Property Valuation for Capital Gains in Gujarat

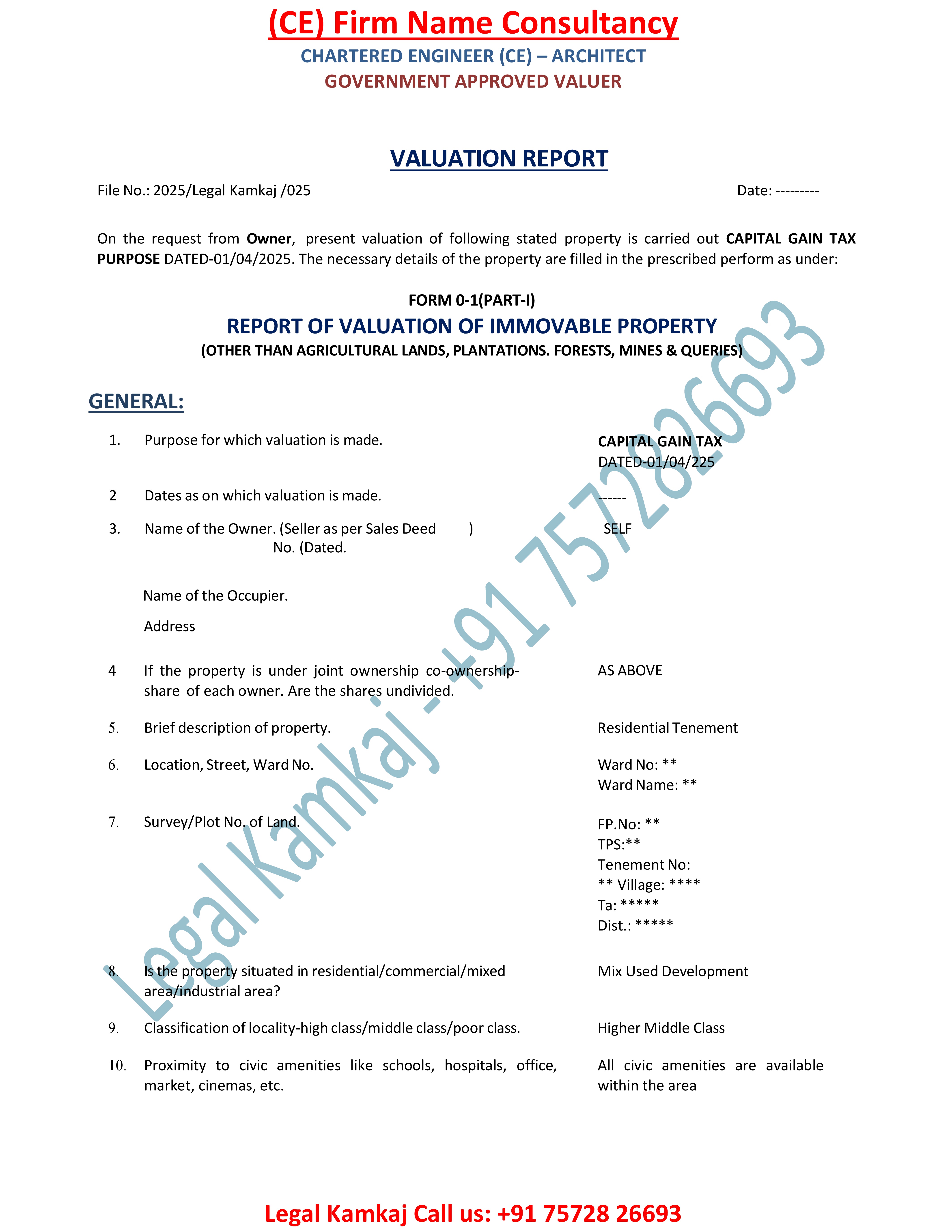

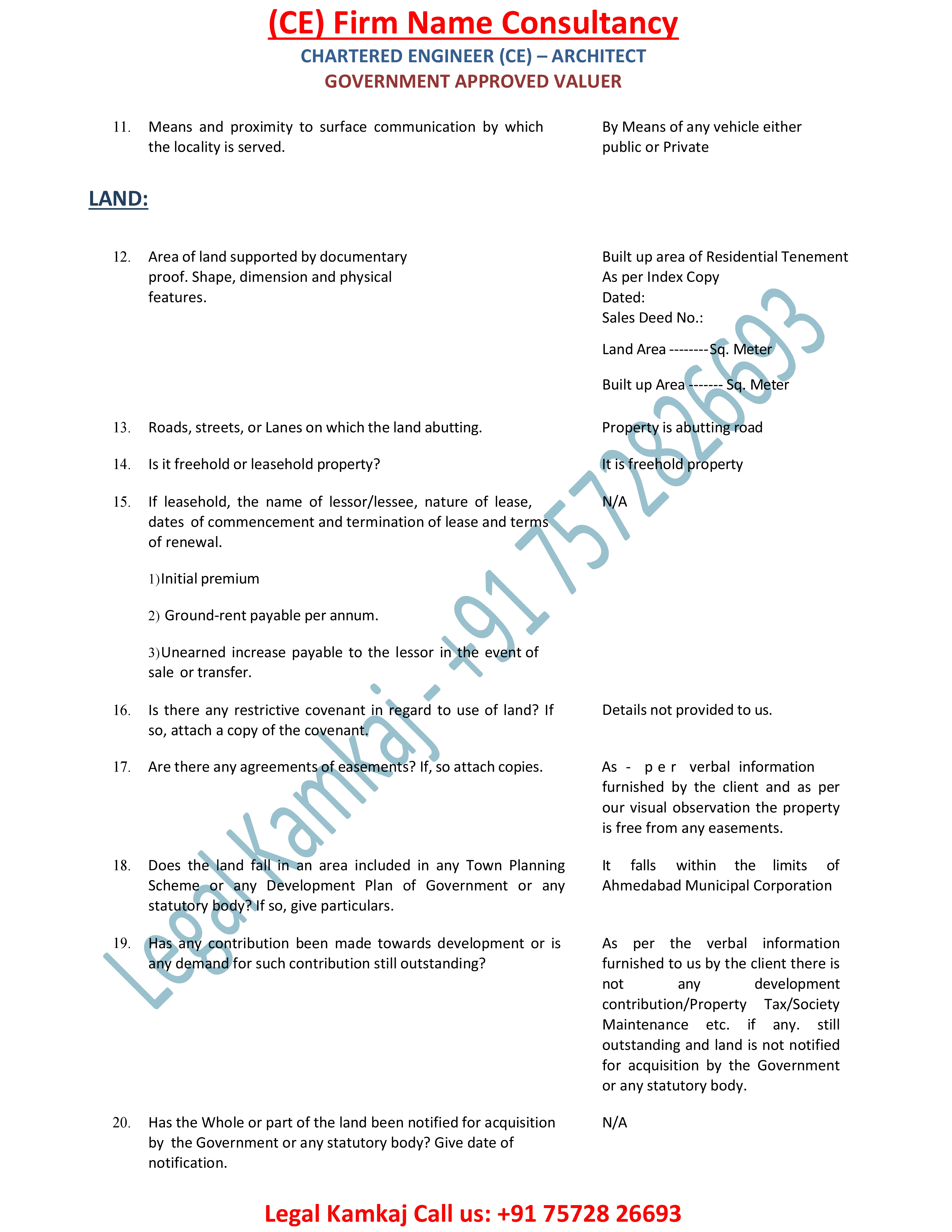

When calculating Capital Gain Tax, having an accurate property valuation is essential. Our online property valuation process for Capital Gain in Gujarat provides you with a government-approved report, ensuring compliance with tax laws and accuracy.

At Legal Kamkaj, we make the process simple and fast. Our team uses the latest tools to provide clear and accurate property valuation reports. Whether you’re selling property or managing your taxes, our online process makes everything easy and convenient.

Apply For Property Valuation for Capital Gains ?

Property Valuation Services for Capital Gains in Gujarat

Accurate property valuation is essential when calculating Capital Gains Tax, and Legal Kamkaj offers expert Property Valuation Services for Capital Gains in Gujarat to help you navigate the process smoothly. Whether you’re selling property, managing tax obligations, or transferring ownership, getting the right property value is crucial for tax compliance.

