LLP Registration Consultant in Uttar Pradesh

Looking for an LLP Registration Consultant in Uttar Pradesh? Registering a Limited Liability Partnership (LLP) in Uttar Pradesh is a straightforward process that offers both flexibility and legal protection. To start, you need to obtain a Digital Signature Certificate (DSC) and a Director Identification Number (DIN) for all partners. Once you have these, the next step in LLP Registration is to apply for name approval through the MCA portal. After you secure the name, you can file the incorporation documents, including the LLP Agreement, with the Registrar of Companies (RoC). After the RoC verifies the documents, it will issue the Certificate of Incorporation, completing the LLP Registration. This structure is popular among small businesses and professionals because it combines the benefits of a partnership with the added advantage of limited liability.

Specialized LLP Formation Services in Uttar Pradesh

LLP Registration in Uttar Pradesh

A Limited Liability Partnership (LLP) is a versatile business structure regulated by the Limited Liability Partnership Act, 2008. It merges the benefits of both partnerships and corporations, offering limited liability protection to its partners and ensuring that personal assets remain shielded from business debts. An LLP requires at least two designated partners to function, and there is no upper limit on the number of partners, making it an appealing choice for a wide range of businesses, particularly in service-oriented sectors across Uttar Pradesh.

Businesses in Uttar Pradesh widely favor the LLP structure due to its simplified registration process, ease of compliance, operational flexibility, and robust asset protection. If you’re planning to establish an LLP in Uttar Pradesh, our team of seasoned professionals—including lawyers, chartered accountants, and company secretaries—can guide and support you throughout the registration process. With our assistance, you can ensure that your LLP complies with all regulatory requirements and operates seamlessly within the Uttar Pradesh region.

