One Person Company Registration in Punjab

Interested in One Person Company Registration in Punjab? The procedure for One Person Company Registration in Punjab is designed to be straightforward, allowing a single individual to start and operate a business with limited liability. When pursuing “One Person Company Registration in Punjab,” you’ll need to provide necessary documents such as proof of identity, address, and a registered office in Punjab. The “One Person Company Registration in Punjab” process involves completing and submitting forms to the Registrar of Companies (ROC) and covering the required fees. By choosing “One Person Company Registration in Punjab,” you ensure that your business will operate with a distinct legal identity, protecting your personal assets and streamlining business management. This registration offers a strong foundation for efficiently managing contracts, finances, and other business operations.

Get Started with One Person Company (OPC) Registration in Punjab

One Person Company Registration in Punjab

The One-Person Company (OPC) structure, introduced under India’s Companies Act, 2013, allows individuals to easily start their businesses as separate legal entities. This setup ensures protection for personal assets, giving solo entrepreneurs the freedom to focus on business operations and growth without worrying about personal financial risks.

The process of starting a One Person Company (OPC) in Punjab is both easy and efficient. You can set up your business with only one director and benefit from limited liability. The Ministry of Corporate Affairs (MCA) manages the registration process in accordance with the Companies Act, 2013. To keep your OPC operational, you need to file income tax returns, annual returns, and financial statements on time. Overall, registering an OPC in Punjab is a smart choice for those who want to start a small business with minimal risk and straightforward compliance.