Our team provides reliable, government-approved property valuations that ensure you meet all legal requirements. We use advanced tools and market insights to deliver precise reports, making the complex process of tax calculations simple and efficient. With our online process, you can easily submit your property details and receive a detailed, accurate valuation report, all from the comfort of your home.

At Legal Kamkaj, we prioritize clarity and accuracy, ensuring you get the best possible service for Property Valuation Services for Capital Gains in Gujarat. Trust us to handle your property valuation needs with professionalism and efficiency.

Benefits of Property Valuation Services for Capital Gains in Gujarat

Accurate and Reliable Valuations

Our team ensures precise property valuations, using the latest market data and tools for accurate results.

Government-Approved Reports

Our reports are fully approved by the government, ensuring they all tax and legal requirements.

Easy Online Process

Submit your property details online and get your valuation report quickly, with no hassle or delays.

Expert Guidance

Our experienced team is here to guide you through the entire valuation process, offering support whenever needed.

Affordable and Transparent

We offer affordable, clear pricing with no hidden charges for your property valuation.

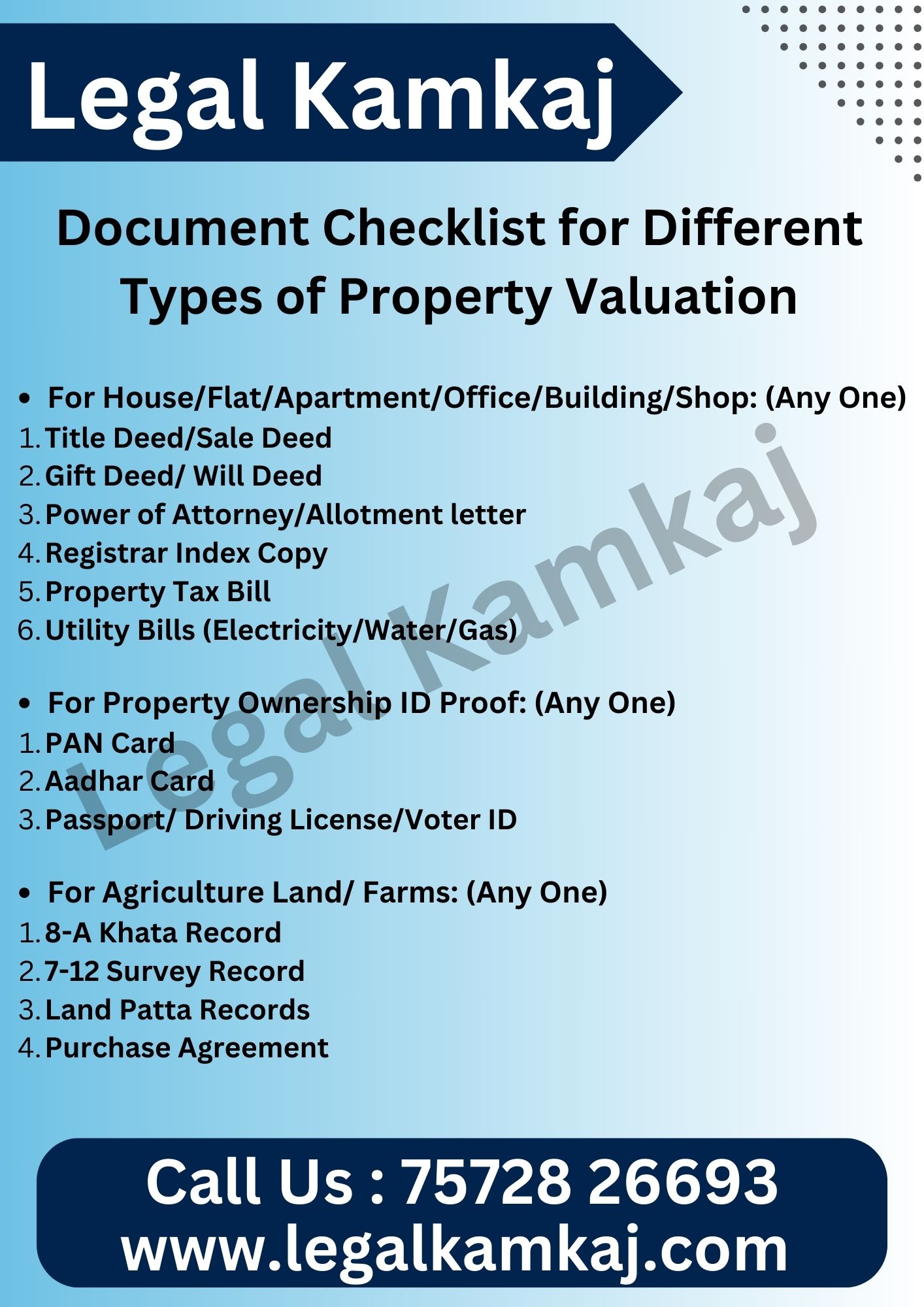

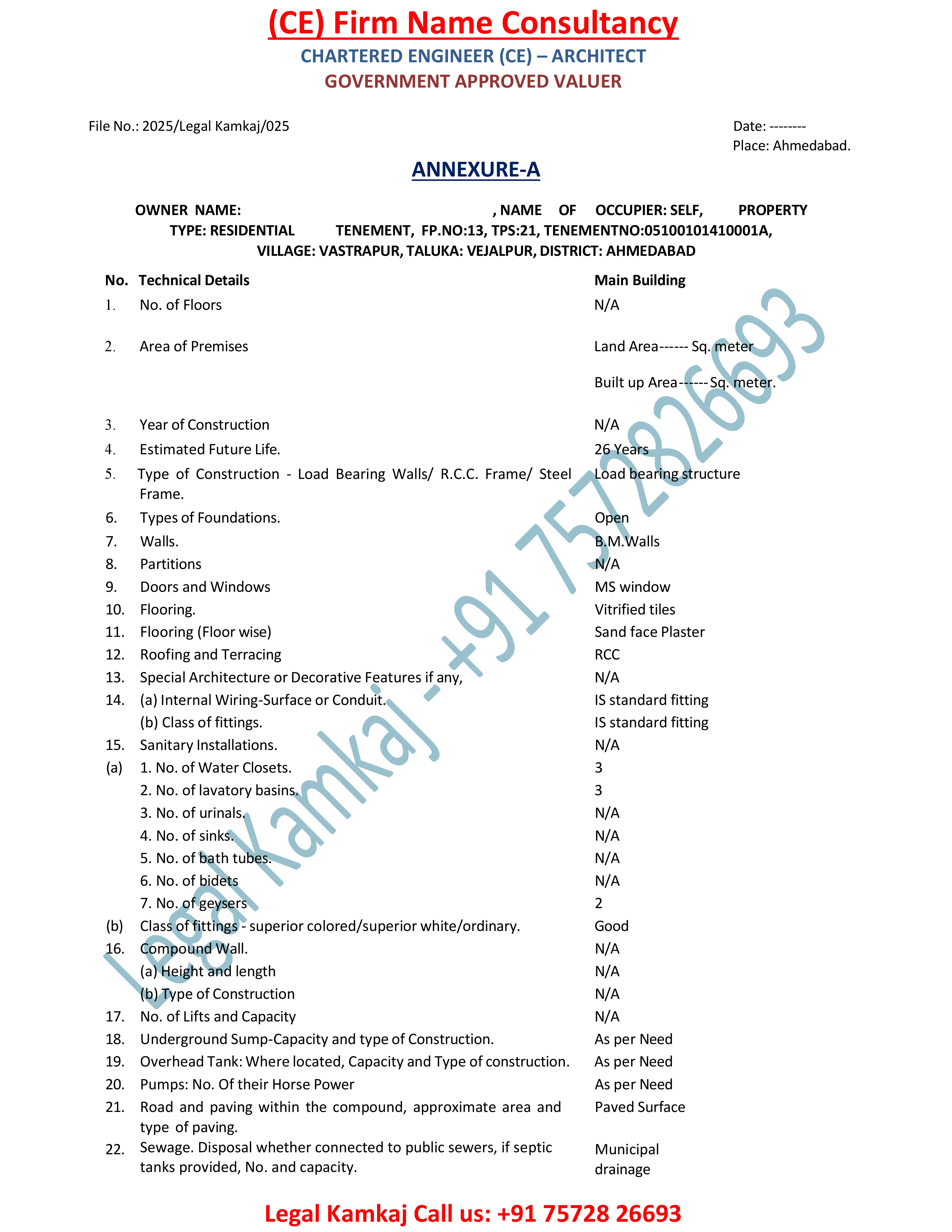

Document Checklist for Different Types of Property Valuation

- For House/Flat/Apartment/Office/Building/Shop: (Any One)

