing of the company

- Avoids penalties & legal consequences

- Maintains transparency & financial credibility

- Essential for business growth & funding opportunities

With Legal Kamkaj, you get expert assistance, timely filings, and complete compliance solutions for all your ROC requirements. Contact us today to streamline your ROC Compliance Filing!

Benefits of Annual ROC Filing

Ensuring timely and accurate ROC Compliance Filing offers several advantages for companies and LLPs. Here’s why Annual ROC Filing is essential:

Avoids Penalties & Legal Issues

Avoids ₹100 per day penalty and ensures legal company status.

Maintains Business Credibility

Essential for loans, investments, and tenders, enhancing trust with banks and investors.

Builds Financial Credibility

Supports business growth, mergers, and acquisitions while simplifying future filings and tax compliance.

Strengthens Financial Transparency

Ensures ROC record updates and demonstrates financial stability to stakeholders.

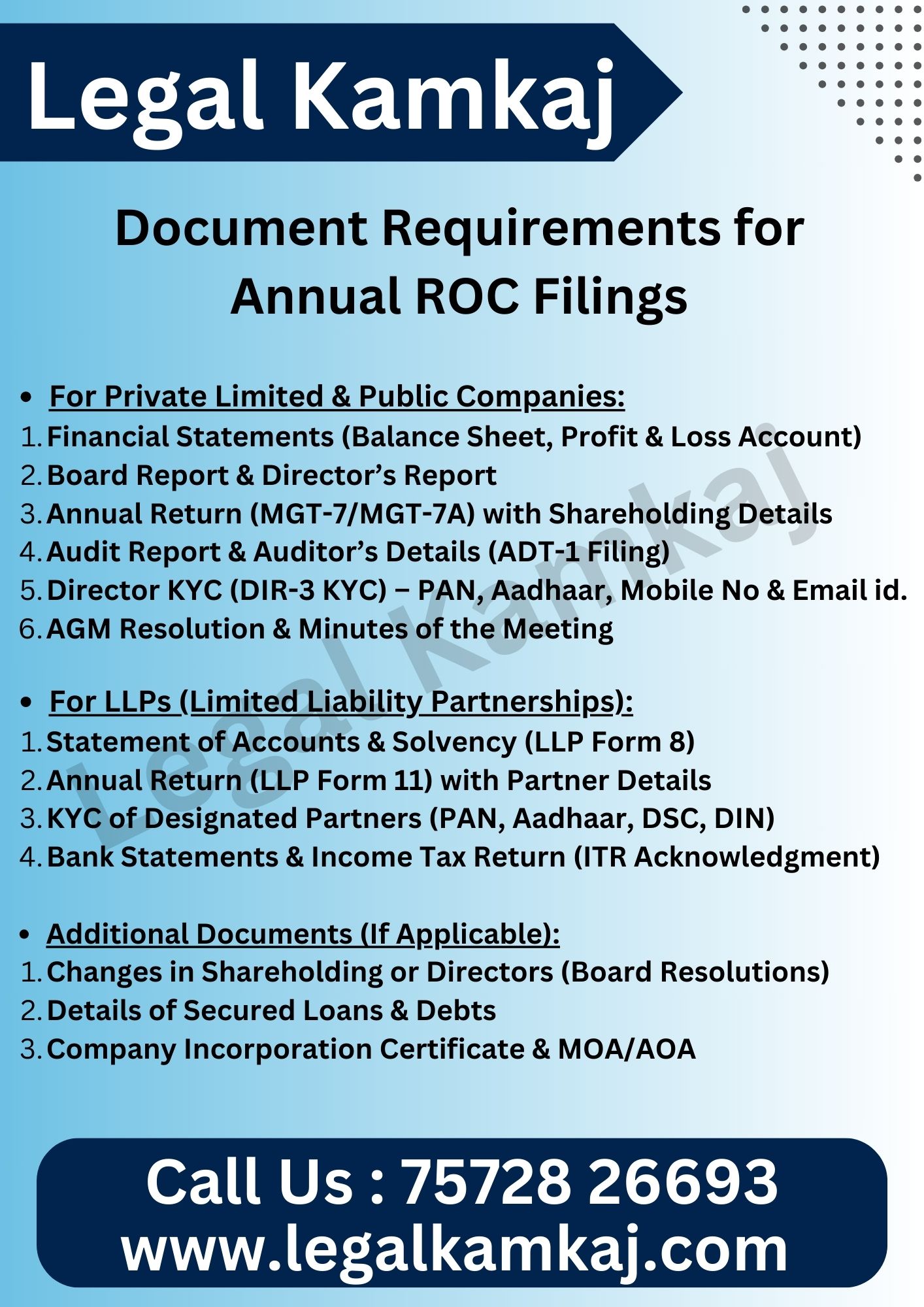

Document Requirements for Annual ROC Filings

To ensure smooth and timely Annual ROC Filings for Companies & LLPs, the following documents are required:

