LLP Registration Consultant in Haryana

Looking to get an LLP Registration Consultant in Haryana? The process to get LLP Registration Consultant in Haryana is straightforward and provides both flexibility and legal protection. To start, you’ll need to get a Digital Signature Certificate (DSC) and a Director Identification Number (DIN) for each partner. Next, to proceed with LLP Registration Consultant in Haryana, request name approval through the MCA portal. After receiving the name approval, you can submit the necessary incorporation documents, including the LLP Agreement, to the Registrar of Companies (RoC). Once the RoC verifies the documents, they will issue the Certificate of Incorporation, completing the LLP Registration Consultant in Haryana. This business structure is popular among small businesses and professionals because LLP Registration Consultant in Haryana combines the benefits of a partnership with limited liability. Get started with your LLP Registration Consultant in Haryana today to enjoy these advantages.

Expert LLP Registration Services in Haryana

Starting Limited Liability Partnership Registration in Haryana

A Limited Liability Partnership (LLP) is a flexible business model governed by the Limited Liability Partnership Act, 2008. It combines the advantages of partnerships and corporations, offering limited liability protection to its partners and ensuring personal assets are safeguarded from business liabilities. An LLP requires at least two designated partners to operate, with no upper limit, which makes it an appealing choice for many businesses, particularly in service sectors across Haryana.

The LLP format enjoys a strong reputation in Haryana due to its efficient registration process, straightforward compliance requirements, and the operational freedom it offers. Additionally, the robust asset protection it provides further enhances its appeal. If you are considering establishing an LLP in Haryana, our team of experienced professionals—including attorneys, chartered accountants, and company secretaries—stands ready to guide you through every step of the registration process. With our expert assistance, you will ensure that your LLP complies with all legal requirements and functions smoothly in the Haryana region.

