LLP Registration Consultant in Maharashtra

Looking to establish an LLP in Maharashtra? The process of LLP Registration Consultant in Maharashtra is straightforward and provides both flexibility and legal protections. To begin, you must obtain a Digital Signature Certificate (DSC) and a Director Identification Number (DIN) for each partner. After that, you must apply for name approval through the MCA portal. Once you get approval for the name, you can proceed with submitting the incorporation documents, including the LLP Agreement, to the Registrar of Companies (RoC). After the RoC verifies the documents, they will issue the Certificate of Incorporation, finalizing the LLP Registration Consultant in Maharashtra. This business structure is preferred by small enterprises and professionals because it combines the benefits of a partnership with the advantages of limited liability

Specialized LLP Registration Services in Maharashtra

LLP Registration Process in Maharashtra

A Limited Liability Partnership (LLP) is a highly versatile business structure regulated by the Limited Liability Partnership Act, 2008. It combines the benefits of both partnerships and corporations, providing limited liability protection to its partners and safeguarding personal assets from business-related risks. To operate, an LLP requires at least two designated partners; however, no upper limit on the number of partners exists, making it an attractive option for various businesses, especially in the service industry across Maharashtra.

Moreover, businesses in Maharashtra highly regard the LLP model due to its efficient registration process, straightforward compliance requirements, and the operational flexibility it offers, along with strong asset protection. In addition, the legal framework allows businesses to adapt quickly to changing needs while minimizing risks. If you are considering establishing an LLP in Maharashtra, our team of skilled professionals, including lawyers, chartered accountants, and company secretaries, will guide you through each step and offer expert support during the registration process. With our assistance, you can ensure that your LLP complies with all legal standards and operates smoothly throughout Maharashtra, ultimately setting you up for long-term success.

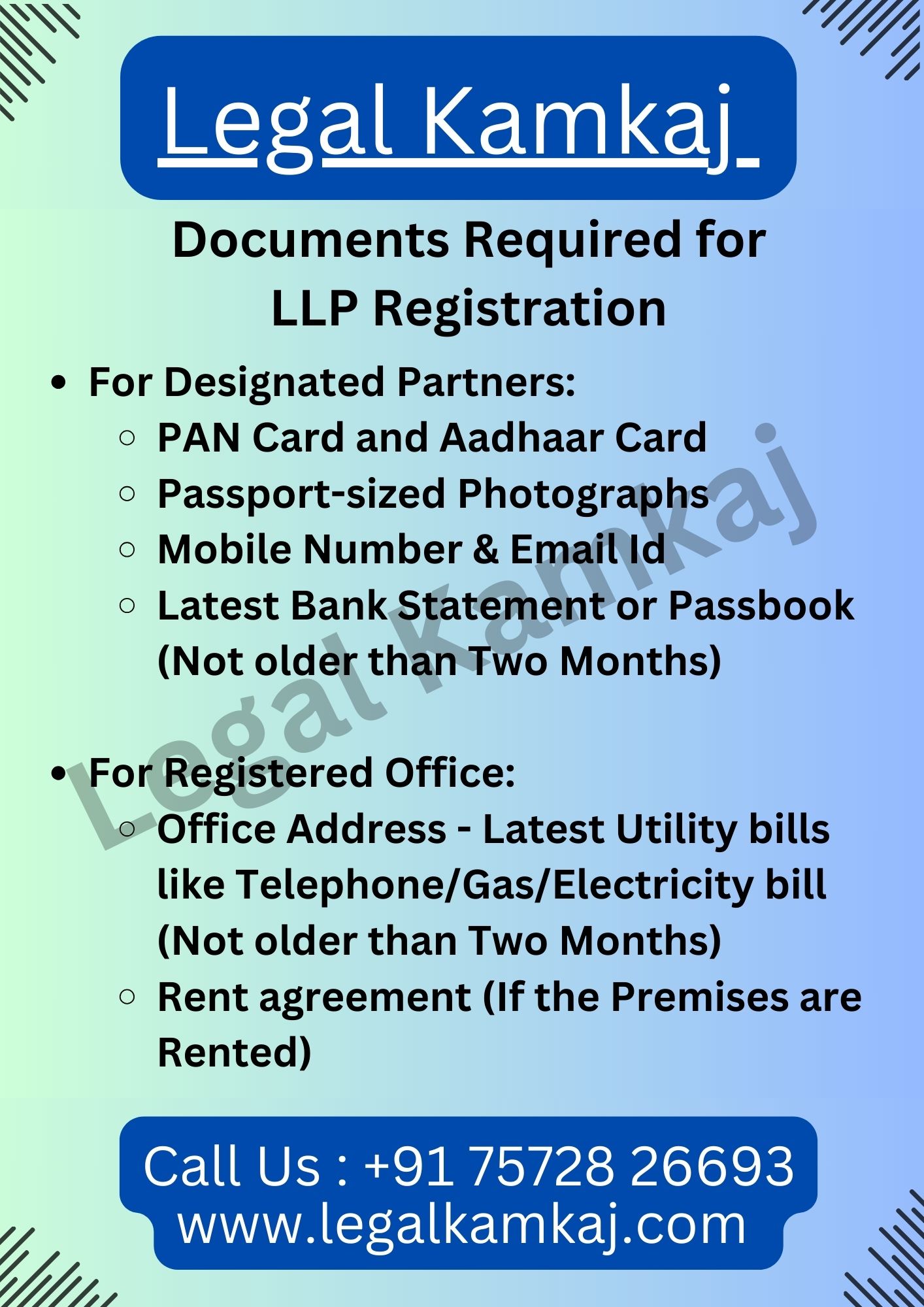

Documents Required for LLP Registration in Maharashtra

For Designated Partners:

