LLP Registration Consultant in Madhya Pradesh

An LLP Registration Consultant in Madhya Pradesh can simplify the process of setting up a Limited Liability Partnership (LLP), a popular business structure offering both legal protection and flexibility. Firstly, each partner must obtain a Digital Signature Certificate (DSC) and a Director Identification Number (DIN). Subsequently, you must submit an application for the LLP’s name through the Ministry of Corporate Affairs (MCA) portal.

Once you secure the name approval, you should immediately proceed to prepare the necessary documents, including the LLP Agreement. Then, you submit these documents to the Registrar of Companies (RoC). Afterward, the RoC reviews the documents and ensures everything is in order.

Following this, the process culminates with the issuance of a Certificate of Incorporation, which officially registers your LLP. Ultimately, hiring an LLP Registration Consultant in Madhya Pradesh allows you to navigate these steps smoothly, ensuring that you complete every requirement accurately and on time

Professional Services for LLP Registration in Madhya Pradesh

LLP Registration Process in Madhya Pradesh

A Limited Liability Partnership (LLP) is a flexible business structure governed by the Limited Liability Partnership Act, 2008. It combines the advantages of both partnerships and corporations, offering limited liability protection to partners and safeguarding their personal assets from business-related risks. To begin LLP registration in Madhya Pradesh, you need a minimum of two designated partners, though the Act does not impose an upper limit, making it an attractive option for a wide range of businesses, particularly in the service sector within the state.

Business owners highly regard LLP registration in Madhya Pradesh for its straightforward process, clear compliance requirements, and operational flexibility, which strongly protects assets. If you plan to register an LLP in Madhya Pradesh, our team of experienced professionals—including attorneys, chartered accountants, and company secretaries—guides and supports you throughout the entire process. Our assistance ensures that your LLP meets all legal requirements and operates efficiently in the Madhya Pradesh region.

Choosing the right structure for your business is essential, and an LLP provides a reliable, secure, and legally compliant option that meets the needs of small and medium enterprises. By partnering with us, you can avoid potential pitfalls during registration and ensure the proper setup of your LLP from the outset. Our professionals simplify the registration process, allowing you to focus on business growth while we handle the legal complexities. Whether you are a startup or an established business expanding into new territories, we make the registration process seamless and efficient. With proper guidance, you can ensure smooth operations for your LLP while maintaining compliance with all applicable laws in Madhya Pradesh, helping you focus on the long-term success of your business.

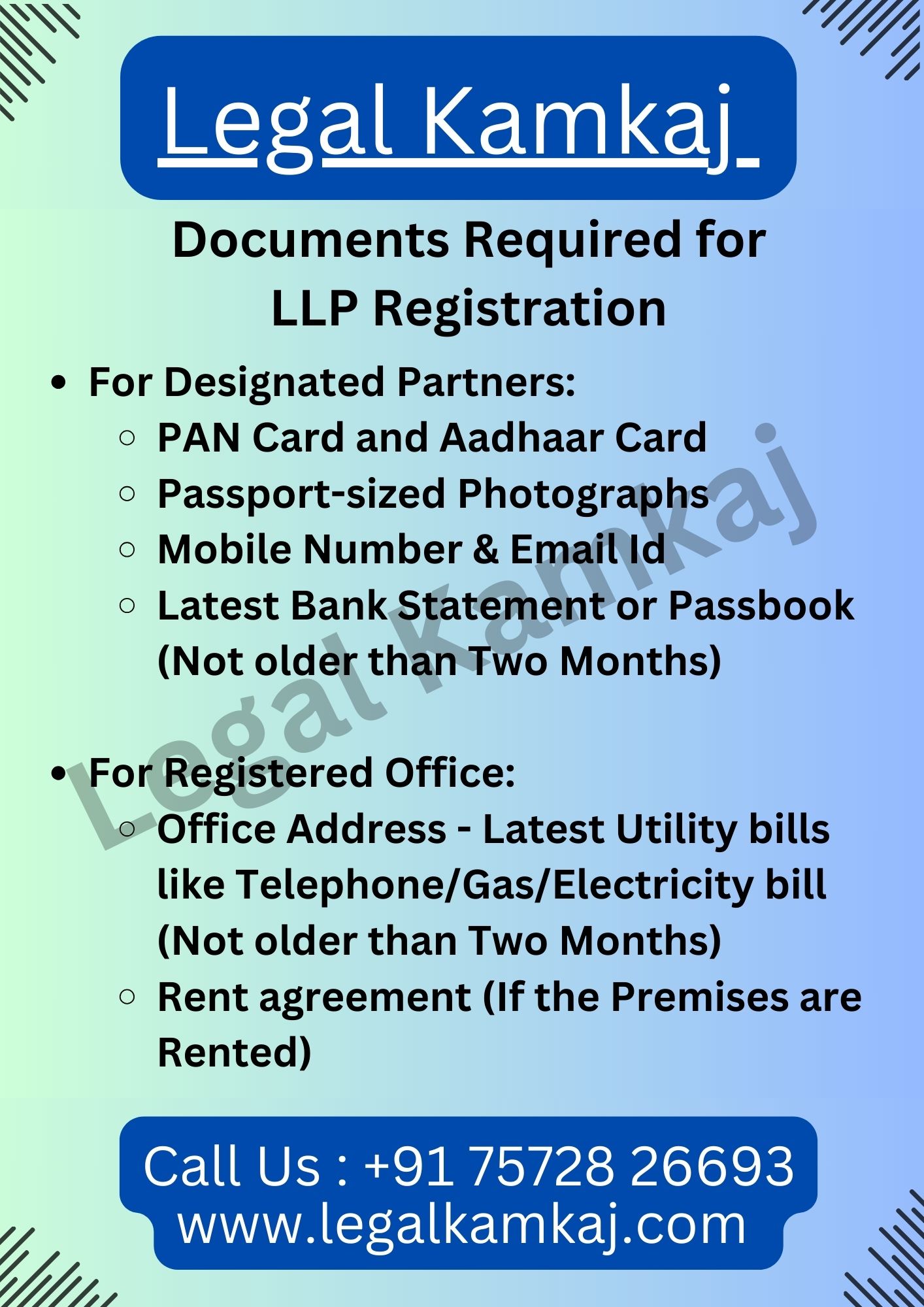

Documents Required for LLP Registration in Madhya Pradesh

For Designated Partners:

