Provident Fund Registration

Are you looking for an Establishment Provident Fund Registration ? These experts not only assist companies in setting up and managing employee provident fund accounts, but they also ensure legal compliance while handling all the necessary paperwork efficiently. Moreover, they stay constantly informed about the latest regulations, therefore providing accurate advice to streamline the entire process.

In addition, Provident Fund Registration s clearly explain the numerous benefits of provident funds to both employers and employees. For instance, they emphasize how these funds play a crucial role in securing financial futures by enabling individuals to save for retirement. Furthermore, by simplifying the complex registration process, they allow businesses to focus on growth while ensuring they professionally manage employees’ financial security.

Consequently, with their specialized expertise, companies can navigate the intricate world of provident fund management with confidence. As a result, they offer peace of mind to employees and, ultimately, contribute to creating a secure future for everyone involved.

Provident Fund Registration?

Employee Provident Fund – Overview

The Employee Provident Fund (EPF) is a government-mandated savings scheme designed to provide financial security and stability to employees after retirement. Administered by the Employees’ Provident Fund Organisation (EPFO), the scheme requires both employees and employers to contribute 12% of the employee’s basic salary and dearness allowance into the fund. Over time, these contributions accumulate with annual interest, creating a significant financial reserve for employees. EPF accounts are linked to a Universal Account Number (UAN), ensuring portability and seamless management across multiple jobs. The scheme also offers tax benefits under Section 80C of the Income Tax Act, with the fund balance (including interest) being tax-exempt upon withdrawal under specified conditions.

In addition to retirement savings, EPF allows partial withdrawals for specific purposes such as marriage, education, medical emergencies, or housing needs. It applies to organizations with 20 or more employees and is mandatory for employees earning up to a specified wage limit, although individuals with higher incomes can join voluntarily. By fostering disciplined saving habits, the EPF acts as a financial safety net for employees and promotes long-term financial well-being. For employers, it ensures compliance with legal obligations while supporting a financially secure workforce, ultimately contributing to a stable and productive work environment.

Benefits of EPFO Registration

Pension Coverage

In addition to the employee’s contribution to the Employees’ Provident Fund (EPF), the employer contributes an equal amount, which notably includes the Employee Pension Scheme (EPS). As a result, EPF registration not only facilitates savings but also ensures that employees receive a substantial pension, thereby providing them with enhanced financial security for their future.

Cover of Risk

In situations such as illness, death, or retirement, EPF online registration helps the employee’s dependents by providing financial risk coverage.

Single Account/one EPF Account

When changing jobs, employees can transfer their online PF account. The Universal Account Number (UAN), which is linked to the Aadhar, facilitates linking previous accounts and allows employees to carry forward their accounts to the new employer instead of closing them. This continuity ensures that employees benefit from compounded returns over time.

Emergency Fund

Emergencies can occur at any time, and having access to the EPF amount can greatly benefit employees during such situations, including emergencies, illnesses, weddings, and educational expenses. Furthermore, employees can conveniently make claims online, ensuring they quickly access their funds when they need them most.

Employee Deposit Linked Insurance Scheme

To begin with, anyone with an online PF account is eligible for this insurance scheme. Moreover, it requires only a 0.5% salary deduction as a premium. Therefore, this makes it an accessible option for many individuals.

Extended Goals

The PF account can be, without a doubt, extremely helpful for long-term objectives, such as for instance, purchasing property or alternatively, establishing a fund for children. Moreover, it serves as a valuable tool for financial planning, which ultimately supports individuals in achieving their goals.

