LLP Registration in Kerala

Looking to set up an LLP in Kerala? The process of LLP registration in Kerala involves a few important changes that ensure both flexibility and legal safeguards. To begin, you’ll need to acquire a Digital Signature Certificate (DSC) and a Director Identification Number (DIN) for each partner. Following this, the next step in the LLP registration in Kerala process is to request name approval via the MCA portal. Once the name is confirmed, you can submit the incorporation paperwork, including the LLP Agreement, to the Registrar of Companies (RoC). After successful verification and making any necessary changes, the RoC will issue the Certificate of Incorporation, finalizing the LLP registration in Kerala. This business structure is favored by small enterprises and professionals because LLP registration in Kerala blends the advantages of a partnership with the benefit of limited liability, allowing businesses to adapt to changes as they grow.

Expert LLP Registration Services in Kerala

Limited Liability Partnership Registration in Kerala

A Limited Liability Partnership (LLP) is a versatile business model governed by the Limited Liability Partnership Act, 2008. It blends the benefits of partnerships and corporations, offering limited liability protection to its partners while safeguarding personal assets from business obligations. With a requirement of at least two designated partners to operate and no upper limit on the number of partners, LLPs are an appealing option for businesses, particularly in Kerala’s thriving service sectors.

Kerala’s business community values the LLP format for its efficient registration process, straightforward compliance requirements, and operational flexibility. This structure not only ensures robust asset protection but also promotes smooth business operations. If you plan to establish an LLP in Kerala, our team of skilled professionals—comprising attorneys, chartered accountants, and company secretaries—is ready to provide expert guidance and comprehensive support. We will help you navigate the registration process, ensure compliance with all legal requirements, and set your business up for success in Kerala’s dynamic market.

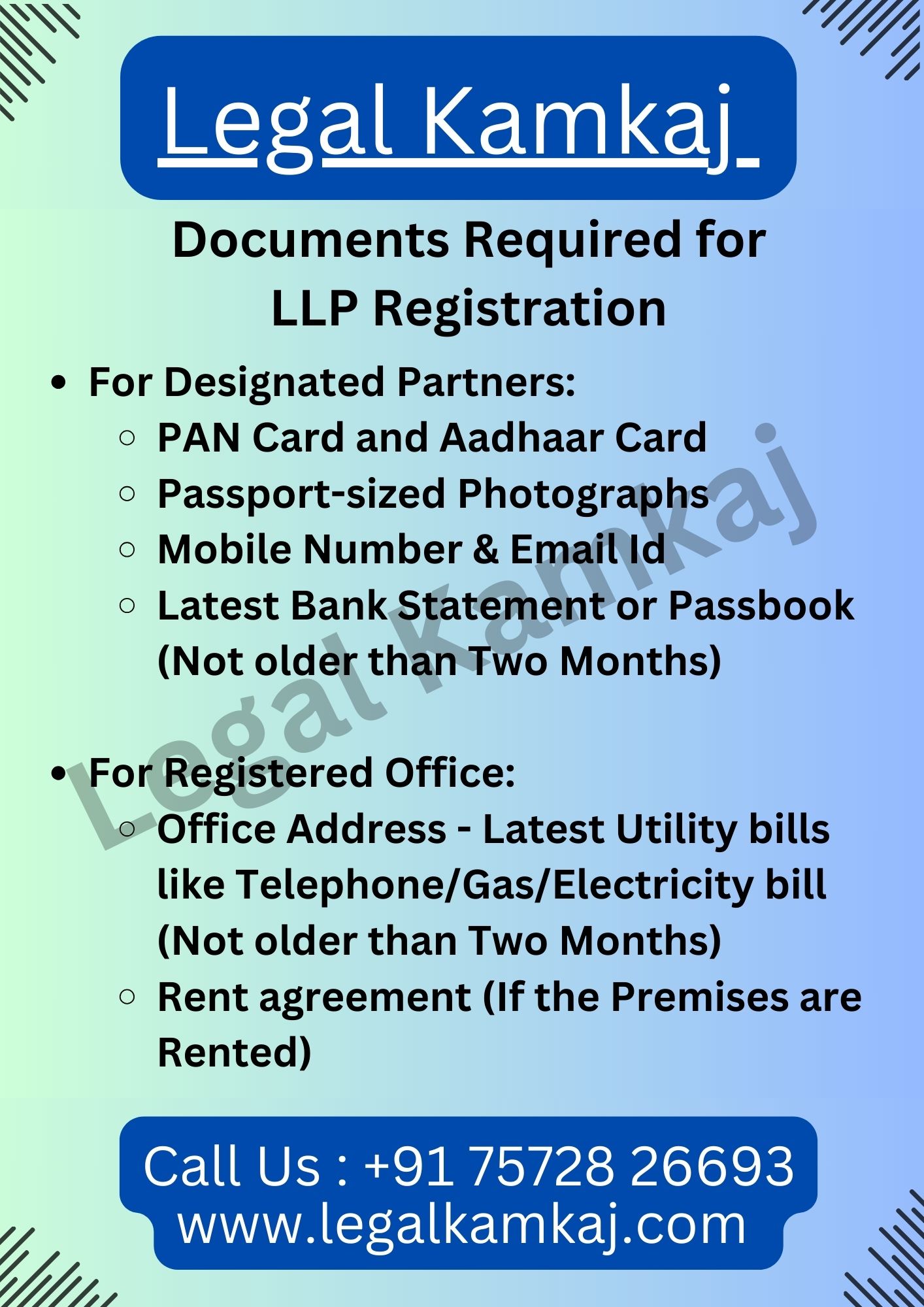

Documents Required for LLP Registration in Kerala

For Designated Partners:

