Private Limited Company Registration in Karnataka

Looking to register a Private Limited Company in Karnataka? This step is a smart choice for entrepreneurs, as Karnataka boasts a growing economy and a supportive business environment. By opting for Private Limited Company Registration in Karnataka, you gain the advantage of limited liability protection, ensuring your personal assets are safe from business liabilities. With just two directors and shareholders needed, raising capital and gaining investor trust becomes simpler. The process of Private Limited Company Registration in Karnataka includes selecting a unique company name, preparing the necessary documents, and submitting them to the Registrar of Companies. Once approved, your company will obtain its own legal identity, giving you a competitive advantage in Karnataka’s market. In summary, choosing Private Limited Company Registration in Karnataka is a wise decision for any business looking to expand in one of India’s most promising states.

Start your business today

How to Set Up a Private Limited Company in Karnataka

Private Limited Company Registration in Karnataka: Simple Step-by-Step Guide

- Select a Unique Name: Choose a distinctive company name that complies with MCA regulations.

- Obtain Digital Signatures: Directors and shareholders need Digital Signature Certificates (DSCs) for online submissions.

- Apply for DIN: Directors must acquire a Director Identification Number (DIN).

- Prepare Your Documents: Gather necessary documents such as ID proofs, office address proof, MoA, and AoA.

- Submit the Application: Complete and file the SPICe+ form online via the MCA portal.

- Receive Your Certificate of Incorporation: After approval, the Registrar of Companies (RoC) will issue this certificate.

- Apply for PAN and TAN: Obtain these from the Income Tax Department for tax purposes.

- Open a Company Bank Account: Use the Certificate of Incorporation and PAN to set up a company bank account.

- Register for GST: Register for GST if your business meets the required turnover and operational criteria.

- Ensure Compliance: Regularly file annual returns, maintain statutory records, and adhere to all regulations.

Required Documents for Online Private Limited Company Registration in Karnataka

- Identity Proof: Aadhaar card, passport, voter ID, or driver’s license for each director and shareholder.

- Address Proof: Utility bills, bank statements, or rent agreements for directors and shareholders.

- Office Address Document: Utility bill, lease agreement, or NOC from the property owner.

- Photos: Recent passport-sized photos of all directors and shareholders.

- Company Goals (MoA): A document outlining the company’s objectives.

- Company Rules (AoA): A document that sets out the company’s internal rules and management.

- Director’s ID Number (DIN): A unique ID required for each director.

- Digital Signature (DSC): Needed for signing documents online.

- Tax ID (PAN Card): Permanent Account Number for the company, directors, and shareholders.

- SPICe+ Form: The main online application form for registration on the MCA portal.

These documents will help you easily complete the online registration of your Private Limited Company in Karnataka.