- For Private Limited & Public Companies:

✅ Financial Statements (Balance Sheet, Profit & Loss Account)

✅ Board Report & Director’s Report

✅ Annual Return (MGT-7/MGT-7A) with Shareholding Details

✅ Audit Report & Auditor’s Details (ADT-1 Filing)

✅ Director KYC (DIR-3 KYC) – PAN, Aadhaar, Mobile No & Email id.

✅ AGM Resolution & Minutes of the Meeting

- For LLPs (Limited Liability Partnerships):

✅ Statement of Accounts & Solvency (LLP Form 8)

✅ Annual Return (LLP Form 11) with Partner Details

✅ KYC of Designated Partners (PAN, Aadhaar, DSC, DIN)

✅ Bank Statements & Income Tax Return (ITR Acknowledgment)

- Additional Documents (If Applicable):

✔ Changes in Shareholding or Directors (Board Resolutions)

✔ Details of Secured Loans & Debts

✔ Company Incorporation Certificate & MOA/AOA

RoC Filing Charges in India

Here’s a breakdown of Registrar of Companies (RoC) Filing Charges, including professional fees:

Type of RoC Filing

Govt. Fee (Approx.)

Professional Fee (Approx.)

Total Cost (Approx.)

Private Limited Company (Annual RoC Compliance – AOC-4 & MGT-7)

Rs. 2,000 – Rs. 10,000

Rs. 5,000 – Rs. 15,000

Rs. 7,000 – Rs. 25,000

LLP (Annual Compliance – LLP Form 8 & LLP Form 11)

Rs. 500 – Rs. 7,000

Rs. 4,000 – Rs. 10,000

Rs. 4,500 – Rs. 17,000

One Person Company (OPC) Annual Filing

Rs. 2,000 – Rs. 8,000

Rs. 5,000 – Rs. 10,000

Rs. 7,000 – Rs. 18,000

Section 8 Company

Rs. 2,000 – Rs. 10,000

Rs. 5,000 – Rs. 15,000

Rs. 7,000 – Rs. 25,0000

Additional Charges (If Applicable):

- Director KYC (DIR-3 KYC): Rs. 1,000 (Per Director)

- Auditor Appointment Filing (ADT-1) – Rs. 1,500

- Change in Directors (DIR-12 Filing): Rs. 2,500

- Change in Registered Office (INC-22 Filing): Rs. 3,000

- MoA & AoA Amendments: Rs. 5,000

- Company Name Change: Rs. 7,000

- Director Addition or Removal: Rs. 3,000 Per Form

Late Filing Penalty:

- RoC Annual Filings: ₹100 per day per form if delayed.

Annual ROC Filings Required for Companies & LLPs

Annual ROC Filings are mandatory for all Private Limited Companies, LLPs, OPCs, and Public Companies registered under the Ministry of Corporate Affairs (MCA). These filings ensure compliance with the Companies Act, 2013, and the Limited Liability Partnership Act, 2008.

- Mandatory ROC Filings for Companies:

- AOC-4 Filing : Submission of Financial Statements

- MGT-7 Filing : Annual Return with Company Details

- DIR-3 KYC : Director KYC Compliance

- ADT-1 Filing : Auditor Appointment Filing

- Mandatory ROC Filings for LLPs:

- LLP Form 11 : Annual Return Filing

- LLP Form 8 : Statement of Accounts & Solvency

- Due Dates & Penalties:

- AOC-4: 30th October (For Companies)

- MGT-7: 29th November (For Companies)

- LLP Form 11: 30th May

- LLP Form 8: 30th October

- DIN KYC Penalty for Late Filing: Rs. 5,000/-

- Late Filing Penalty: Rs. 100/- per day

Avoid penalties & legal issues! Let Legal Kamkaj handle your Annual ROC Filings with expert compliance solutions.