- Title Deed/Sale Deed

- Gift Deed/ Will Deed

- Power of Attorney/Allotment letter

- Registrar Index Copy

- Property Tax Bill

- Utility Bills (Electricity/Water/Gas)

- For Property Ownership ID Proof: (Any One)

- PAN Card

- Aadhar Card

- Passport/ Driving License/Voter ID

- For Agriculture Land/ Farms: (Any One)

- 8-A Khata Record

- 7-12 Survey Record

- Land Patta Records

- Purchase Agreement

- For Other Property Details:

- Information about the Property Including size, layout, location, and condition. This may also include construction plans or architectural designs if available.

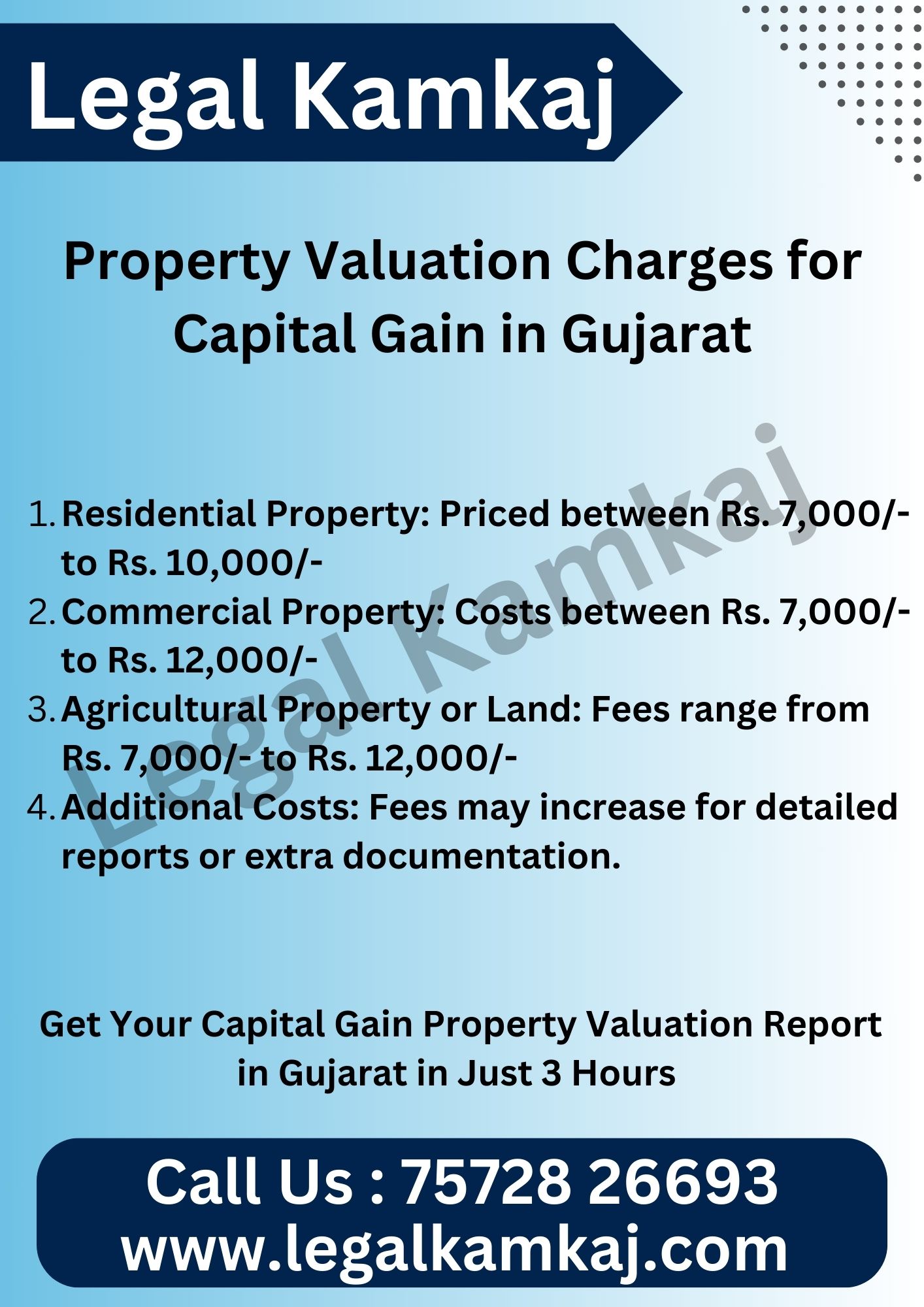

Property Valuation Charges for Capital Gain in Gujarat

Property valuation charges vary based on the Property type (Residential, Commercial, Agricultural), location (urban or rural), and the size or complexity of the property.

- Residential Property: Priced between Rs. 7,000/- to Rs. 10,000/-

- Commercial Property: Costs between Rs. 7,000/- to Rs. 12,000/-

- Agricultural Property or Land: Fees range from Rs. 7,000/- to Rs. 12,000/-

- Additional Costs: Fees may increase for detailed reports or extra documentation.

- Properties with legal issues, complex ownership, or unique features may cost more.

- Some agencies may charge a small percentage of the property value (around 0.1% to 0.5%).

Get Your Capital Gain Property Valuation Report in Gujarat in Just 3 Hours

(Fast and Reliable Services Across Gujarat)

Uses of a Property Valuation Report for Capital Gain in Gujarat

A Property Valuation Report is an essential document for various purposes, especially related to Capital Gains Tax. Here’s how it is used:

- Capital Gains Tax Calculation

- It helps determine the market value of the property, which is needed to calculate the tax when selling a property.

- It helps determine the market value of the property, which is needed to calculate the tax when selling a property.

- Legal and Tax Compliance

- Ensures you meet government regulations and avoid penalties during property transactions.

- Ensures you meet government regulations and avoid penalties during property transactions.

- Buying or Selling Property

- Provides an accurate value, making transactions fair and transparent for both parties.