All-in-One Solution for Starting a Private Limited Company in Karnataka

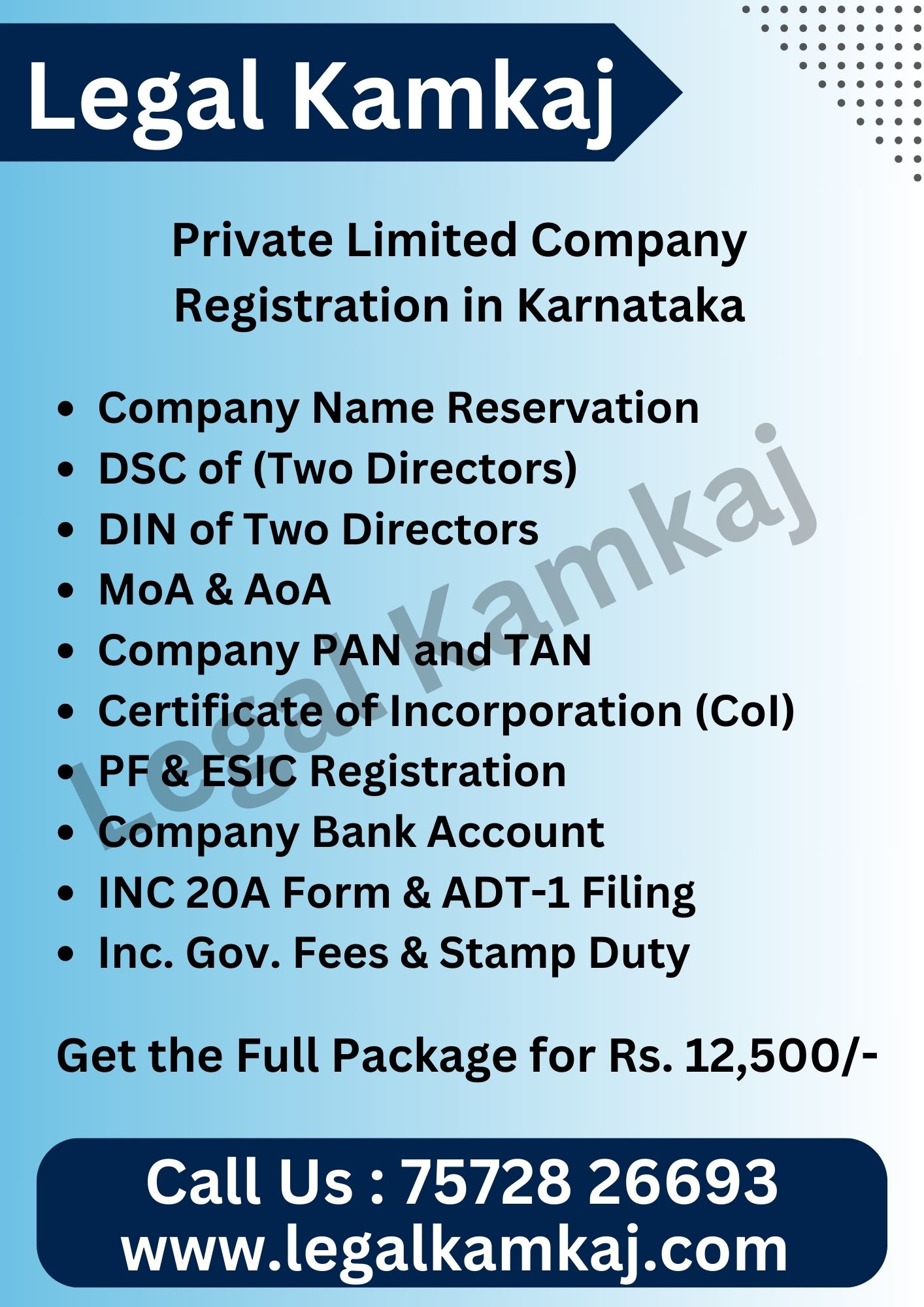

Our Transparent Pricing Package for Starting a Private Limited Company in Karnataka with our clear pricing, there are no hidden fees or upfront payments. Our all-inclusive package includes:

- MoA and AoA Drafting: We prepare and file the Memorandum of Association (MoA) and Articles of Association (AoA) for you.

- Name Reservation: We cover all costs for reserving your company name.

- Government Fees & Stamp Duty: All required government fees and stamp duties are included.

- PAN Card: We help you get your company’s PAN card.

- TAN: We also handle the process for obtaining your Tax Deduction and Collection Account Number (TAN).

- PF & ESIC Registration: We manage the registration for Provident Fund (PF) and Employees’ State Insurance Corporation (ESIC).

- MSME Registration: We assist with registering as a Micro, Small, and Medium Enterprise (MSME).

- DIN for Two Directors: We secure Director Identification Numbers (DIN) for two directors.

- DSC for Two People: We provide Digital Signature Certificates (DSC) for two individuals.

- Bank Account Setup: We help you open a bank account in your company’s name.

- Share Certificates: We prepare and issue share certificates.

- Filing of INC-20A: We file the INC-20A form to declare the start of your business.

- Submission of Auditor ADT-1: We handle the submission of ADT-1 to appoint your auditor.

Choose our service for an easy and efficient Private Limited Company registration in Karnataka.

What You Need to Register a Private Limited Company Online in Karnataka

Director and Shareholder Criteria: Initially, ensure you meet the criteria for directors and shareholders, including their qualifications and number requirements.

Selecting a Company Name: Subsequently, choose a unique company name that adheres to regulatory guidelines.

Registered Office Address: Next, provide a valid registered office address, which will serve as your company’s official location.

Obtaining Additional Documentation: Additionally, gather any other required documentation to support your registration process.

Digital Signature Certificate (DSC): Furthermore, acquire a Digital Signature Certificate (DSC) for signing electronic documents.

Director Identification Number (DIN): Moreover, apply for a Director Identification Number (DIN) for each director.

Name Approval: Then, seek approval for your chosen company name from the relevant authorities.