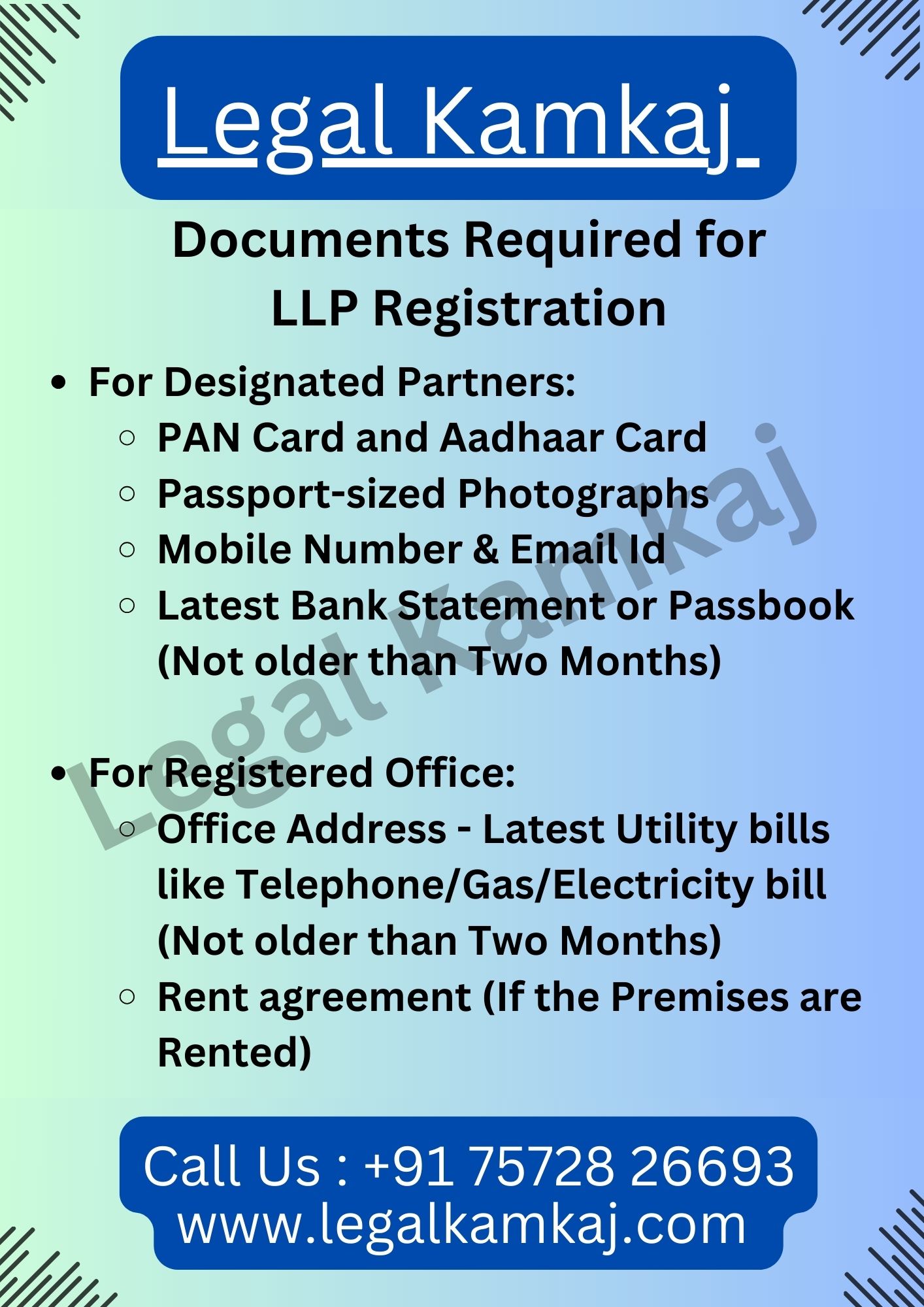

Documents Required for LLP Registration in Uttar Pradesh

For Designated Partners:

- PAN Card and Aadhaar Card

- Passport-sized Photographs

- Mobile Number & Email Id

- Latest Bank Statement or Passbook (Not older than Two Months)

For Registered Office:

- Office Address – Latest Utility bills like Telephone/Gas/Electricity bill (Not older than Two Months)

- Rent agreement (If the Premises are Rented)

Limited Liability Partnership (LLP) Registration Package in Uttar Pradesh

Start Your LLP Easily with Our Affordable Package. You’ll Get Everything Needed to Set up Your Limited Liability Partnership:

- LLP Name Reservation

- LLP Agreement Drafting

- FiLLiP & Form 3 Filing

- DSC for Two Partners

- DIN of Two Directors

- Certificate of Incorporation (CoI)

- LLP PAN & TAN Registration

- PF & ESIC Registration (if Applicable)

- Government Fees & Stamp Duty

- LLP Business Bank Account Opening

Advantages of LLP Incorporation in Uttar Pradesh

The major advantages of setting up an LLP in Uttar Pradesh are:

An LLP is easier to establish and manage due to fewer regulatory requirements. Therefore, LLP registration is often preferred over Pvt. Ltd. company registration.

Registration is more cost-effective compared to starting a company.

An LLP is a corporate entity that exists independently of its partners, offering similar benefits.

There is no mandatory minimum capital requirement for forming an LLP.

The entire process can be completed in under 30 days.

Process for LLP Registration in Uttar Pradesh

Here are the 5 steps we have to follow for LLP registration in Uttar Pradesh:

- The partners must obtain digital signatures in the first step of setting up an LLP in Uttar Pradesh.

- Next, you need to apply to the Ministry of Corporate Affairs (MCA) to reserve the LLP’s name.

- We prepare the incorporation documents and deliver them to the partners for signature. The partners must scan and upload the documents to the LegalKamkaj website, and our experts will provide the necessary information.

- The MCA must approve the signed copy of the documents before the company sends them to us.

- In the final step of registering an LLP in Uttar Pradesh, our legal experts review and submit the LLP deed, which all partners must sign.

- We can make the necessary changes, if any, in no time at LegalKamkaj!

Why Choose Legal Kamkaj?

LegalKamkaj offers exceptional services from leading legal experts in India for LLP registration in Uttar Pradesh. We guarantee timely submission of the LLP deed and provide 100% online, hassle-free services to simplify legal processes for our clients. We handle business setups efficiently, making us one of India’s largest legal service providers.

FAQ's on LLP Registration in Uttar Pradesh

The key requirements for LLP registration in Uttar Pradesh include obtaining Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) for all partners, reserving the LLP’s name with the Ministry of Corporate Affairs (MCA), and submitting the necessary incorporation documents.

- The registration process for an LLP in Uttar Pradesh typically takes around 15 to 20 working days, depending on the promptness of document submission and approvals from the MCA.

- No, there is no minimum capital requirement for forming an LLP in Uttar Pradesh. Partners can contribute any amount they deem necessary for the business.

Yes, foreign nationals can be partners in an LLP registered in Uttar Pradesh, provided they meet the necessary legal and regulatory requirements.

LLPs in Uttar Pradesh are required to file annual returns, maintain proper financial records, and comply with any other legal requirements such as tax filings and statutory audits.

The cost of registering an LLP in Uttar Pradesh varies depending on professional fees, government charges, and other expenses related to document preparation and submission.