- Provides an accurate value, making transactions fair and transparent for both parties.

- Inheritance or Gifts

- Useful for determining the value of inherited or gifted property for tax purposes.

- Useful for determining the value of inherited or gifted property for tax purposes.

- Loan or Mortgage Applications

- Banks require this report to approve loans or mortgages against the property.

- Banks require this report to approve loans or mortgages against the property.

- Disputes Resolution

- In cases of legal disputes, family settlements, or division of property, the report helps establish the property’s accurate market value.

- In cases of legal disputes, family settlements, or division of property, the report helps establish the property’s accurate market value.

- Income Tax Returns

- Required to support tax filings when reporting capital gains from property sales.

- Required to support tax filings when reporting capital gains from property sales.

- Investment Planning

- Gives a clear idea of the property’s current worth to make better investment decisions.

- Gives a clear idea of the property’s current worth to make better investment decisions.

- This report simplifies property-related processes and ensures you comply with all legal and financial requirements.

When is a Property Valuation Report Needed for Capital Gain in Gujarat?

A Property Valuation Report is required in several situations to calculate Capital Gains Tax accurately. Here are the main instances:

- Selling Property

- If you are selling property, a valuation report helps determine its market value for tax calculation.

- If you are selling property, a valuation report helps determine its market value for tax calculation.

- Inherited Property

- When selling inherited property, you need a valuation to calculate the property’s value and tax obligations.

- When selling inherited property, you need a valuation to calculate the property’s value and tax obligations.

- For Gifted Property

- If a property has been gifted to you, its valuation is needed to calculate its value for Capital Gains Tax.

- If a property has been gifted to you, its valuation is needed to calculate its value for Capital Gains Tax.