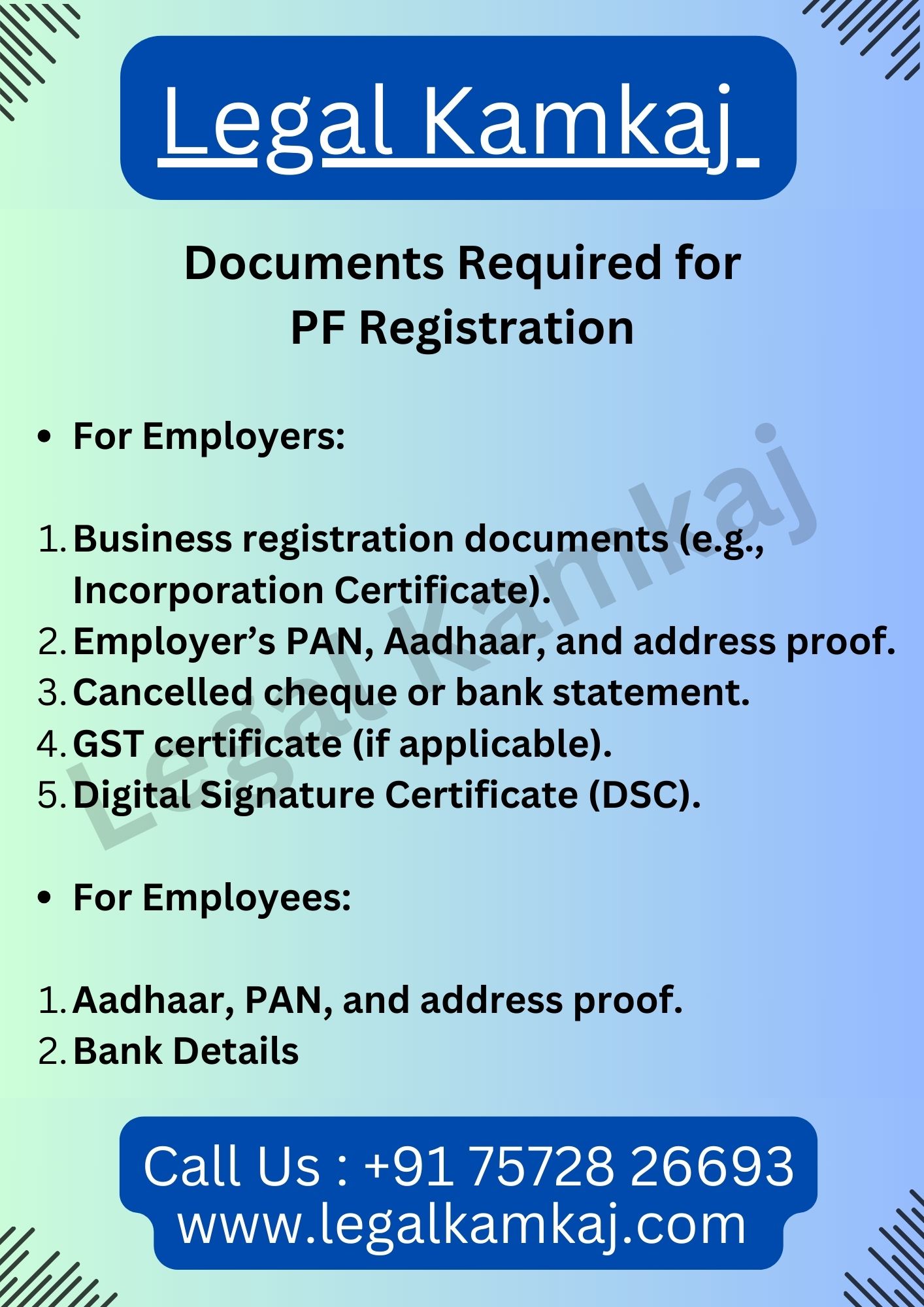

Documents Required for PF Registration

For Employers:

- Business registration documents (e.g., Incorporation Certificate).

- Employer’s PAN, Aadhaar, and address proof.

- Cancelled cheque or bank statement.

- GST certificate (if applicable).

- Digital Signature Certificate (DSC).

For Employees:

- Aadhaar, PAN, and address proof.

- Bank details and Form 11.

Other Details:

- Minimum 20 employees, salary info, and business start date.

PF Registration Charges

PF Registration Rs. 3,000/-

What Is the Meaning of Employee Under Employee Provident Fund?

Here is the revised text with passive voice sentences converted to active voice:

Under section 2(f) of the Employees Provident Funds & Miscellaneous Provisions Act, 1952, anyone who performs a task with the intent of earning compensation qualifies as an employee. This includes all individuals recognized as workers who receive compensation, whether directly or indirectly.

Below is a list of those considered employees:

Full-Time Workers

Anyone who consistently works for the organization qualifies as a full-time employee. The existing relationship between the employer and the employee determines this status. You can use the appointment letter to confirm the employment status.

Part-Time Workers

Any individual performing part-time work for an establishment qualifies as a part-time worker and must register with the EPFO. A part-time worker typically works fewer hours per week compared to a full-time employee.