Memorandum of Association (MoA) and Articles of Association (AoA): In addition, prepare the Memorandum of Association (MoA) and Articles of Association (AoA) to outline your company’s objectives and governance.

Identity and Address Verification: Ensure that all identity and address verification documents are accurate and up-to-date.

Registered Office Proof: Finally, provide proof of the registered office address, including utility bills or a lease agreement, to complete the registration process.

Types of Business Structures for Registering a Company in Karnataka

Sole Proprietorship: First, consider a Sole Proprietorship, which is the simplest business form, allowing you to operate individually with minimal regulatory requirements.

Partnership Firm: Next, explore a Partnership Firm, where two or more individuals share ownership and responsibilities, offering a collaborative approach to business operations.

One Person Company (OPC): Additionally, think about forming a One Person Company (OPC), which allows a single individual to enjoy the benefits of a company structure while maintaining full control.

Private Limited Company (Pvt Ltd): Furthermore, a Private Limited Company (Pvt Ltd) provides limited liability protection and is suitable for small to medium-sized businesses seeking growth and investment opportunities.

Limited Liability Partnership (LLP): Moreover, consider a Limited Liability Partnership (LLP), which combines the flexibility of a partnership with the liability protection of a company.

Public Limited Company (Ltd): Finally, if you aim for extensive capital raising and public trading, a Public Limited Company (Ltd) may be appropriate, allowing shares to be traded publicly and attracting a wide range of investors.

Advantages of Setting Up a Private Limited Company in Karnataka

Thriving Economy of Karnataka

According to recent reports, Karnataka’s Gross State Domestic Product (GSDP) has surged from ₹1.27 lakh crore to ₹16.19 lakh crore over the last two decades. Consequently, the Chief Minister has highlighted the state’s commitment to significantly contributing to India’s goal of a $5 trillion economy. Therefore, Karnataka is targeting an impressive $1 trillion economy by 2030.

Protect Your Assets

By registering a Private Limited Company (PVT Ltd), Limited Liability Partnership (LLP), or One-Person Company (OPC) in Karnataka, you safeguard your personal assets from business liabilities. Specifically, this ensures that your personal wealth is protected from legal disputes or financial challenges faced by the company, thus reducing your personal risk.

Establish a Legal Entity

When you register your business as a Private Limited Company, LLP, or OPC online, you create a distinct legal entity separate from its owners. This separation, therefore, allows the company to acquire assets, sign contracts, engage in legal actions, and operate independently of its founders.

Enhance Funding Opportunities

Registering as a Private Limited Company, LLP, or OPC opens up diverse funding options, including equity investments, debt financing, angel investors, venture capital, and bank loans. As a result, this status enables you to issue shares and debentures, attracting public investment and expanding your capital base.

Tax Advantages

Opting to register as a Private Limited Company or startup in Karnataka offers several tax benefits under the Income Tax Act of 1961. For instance, these benefits include deductions for business expenses, asset depreciation, and more favorable corporate tax rates compared to other business structures.

Step-by-Step Guide to Registering a Private Limited Company Online in Karnataka

Legal Kamkaj offers a streamlined process for registering a Private Limited Company online in Karnataka, completing it in just 4 simple steps:

Step 1: Document Collection

Initially, our team will gather all the necessary documents. Subsequently, we will authenticate these documents to ensure everything is prepared correctly for the incorporation process. By doing so, we ensure that the documentation is accurate and compliant with regulations.

Step 2: DSC Application and Name Reservation

Next, we will apply for the Digital Signature Certificate (DSC) on your behalf. Additionally, we will secure approval for your company’s name from the Ministry of Corporate Affairs (MCA). This step ensures that your business name is unique and reserved, establishing your company’s identity.

Step 3: Preparation and Submission of MOA and AOA

Subsequently, we will draft the Memorandum of Association (MOA) and Articles of Association (AOA) for your company. Once prepared, we will file these documents along with the necessary forms with the Registrar of Companies (ROC) for the final incorporation stage. This ensures that your company’s structure and governance are properly documented and submitted.

Step 4: Issuance of Company Incorporation Certificate

Finally, we will complete the registration process with the appropriate government authorities. Upon review and approval of the documents, you will receive your company incorporation certificate directly from the MCA. This step finalizes your company’s legal standing and registration.

Note: Ensure that all documents are submitted within the specified time frame and are accurate to comply with government regulations and avoid delays. Legal Kamkaj will manage and assist you throughout the entire registration process, ensuring a seamless and efficient experience.