- PAN Card and Aadhaar Card

- Passport-sized Photographs

- Mobile Number & Email Id

- Latest Bank Statement or Passbook (Not older than Two Months)

For Registered Office:

- Office Address – Latest Utility bills like Telephone/Gas/Electricity bill (Not older than Two Months)

- Rent agreement (If the Premises are Rented)

Limited Liability Partnership (LLP) Registration Package in Kerala

Start Your LLP Easily with Our Affordable Package. You’ll Get Everything Needed to Set up Your Limited Liability Partnership:

- LLP Name Reservation

- LLP Agreement Drafting

- FiLLiP & Form 3 Filing

- DSC for Two Partners

- DIN of Two Directors

- Certificate of Incorporation (CoI)

- LLP PAN & TAN Registration

- PF & ESIC Registration (if Applicable)

- Government Fees & Stamp Duty

- LLP Business Bank Account Opening

Advantages of Setting Up an LLP Registration in Kerala

The major advantages of setting up an LLP in Kerala are:

- An LLP is easier to establish and manage due to fewer requirements. Therefore, LLP registration often proves more advantageous than private limited company registration, offering simplicity and reduced compliance. With less administrative burden, it becomes an attractive choice for entrepreneurs seeking streamlined operations and flexibility in structuring their business.

- Registering a business costs significantly less than launching a company. Establishing a new business requires substantial expenses for infrastructure, operations, and legal processes, whereas registration involves comparatively minimal fees. Therefore, choosing to register an existing entity first can save resources, streamline processes, and simplify initial steps in entering the business landscape.

- A corporate entity functioning autonomously from its partners mirrors the structure of an LLP. This similarity arises due to the shared characteristic of legal independence, where obligations and liabilities rest with the entity itself. Consequently, the partners or members retain limited personal liability, fostering a distinct separation between personal and business affairs.

- LLPs have no mandatory minimum capital requirement for formation, allowing flexibility in setting the capital structure. This flexibility enables partners to determine their contributions without fixed constraints. Consequently, the capital structure of an LLP is shaped by the agreement among the partners, ensuring adaptability to various business needs.

- The task could be completed in less than 30 days. Additionally, with significant effort and resources, it would be finished within the given timeframe. Various steps, including planning, preparation, and execution, will be taken to ensure efficiency, and all objectives should be met promptly and successfully.

Complete Overview of the LLP Incorporation Process in Kerala

Here are the 5 steps we have to follow for LLP registration in Kerala:

- To set up an LLP in Kerala, partners must first secure digital signatures. This essential step ensures proper authentication for filing online documents and complying with legal requirements. Digital signatures uniquely identify each partner, providing a secure foundation for the registration process and subsequent operations of the LLP.

- First, apply to the Ministry of Corporate Affairs (MCA) to reserve the LLP’s name. This step ensures the chosen name is unique and complies with regulatory guidelines. Provide preferred names during the application, ranked by priority. Once approved, proceed with further steps in the LLP registration process.

- We prepare the incorporation documents and deliver them to the partners for signatures. Afterward, scan and upload the signed documents to the Legal Kamkaj website. Our experts will then guide you with all necessary information, ensuring a smooth process and addressing any queries promptly for your complete understanding.

- The MCA reviews and approves the signed documents before forwarding them to our company. This ensures accuracy and compliance with regulatory standards. Once the approval is granted, the documents proceed efficiently, streamlining the process and maintaining clear communication between all parties involved. This step is crucial for smooth operations.

- The final step to register an LLP in Kerala involves submitting the LLP deed after all partners sign it. Our legal experts thoroughly review the document to ensure accuracy and compliance before submission, completing the registration process seamlessly. This ensures your LLP is established efficiently and in accordance with regulations.

-> We can make the necessary changes if any within no time at Legal Kamkaj!

What Makes Legal Kamkaj the Best Choice?

Legal Kamkaj provides exceptional services by connecting clients with top legal professionals in India for LLP formation in Kerala. We prioritize the swift submission of LLP agreements and offer fully online, seamless services to simplify legal procedures. With our expertise in managing business setups and implementing necessary changes, we enhance our reputation as a leading legal service provider in India.

Frequently Asked Questions Regarding LLP Setup in Kerala

A Limited Liability Partnership (LLP) combines features of both a partnership and a corporation. It provides partners with limited liability, protecting personal assets from business debts. LLPs allow flexible management, enabling partners to define roles and responsibilities. This structure offers liability protection while avoiding many formalities of corporations, making it a versatile option for business operations.

- Limited Liability: Partners’ financial obligations remain confined to their respective contributions.

Management Flexibility: This structure provides flexibility, allowing for adaptable management and operations. - Tax Advantages: LLPs benefit from being taxed as partnership entities, which avoids the double taxation that corporations face.

- Independent Legal Entity: LLPs function as separate legal entities, capable of holding assets, initiating legal actions, and participating in legal disputes.

- Required Partners: You need at least two partners to start, and there’s no upper limit.

- Eligibility for Partners: Both individuals and entities can be partners, but at least one must reside in India.

- Designated Partner Requirement: Two designated partners are required, and at least one must be a resident of India.