One Person Company Registration in Haryana

Are you looking into One Person Company Registration in Haryana? The process for One Person Company Registration in Haryana is straightforward, allowing a single individual to start and operate a business with limited liability. If you’re considering One Person Company Registration in Haryana, you must provide key documents, including proof of identity, address, and a registered office in Haryana. Completing the One Person Company Registration in Haryana process involves submitting the required forms to the Registrar of Companies (ROC) and paying the applicable fees. Opting for One Person Company Registration in Haryana ensures that your business operates with a distinct legal status, protecting your personal assets and facilitating easier business management. This registration establishes a solid foundation for your business, streamlining the handling of contracts, finances, and other operations effectively.

Get Started with One Person Company (OPC) Registration in Haryana

One Person Company Registration in Haryana

The One Person Company (OPC) concept, as set out in the Companies Act, 2013, makes it easy for entrepreneurs to establish their business as a distinct legal entity. By choosing this structure, solo business owners are able to protect their personal assets, focusing entirely on expanding their operations without the worry of financial risk affecting their personal wealth.

Starting a One Person Company (OPC) in Haryana is straightforward and effective. You can establish your business with just a single director and benefit from limited liability protection. The process is managed by the Ministry of Corporate Affairs (MCA) and adheres to the Companies Act, 2013. To keep your OPC operational, it’s important to submit income tax filings, annual reports, and financial records punctually. Ultimately, OPC registration in Haryana is an ideal option for individuals looking to launch a small business with minimal risk and uncomplicated regulations.