Business Compliance Rules in Karnataka

Operating a business in Karnataka requires strict adherence to local, state, and national regulations. These regulations encompass various aspects including operations, taxation, licenses, and statutory obligations. To operate legally, businesses must maintain accurate records, ensure transparency, and fulfil all regulatory requirements. To help you stay compliant with these regulations, our team of specialists offers thorough support, allowing you to focus on expanding your business while we handle the complexities of regulatory compliance.

Compliance Requirements:

- ADT-1: Appointment of Auditor

To begin with, you must file Form ADT-1 for the appointment of an auditor. This step is crucial for ensuring that your financial statements are audited properly. - INC-20A: Certificate of Commencement of Business

Next, submit Form INC-20A to obtain the Certificate of Commencement of Business. This document signifies that your company has officially started its business operations. - AOC-4: Filing of Financial Statements

Subsequently, file Form AOC-4 to submit your financial statements. This ensures that your financial records are officially reported and comply with legal standards. - MGT-7: Filing of Annual Returns

Additionally, file Form MGT-7 for annual returns. This form provides a comprehensive overview of your company’s activities and compliance status over the year. - DIR-3 KYC: Directors’ KYC

Ensure that Form DIR-3 KYC is filed for the Know Your Customer (KYC) compliance of your directors. This step is necessary for verifying the identity and credentials of the directors. - DPT-3: Return of Deposits

Finally, file Form DPT-3 for the return of deposits. This form ensures that all deposits are accurately reported and managed in accordance with regulatory requirements.

In summary, adhering to these compliance requirements will help you operate legally and effectively in Karnataka.

Our Services for Registering a Private Limited Company in Karnataka

Starting a business in Karnataka is straightforward with our expertise. To establish a company in Karnataka, adherence to state regulations is essential. Here’s a simplified breakdown of the key components:

1. Director Identification Number (DIN) and Digital Signature Certificate (DSC): First and foremost, obtain DIN and DSC for at least two directors. These are crucial to initiating the registration process and ensuring that your directors are properly identified and authorized.

2. Drafting the Memorandum of Association (MoA) and Articles of Association (AoA): Next, draft the MoA and AoA. The MoA outlines your company’s objectives, while the AoA defines the internal rules and governance framework. Both documents are essential for establishing the legal foundation of your company.

3. Payment of Registration Fees and Stamp Duty: Subsequently, ensure the payment of all necessary registration fees and stamp duties. This step fulfills the legal requirements and advances your registration process.

4. Receiving the Company Incorporation Certificate: Once the documents and fees are processed, you will receive the company incorporation certificate. This certificate officially recognizes your business and marks the formal establishment of your company.

5. Obtaining PAN and TAN: Additionally, apply for the company PAN and TAN. These are required for tax-related purposes and ensure that your business complies with tax regulations.

6. Opening a Zero-Balance Current Account: Finally, open a zero-balance current account. This facilitates smooth financial transactions and helps in managing your business finances effectively.

By following these steps, you can successfully set up your private limited company. Consulting with professionals is highly advisable to make well-informed decisions and ensure the efficient growth of your business. This comprehensive approach guarantees that your business starts with a strong foundation, fully compliant with regulatory standards.

Frequently Asked Questions About Private Limited Company Registration in Karnataka

To register a company in Karnataka, first obtain Director Identification Numbers (DIN) and Digital Signature Certificates (DSC) for each director. Next, draft the Memorandum of Association (MoA) and Articles of Association (AoA), and provide proof of identity, address, and the office location. Finally, pay all required registration fees.

Registering a Private Limited Company in Karnataka usually takes 15 to 30 days, depending on document completeness and the Ministry of Corporate Affairs (MCA) processing speed. Accurate and timely submissions can expedite the process, while issues or missing documents may cause delays.

Expenses include registration fees, stamp duty, and professional charges, varying based on registration complexity and assistance needed. For an accurate estimate, consult a service provider.

A Private Limited Company must have a minimum of two directors and two shareholders. There is no maximum limit on the number of shareholders, but the company can accommodate up to 200 shareholders. This arrangement offers flexibility while maintaining a manageable number of shareholders.

Yes, you must provide evidence of a registered office address in Karnataka. This can be a leased property, rented space, or even a residential address. However, the address needs to be valid and verifiable to comply with legal requirements. Ensuring the address is correct and suitable will help streamline the registration process.