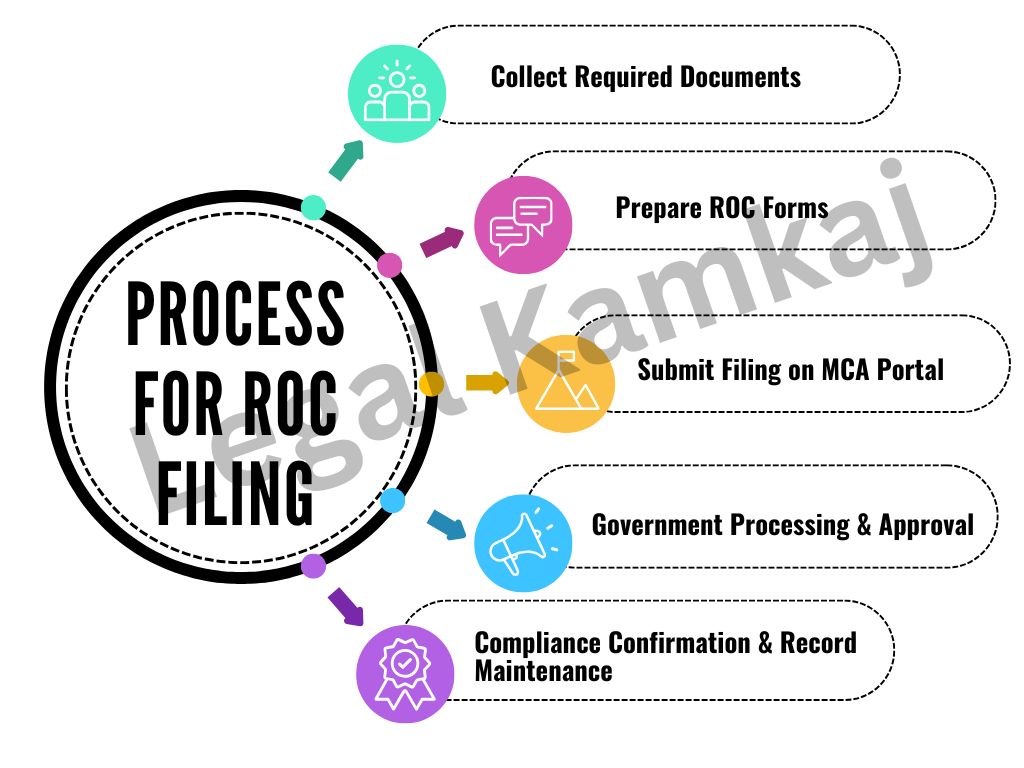

Process for ROC Compliance Filing

Filing ROC Compliance is a structured process to ensure your company or LLP meets legal requirements. Here’s how it works:

Step 1: Collect Required Documents

- Financial Statements (Balance Sheet, Profit & Loss Account)

- Annual Return (MGT-7/MGT-7A for Companies, LLP Form 11 for LLPs)

- Director KYC (DIR-3 KYC), Auditor Details (ADT-1), and Board Resolutions

Step 2: Prepare ROC Forms

- Fill necessary forms like AOC-4, MGT-7, LLP Form 8, and LLP Form 11

- Verify details and ensure accuracy to avoid rejections

Step 3: Submit Filing on MCA Portal

- Upload forms on the Ministry of Corporate Affairs (MCA) portal

- Pay the government filing fees

Step 4: Government Processing & Approval

- MCA reviews the filings and verifies compliance

- Upon approval, the company receives an acknowledgment

Step 5: Compliance Confirmation & Record Maintenance

- Keep acknowledgment and filed documents for future reference

- Ensure timely filing every year to avoid penalties

Why Choose Legal Kamkaj for ROC Filing?

- Expert ROC Compliance Consultants

- Timely & Hassle-Free ROC Filings

- Affordable Pricing with No Hidden Costs

- Compliance for Private Limited, LLP, OPC & Public Companies

- End-to-End Support for MCA & ROC Filings

FAQs on ROC Filing

- ROC Filing refers to the process of submitting financial statements, annual returns, and other documents to the Registrar of Companies as per the Companies Act, 2013.

- All companies registered under the Companies Act, including Private Limited Companies, Public Limited Companies, One Person Companies (OPCs), and Limited Liability Partnerships (LLPs), must file ROC returns.

- Yes, ROC filings can be revised by filing a corrective form with additional fees.