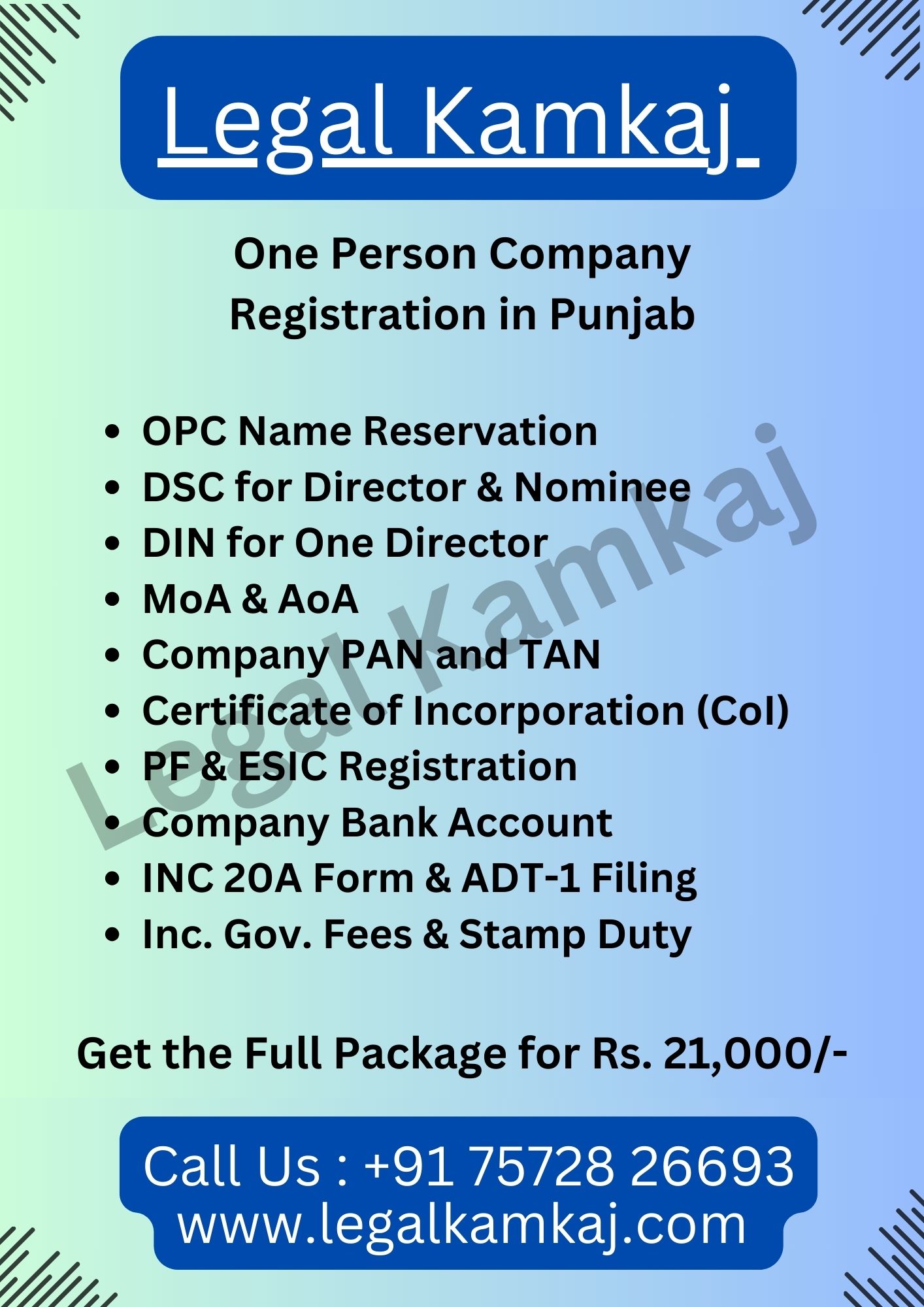

One Person Company Registration in Punjab - Package

Documents Needed for OPC Registration in Punjab

To easily set up an OPC (One Person Company) online in India, you’ll need these documents:

- PAN Card, Aadhaar Card or Passport of the Director and Nominee

- Latest Bank Statement or Passbook of the Director and Nominee (Not older than two months)

- Passport size Photo of the Director and Nominee

- Mobile Number & Email Id of the Director and Nominee

- Office Address – Latest Utility bills like Telephone/Gas/Electricity bill (Not older than two months)

Advantages of OPC Registration in Punjab

Registering an OPC offers several benefits that can greatly facilitate the founder’s growth and success. Some notable advantages include:

Separate Legal Identity: An OPC is recognized as a separate legal entity, enabling it to enter contracts, own assets, and take legal action independently.

Tax Benefits: OPCs can benefit from various tax advantages, including reduced rates, exemptions, and deductions.

Ease of Establishment: In Punjab, setting up an OPC is straightforward and efficient, requiring only one director.

Increased Business Credibility: An OPC in Punjab is often perceived as more reputable than other business structures, such as partnerships or sole proprietorships, which can be beneficial for attracting investors, clients, and suppliers.

Requirements for OPC Registration in Punjab

- Minimum and Maximum of one member

- Appoint a nominee before incorporation

- Nominee consent in Form INC-3

- OPC name selected as per the provisions of the Companies (Incorporation Rules) 2014

- Minimum authorised capital of ₹1 lakh

- DSC of the proposed director

- Proof of registered office of the OPC.

Steps for OPC Registration in Punjab

Legal Kamkaj has simplified the whole OPC process for easy registration in 5 easy steps

Step 1: Get in Touch With Consultant

Contact an OPC registration expert at Legal Kamkaj. We will assist you with the entire OPC registration process, including eligibility requirements and compliance matters.

Step 2: OPC Name Reservation

To avoid duplication, our expert will help you select a unique name for your One Person Company and reserve it with the MCA.

Step 3: Preparation of Documents

Our specialist will assist you in preparing all necessary documents, including the Memorandum of Association (MOA), Articles of Association (AOA), and other required forms and disclosures.

Step 4: Filing of Forms

Once the documents are prepared, our expert will assist you in submitting them to the MCA through the online portal, ensuring that all information is accurate and complete.

Step 5: Certificate from MCA

After the application is verified, the MCA will issue a Certificate of Incorporation, officially registering your OPC. Our expert will also help you obtain the PAN and TAN numbers for your company.

Why Legal Kamkaj is the Ideal Choice for Opening an OPC in Punjab ?

The process for OPC registration in Punjab is straightforward and allows individuals to set up and operate a company with ease. Requirements include being an Indian resident, having a valid PAN card, and providing a registered office address in India. The registration typically takes between 10-15 days. The company must also meet annual compliance requirements, including filing annual returns and maintaining accounting records. At Legal Kamkaj, we offer efficient and dependable solutions tailored to your needs, enabling you to focus on your business growth while we manage the legal intricacies.

Common Questions about One Person Company Registration in Punjab

The minimum authorized capital needed for OPC registration in Punjab is ₹1 lakh.

For OPC registration in Punjab, the nominee must be an Indian citizen and resident who complies with the eligibility standards set by the Companies Act, 2013.

The registration cost for an OPC may vary but generally comprises government fees, professional service costs, and digital signature charges. You can expect a total cost of approximately ₹12,000, which covers most of the expenses.

In Punjab, OPCs must manage their financial records and file an annual report with the Registrar of Companies (ROC). An audit of the accounts is required if the turnover exceeds ₹40 lakhs.