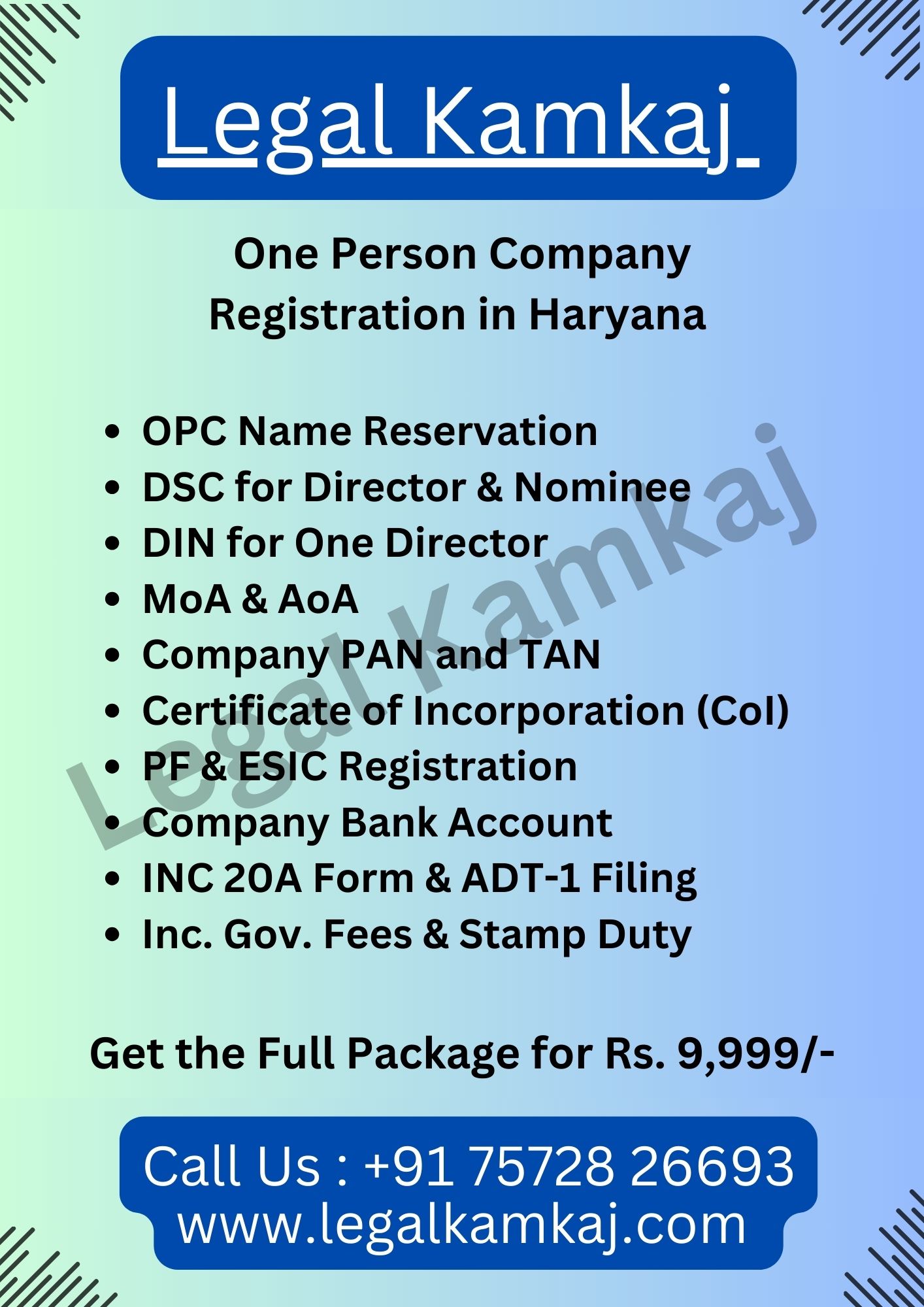

One Person Company Registration in Haryana - Package

Documents Required for OPC Registration in Haryana

To easily set up an OPC (One Person Company) online in India, you’ll need these documents:

- PAN Card, Aadhaar Card or Passport of the Director and Nominee

- Latest Bank Statement or Passbook of the Director and Nominee (Not older than two months)

- Passport size Photo of the Director and Nominee

- Mobile Number & Email Id of the Director and Nominee

- Office Address – Latest Utility bills like Telephone/Gas/Electricity bill (Not older than two months)

Benefits of OPC Registration in Haryana

OPC benefits are numerous and can significantly support the founder’s growth and success. Some of these advantages include:

Separate Legal Entity

An OPC is considered a separate legal entity, which means it can enter into contracts, own property, and take legal action independently.

Tax advantages

OPCs can benefit from various financial advantages, such as lower tax rates, tax exemptions, and deductions.

Easy to Start

In Haryana, you can set up an OPC with only one director, making the online registration process straightforward and efficient.

Greater Credibility

In Haryana, an OPC is often seen as more reputable than a partnership or sole proprietorship, which can help attract investors, clients, and suppliers.

Checklist for Registering OPC in Haryana

- Minimum and Maximum of one member

- Appoint a nominee before incorporation

- Nominee consent in Form INC-3

- OPC name selected as per the provisions of the Companies (Incorporation Rules) 2014

- Minimum authorised capital of ₹1 lakh

- DSC of the proposed director

- Proof of registered office of the OPC.

Process for OPC Registration in Haryana

Legal Kamkaj has simplified the whole OPC process for easy registration in 5 easy steps

Step 1: Get in Touch With Consultant

Contact an OPC registration expert at Legal Kamkaj. We will assist you with the entire OPC registration process, including eligibility requirements and compliance matters.

Step 2: OPC Name Reservation

To avoid duplication, our expert will help you select a unique name for your One Person Company and reserve it with the MCA.

Step 3: Preparation of Documents

Our specialist will assist you in preparing all necessary documents, including the Memorandum of Association (MOA), Articles of Association (AOA), and other required forms and disclosures.

Step 4: Filing of Forms

Once the documents are prepared, our expert will assist you in submitting them to the MCA through the online portal, ensuring that all information is accurate and complete.

Step 5: Certificate from MCA

After the application is verified, the MCA will issue a Certificate of Incorporation, officially registering your OPC. Our expert will also help you obtain the PAN and TAN numbers for your company.

Why Legal Kamkaj is Your Ideal Partner for OPC Registration in Haryana ?

The process of OPC registration in Haryana is straightforward, allowing an individual to set up and manage a company. To register, you must be an Indian resident with a valid PAN card and provide a registered office address in India. The registration usually takes about 10-15 days. The company must also adhere to annual compliance requirements, including submitting annual returns and maintaining proper accounting records. At Legal Kamkaj, we offer effective and reliable services tailored to your needs, enabling you to concentrate on business development while we handle the legalities.

One Person Company Registration in Haryana: Frequently Asked Questions

The minimum amount of authorized capital required for OPC registration in Haryana is ₹1 lakh.

To serve as a nominee for an OPC in Haryana, an individual must be an Indian citizen residing in India and adhere to the eligibility criteria set forth by the Companies Act, 2013.

The fee for OPC registration may fluctuate, but it generally includes government charges, service provider fees, and expenses for digital signatures. On average, the complete cost is approximately ₹12,000, covering the majority of fees.

For an OPC in Haryana, it is essential to track financial records and submit an annual report to the Registrar of Companies (ROC). Should the company’s turnover surpass ₹40 lakhs, an audit of its accounts is also mandatory.