- PAN Card and Aadhaar Card

- Passport-sized Photographs

- Mobile Number & Email Id

- Latest Bank Statement or Passbook (Not older than Two Months)

For Registered Office:

- Office Address – Latest Utility bills like Telephone/Gas/Electricity bill (Not older than Two Months)

- Rent agreement (If the Premises are Rented)

Limited Liability Partnership (LLP) Registration Package in Madhya Pradesh

Start Your LLP Easily with Our Affordable Package. You’ll Get Everything Needed to Set up Your Limited Liability Partnership:

- LLP Name Reservation

- LLP Agreement Drafting

- FiLLiP & Form 3 Filing

- DSC for Two Partners

- DIN of Two Directors

- Certificate of Incorporation (CoI)

- LLP PAN & TAN Registration

- PF & ESIC Registration (if Applicable)

- Government Fees & Stamp Duty

- LLP Business Bank Account Opening

Benefits of Establishing an LLP Registration in Madhya Pradesh

The major advantages of setting up an LLP in Madhya Pradesh are:

An LLP is easier to set up and manage compared to a Private Limited Company because it involves fewer requirements. This simplicity makes the LLP registration process more straightforward and less time-consuming. Many individuals prefer registering an LLP over a Pvt. Ltd. Company because of its flexibility and lower complexity.

Registering an LLP also costs less than starting a company. The process includes fewer formalities, which reduces expenses. Unlike company registration, which requires extensive paperwork and compliance, the LLP registration procedure remains simpler and quicker. As a result, small businesses often choose an LLP for its affordability.

An LLP operates as a separate corporate entity, unlike traditional partnerships, which depend on the individuals involved. This structure enables the LLP to function independently, offering protection and flexibility to its partners. Therefore, the LLP provides a secure and sustainable business model.

Forming an LLP does not require a minimum capital investment, making it accessible to many entrepreneurs. Partners can contribute based on their ability, eliminating the need for significant upfront investment. This feature is particularly attractive to small businesses with limited capital.

You can complete the entire process in under 30 days. With the right guidance, you can efficiently obtain DSC and DIN, get name approval, and submit documents to the RoC. Afterward, the RoC registers and incorporates the LLP, ensuring a quick and accurate setup. The entire process is fast and cost-effective, enabling entrepreneurs to start their businesses without unnecessary delays or expenses.

Steps for LLP Incorporation in Madhya Pradesh

Here are the 5 steps we have to follow for LLP registration in Madhya Pradesh :

- Partners must obtain digital signatures as the first step in setting up an LLP in Madhya Pradesh.

- Each partner must secure a Director Identification Number (DIN) after obtaining their digital signatures.

- The partners must approve the LLP name through the MCA portal.

- Partners submit the incorporation documents for registration after the name approval.

- Partners must apply for the LLP’s name through the Ministry of Corporate Affairs (MCA) to reserve it.

- The MCA reviews and approves the application, reserving the name for further registration steps.

- Our team prepares the incorporation documents and delivers them to the partners for signatures.

- Partners must scan and upload the signed documents to the Legal Kamkaj website, where our experts provide the necessary information.

- The MCA approves the signed documents before submission to our company.

- Our company forwards the documents for further processing only after receiving MCA approval, ensuring compliance with regulations.

- Our legal experts review and submit the LLP deed to complete the registration process.

- The partners sign the deed, and we prepare and submit it to ensure compliance with regulations.

-> We can make the necessary changes if any within no time at Legal Kamkaj!

What Makes Legal Kamkaj the Ideal Option?

At Legal Kamkaj, we provide top-notch services for LLP registration in Madhya Pradesh, delivered by esteemed legal professionals. We handle the submission of LLP agreements promptly, ensuring that all processes are completed on time. With our seamless online system, clients can efficiently complete their legal tasks from the comfort of their homes. Our approach to business setups is both efficient and client-focused, making the process as smooth as possible. This has allowed us to build a strong reputation as a leading legal service provider in India. Through dedication and attention to detail, we have earned the trust of numerous businesses, helping them establish themselves successfully. With Legal Kamkaj, clients benefit from a stress-free experience, knowing that their LLP registration is being handled with expertise and professionalism every step of the way.

Top Inquiries on LLP Registration in Madhya Pradesh

A Limited Liability Partnership (LLP) combines partnership and corporation features. It offers limited liability to partners, protecting personal assets from business debts. LLPs provide operational flexibility, as partners manage the business directly without strict corporate rules. Additionally, LLPs are taxed like partnerships, avoiding double taxation. This structure is ideal for small businesses and professionals seeking liability protection and management ease.

- Limited Liability: Partners’ financial obligations are limited to their respective contributions.

- Management Flexibility: Allows for flexible and adaptable management and operations.

- Tax Advantages: LLPs are taxed as partnership entities, avoiding the double taxation that companies endure.

- Independent Legal Entity: LLPs operate separately from their partners, with the ability to hold assets, bring legal actions, or be involved in legal disputes.