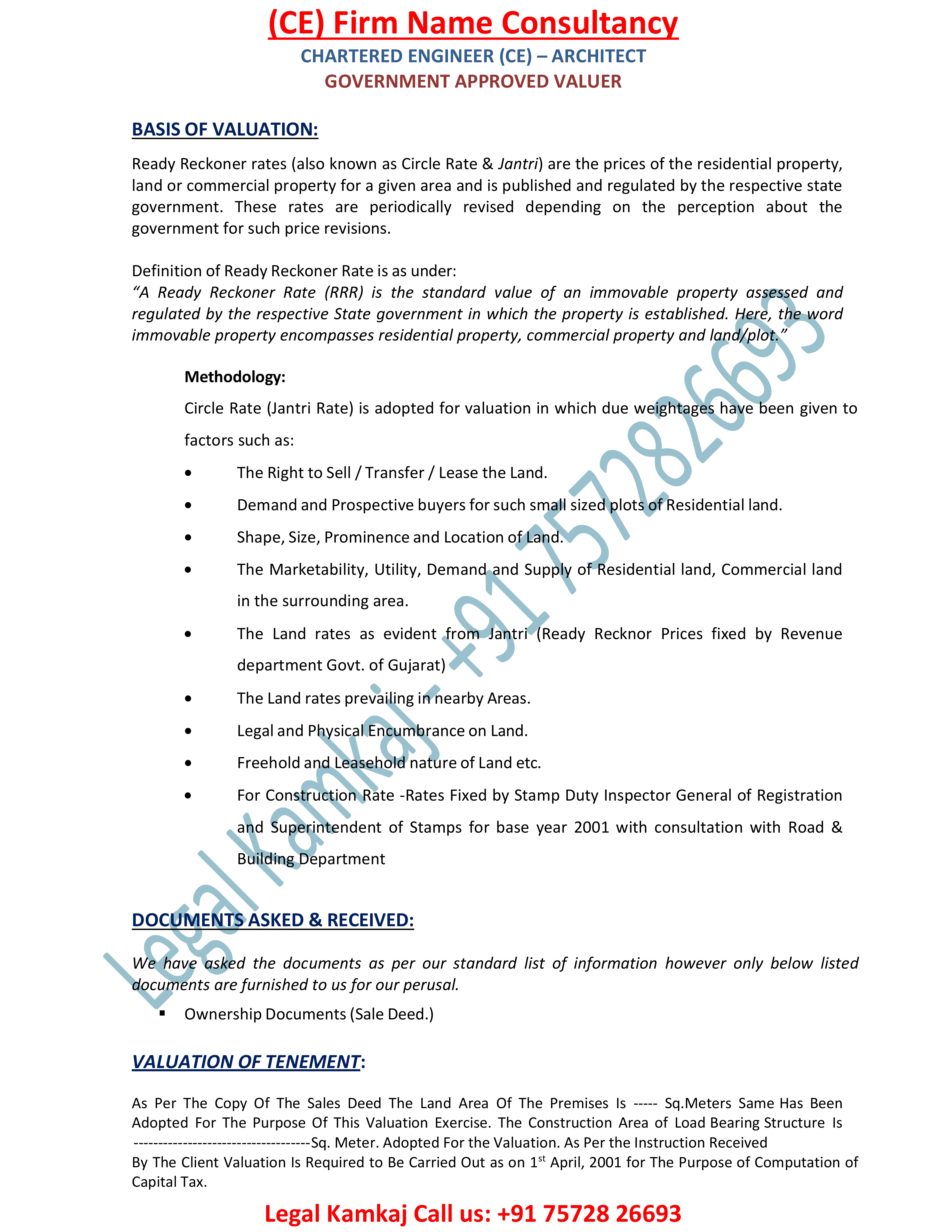

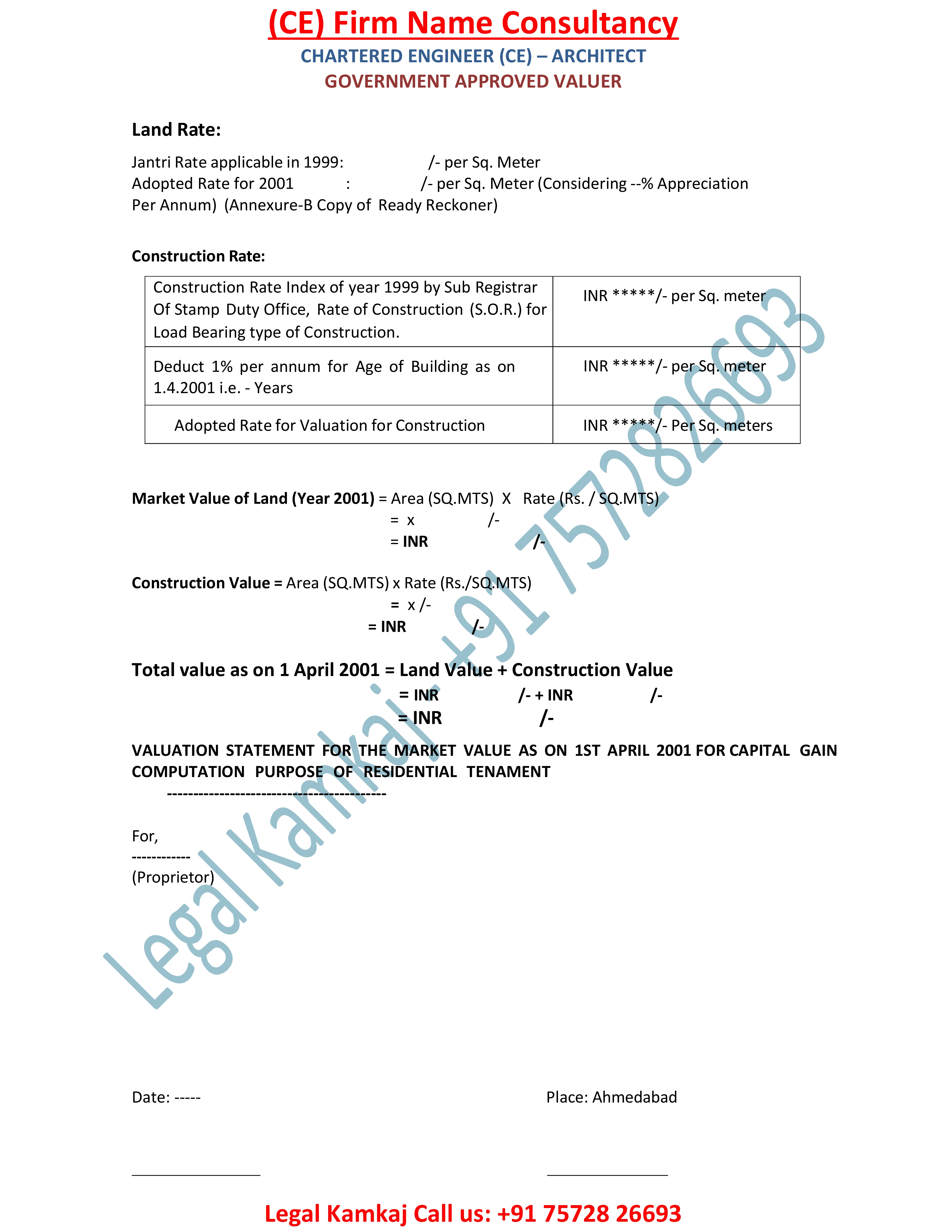

- Property Transactions Before 2001

- For properties purchased before April 1, 2001, the valuation report determines the market value as of that date.

- For properties purchased before April 1, 2001, the valuation report determines the market value as of that date.

- Property Transfers or Settlements

- During family settlements, property division, or legal disputes, a valuation report helps establish its correct value.

- During family settlements, property division, or legal disputes, a valuation report helps establish its correct value.

- Income Tax Filing

- A valuation report is often needed when filing returns that involve Capital Gains from property transactions.

- A valuation report is often needed when filing returns that involve Capital Gains from property transactions.

- In Gujarat, a Property Valuation Report is a vital document to ensure accurate tax calculations and legal compliance. Legal Kamkaj offers quick and reliable valuation services to meet your needs.

Get Your Capital Gain Property Valuation Report in Gujarat in Just 3 Hours

(Fast and Trusted Services Across Gujarat)

Step 1

Send us required Documents

Step 2

Review Report

Step 3

Get Signed Copy

Why Choose Legal Kamkaj for Accurate Capital Gain Property Valuation?

- Accurate Property Valuation: We ensure your property is valued accurately for the correct tax calculations.

- Capital Gain Tax Calculation: Our expert valuations help you determine your Capital Gain Tax without any hassle.

- Government-Approved Valuation Report: We provide official, government-approved reports that all legal and tax requirements.

- Efficient Property Valuation Services: We offer fast and reliable services, making the valuation process simple and quick for you.

- Affordable Property Valuation Services: We offer high-quality property valuations at competitive prices, making it budget-friendly for you.