- PAN Card and Aadhaar Card

- Passport-sized Photographs

- Mobile Number & Email Id

- Latest Bank Statement or Passbook (Not older than Two Months)

For Registered Office:

- Office Address – Latest Utility bills like Telephone/Gas/Electricity bill (Not older than Two Months)

- Rent agreement (If the Premises are Rented)

Limited Liability Partnership (LLP) Registration Package in Maharashtra

Start Your LLP Easily with Our Affordable Package. You’ll Get Everything Needed to Set up Your Limited Liability Partnership:

- LLP Name Reservation

- LLP Agreement Drafting

- FiLLiP & Form 3 Filing

- DSC for Two Partners

- DIN of Two Directors

- Certificate of Incorporation (CoI)

- LLP PAN & TAN Registration

- PF & ESIC Registration (if Applicable)

- Government Fees & Stamp Duty

- LLP Business Bank Account Opening

Advantages of Incorporating an LLP in Maharashtra

The major advantages of setting up an LLP in Maharashtra are:

LLP is easier to establish and manage due to its simpler requirements. This makes the process less complex and more flexible compared to registering a Pvt. Ltd. company. With fewer legal formalities, an LLP offers a streamlined approach for businesses and makes it a more attractive option for many entrepreneurs.

Entrepreneurs find registering an LLP more affordable compared to starting a company. Unlike company formation, which involves additional compliance costs, an LLP registration has fewer formalities and lower fees. This makes it an ideal choice for small businesses and entrepreneurs looking for a cost-effective way to establish their legal entity.

An LLP operates as a separate legal entity, distinct from its partners. This means it exists independently of its partners, allowing for personal asset protection and ensuring the business continues even if partners change or leave.

Entrepreneurs can form an LLP without any minimum capital requirement, which makes it an attractive option for those with limited resources. This flexibility allows businesses to start without worrying about capital constraints, enabling a more accessible and efficient registration process for small and medium-sized enterprises.

Entrepreneurs can complete the process in under 30 days, depending on the efficiency of document preparation and approval. With proper planning and guidance from professionals, they can shorten the timeline. This streamlined approach ensures they can register quickly and begin operations without unnecessary delays.

Process for LLP Registration in Maharashtra

Here are the 5 steps we have to follow for LLP registration in Maharashtra:

- To set up an LLP in Maharashtra, the first step is for each partner to obtain a Digital Signature Certificate (DSC). This is crucial as it enables the partners to sign electronic documents securely and efficiently. Once the DSCs are obtained, the next steps in the registration process can be initiated.

- Next, you must apply to the Ministry of Corporate Affairs (MCA) to reserve the LLP’s name. This step is essential in ensuring the name is unique and complies with legal guidelines. After submitting your application, the MCA will review it, and once approved, you can proceed with the registration process.

- We prepare the incorporation documents and deliver them to the partners for signature. Once signed, the partners must scan and upload the documents to the Legal Kamkaj website. Our experts will guide you with all the necessary information throughout the process, ensuring everything is completed correctly and efficiently.

- Before sending the signed copy of the documents to our company, the MCA must approve them. Once approval is granted, the documents will be forwarded to us for further processing. This step is essential to ensure compliance and facilitate the completion of the necessary legal procedures.

- The final step in registering an LLP in Maharashtra involves our legal experts reviewing and submitting the LLP deed. All partners must sign the deed, ensuring that it complies with the necessary legal requirements. This step concludes the registration process, and your LLP will be officially established and ready for operation.

-> We can make the necessary changes if any within no time at Legal Kamkaj!

What Makes Legal Kamkaj the Top Option?

Legal Kamkaj offers exceptional services, working with leading legal experts in India to assist with LLP formation in Maharashtra. We ensure the prompt submission of the LLP agreement and provide a fully online, hassle-free process, simplifying legal procedures for our clients. Our team efficiently manages business setups, positioning us as one of the top legal service providers in India. Through our expertise, clients benefit from a streamlined experience that minimizes complexities. By maintaining high standards of service, we help businesses navigate the process with confidence and ease. Our commitment to excellence drives us to deliver reliable, timely, and accessible legal solutions, making the entire LLP formation process quick and stress-free for our clients.

Popular Inquiries on LLP Registration in Maharashtra

A Limited Liability Partnership (LLP) combines the benefits of both partnerships and corporations. It offers limited liability protection to partners, shielding their personal assets from business risks. At the same time, it provides flexibility in management and operations. This structure allows partners to have control while enjoying the legal safeguards of a corporation, making it an ideal choice for many businesses.

- Limited Liability: Partners’ financial obligations are limited to their respective contributions.

- Management Flexibility: Allows for flexible and adaptable management and operations.

- Tax Advantages: LLPs are taxed as partnership entities, avoiding the double taxation that companies endure.

- Independent Legal Entity: LLPs operate separately from their partners, with the ability to hold assets, bring legal actions, or be involved in legal disputes.

- Required Partners: You need at least two partners to start, and there’s no upper limit.

- Eligibility for Partners: Both individuals and entities can be partners, but at least one must reside in India.

- Designated Partner Requirement: Two designated partners are required, and at least one must be a resident of India.