Work-From-Home Workers

The company may also register any employee who works remotely for a specified duration for EPF online registration.

Contractors

Contractors are individuals whom the organization hires to execute specific projects based on its requirements. Organizations that employ independent contractors must apply for PF online.

Consultants

Consultants, categorized based on their level of expertise, are neither contractors nor part-time employees. They provide consulting services to an organization for a specified period.

Freelancers

In the latest revision to the Social Security Code introduced in September 2020, the Government of India included freelancers under the definition of an employee. Independent contractors also qualify for services through online PF registration.

Eligibility for Provident Fund Registration for Indian Employers

In India, the Employees’ Provident Fund (EPF) is the primary mechanism for employees to save for retirement, managed by the Employees’ Provident Fund Organisation (EPFO). The Employees’ Provident Fund and Miscellaneous Provisions Act, 1952, outlines the eligibility criteria for participation:

For Employers

- Registration for the Provident Fund (PF) is compulsory for all businesses or organizations employing 20 or more individuals.

- If a business or organization employs fewer than 20 individuals, PF registration may still be required if mandated by a central government notification.

For Employees

- Employees who earn less than ₹15,000 per month must join the EPF and make regular contributions.

- Employees who earn more than ₹15,000 per month at the time of joining are not required to make PF contributions. Yet, they can still opt to join the EPF and make contributions with the agreement of the employer and the Assistant PF Commissioner.

UAN (Universal Account Number) - EPF Registration

Firstly, once the organization registers on the EPFO portal and creates a Universal Account Number (UAN), it must update the KYC documents of its personnel. Moreover, each employee can use their UAN for multiple purposes; for instance, they can transfer PF money electronically to a bank account, claim PF benefits, and facilitate various other transactions. In addition to this, the organization must follow the process to activate the UAN, which is, notably, the only mandatory step for an employee to take.

How to Apply PF Online?

To begin with, online PF registration not only provides valuable support, safety, and assurance to employees, but also offers crucial financial security. In fact, it is regulated by the Employees’ Provident Fund Organization (EPFO), which is one of the largest and most renowned social security organizations in India, managing substantial financial transactions daily. Furthermore, applying for PF online is straightforward, especially when you have professional assistance to guide you through the process.

At the same time, at Legal KamKaj, we ensure you avoid the complexities of online EPF registration. Once we receive the necessary information and documents, our experts accurately complete and promptly submit the forms. In addition, our team handles all follow-ups, so that you receive your PF number as quickly as possible. Thus, with our support, you can navigate the PF registration process with ease and confidence.

Mandatory Compliances - PF Registration

- First, after the establishment registers with EPFO, it must adhere to certain legal requirements on a monthly or annual basis.

- For monthly returns, these are submitted electronically by uploading the ECR (Electronic Challan cum Return) sheet using the establishment’s login credentials.

- Importantly, online returns must be submitted by the 15th of the month following the reporting month.

- Specifically, the ECR sheet is available for download from EPFO in XML format, listing every employee registered with the establishment for the reporting month by name and UAN.

- Additionally, an XML file needs to be created from the XML sheet before it can be uploaded for return filing.

- Finally, complete the return process by using online payment gateways to finalize the submission.

PF Registration FAQs

To begin the process, you can easily register for a PF account by visiting the official website of the Employees’ Provident Fund Organisation (EPFO). Once you’re there, the website will guide you through the necessary steps to complete your registration smoothly. By doing this, you ensure that you properly set up your PF account and can manage your provident fund efficiently.

Yes, if a Private Limited Company has 20 or more employees, it must register for the Provident Fund (PF). Once the company reaches this threshold, it is essential for them to comply with legal regulations, ensuring they provide their employees with retirement savings through the PF. This not only fulfills the company’s legal obligations but also contributes to the financial security of its workforce.

The employer must provide their PAN (Permanent Account Number) as a crucial requirement for PF registration, ensuring accurate identification and linking to the provident fund account. This requirement also verifies the company’s authenticity, streamlining the registration process and helping to ensure compliance with legal requirements.

Without a PF account, you may lack a structured savings plan for retirement, which can hinder your ability to save effectively. The PF system allows employees to accumulate a portion of their salary each month, ensuring greater financial security for the future.