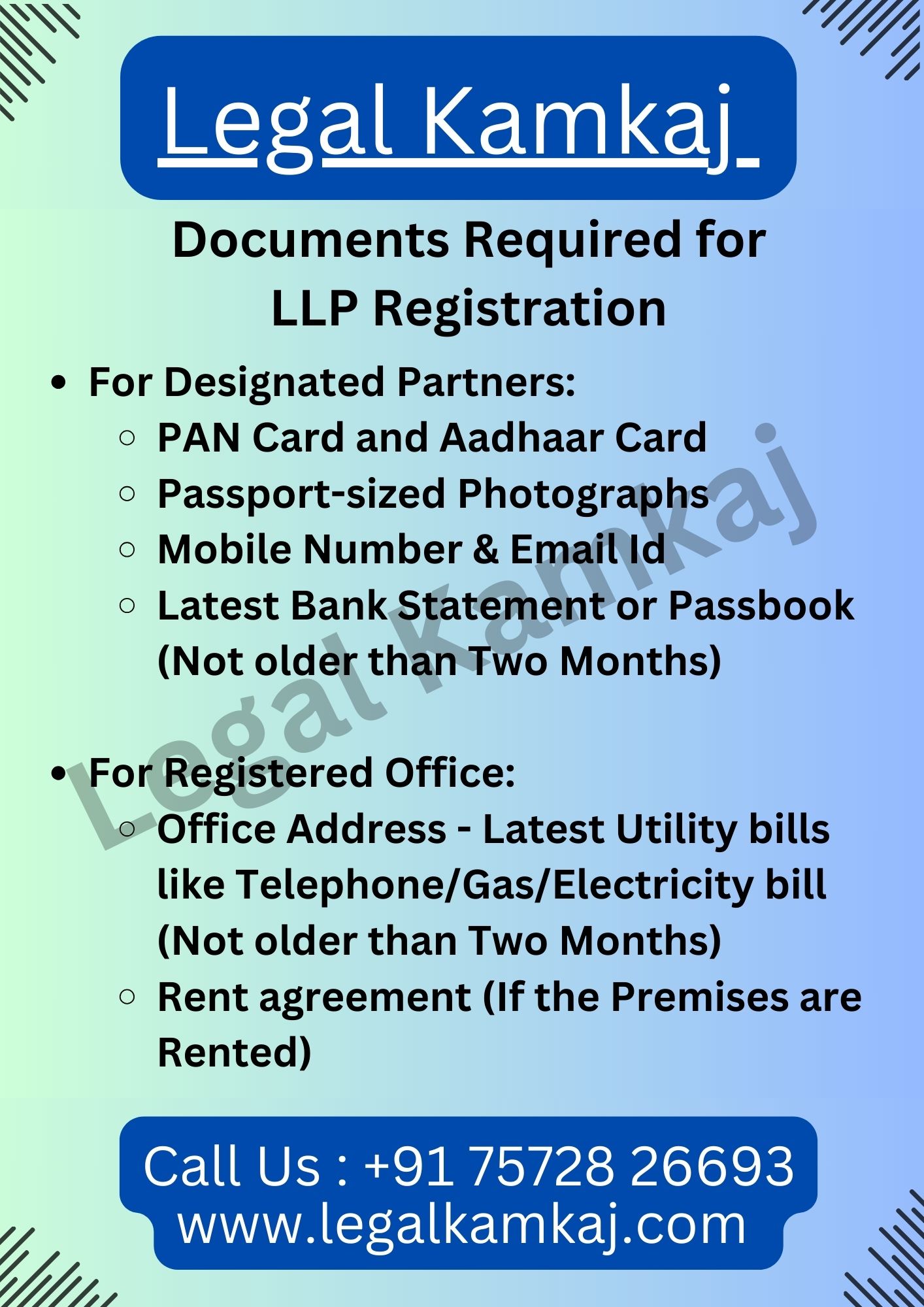

Documents Required for LLP Registration in Haryana

For Designated Partners:

- PAN Card and Aadhaar Card

- Passport-sized Photographs

- Mobile Number & Email Id

- Latest Bank Statement or Passbook (Not older than Two Months)

For Registered Office:

- Office Address – Latest Utility bills like Telephone/Gas/Electricity bill (Not older than Two Months)

- Rent agreement (If the Premises are Rented)

Limited Liability Partnership (LLP) Registration Package in Haryana

Start Your LLP Easily with Our Affordable Package. You’ll Get Everything Needed to Set up Your Limited Liability Partnership:

- LLP Name Reservation

- LLP Agreement Drafting

- FiLLiP & Form 3 Filing

- DSC for Two Partners

- DIN of Two Directors

- Certificate of Incorporation (CoI)

- LLP PAN & TAN Registration

- PF & ESIC Registration (if Applicable)

- Government Fees & Stamp Duty

- LLP Business Bank Account Opening

Advantages of Carrying Out LLP Registration in Haryana

The major advantages of setting up an LLP in Haryana are:

- An LLP is simpler to establish and manage since it has fewer requirements. Hence, we say LLP registration is better than Pvt. ltd company registration.

- Registration is less expensive than starting a company.

- A corporate entity that exists independently of its partners is comparable to an LLP.

- There is no set minimum capital requirement for the formation of LLPs.

- It could be done under 30 days.

LLP Registration Steps in Haryana

Here are the 5 steps to follow for LLP registration in Haryana:

1. Obtain Digital Signatures: The first step in forming an LLP in Haryana involves acquiring digital signatures for each partner. Subsequently, you must proceed with the next necessary steps, such as obtaining a Director Identification Number (DIN) and seeking name approval through the MCA portal. These actions are critical before finalizing the incorporation process.

2. Reserve the LLP Name: Next, you must apply to the Ministry of Corporate Affairs (MCA) for name approval. Following this, the MCA will review and approve the name. Once approved, you can proceed to the next steps in the registration process. This ensures compliance with the regulations required to form an LLP successfully.

3. Prepare and Submit Documents: We will prepare the incorporation documents and send them to the partners for signing. After signing, the partners must scan and upload these documents to the Legal Kamkaj website. There, our experts will assist you throughout the process, ensuring seamless guidance every step of the way.

4. MCA Approval: The MCA must approve the signed documents before forwarding them to our company. Once the MCA grants approval, we can proceed with the next steps in the process. Following this, the documents will be handed over to our company, ensuring compliance with necessary regulations and formalities.

5. Review and Submit LLP Deed: Finally, our legal team will carefully review and file the LLP deed. They will ensure that all partners sign the document, completing the process. The team will verify all terms and conditions, ensuring compliance with regulations. Once completed, they will finalize and submit the deed, securing its legal standing.

If any adjustments are needed, we at Legal Kamkaj can make them quickly!

What Makes Legal Kamkaj the Preferred Choice?

Legal Kamkaj offers exceptional services from top legal experts in India for LLP formation in Haryana. We ensure the prompt submission of the LLP agreement and provide a fully online, streamlined process that simplifies legal tasks for our clients. Furthermore, we efficiently manage business setups, which has positioned us as one of the largest legal service providers in India. By working closely with our clients, we aim to make every step of the process as seamless and efficient as possible.

Frequently Asked Questions About LLP Establishment in Haryana

An LLP (Limited Liability Partnership) combines partnership features with corporation benefits, offering partners limited liability and flexible management options. It protects personal assets, allows customizable profit-sharing, and offers tax advantages through pass-through taxation. Ideal for professionals and small businesses, LLPs minimize compliance burdens while ensuring legal protection.

- Liability Limitation: Partners’ financial liabilities are confined to their individual contributions.

- Management Flexibility: Allows for a flexible approach to management and operations.

- Tax Advantages: LLPs are treated for tax purposes as partnerships, thus evading the double taxation faced by corporations.

- Legal Independence: LLPs operate separately from their partners, with the ability to own assets, file lawsuits, or participate in legal disputes.

- Partner Requirements: At least two partners are required to form an LLP, with no upper limit on the number.

- Eligibility for Partners: Partners can be both people and organizations, but one must live in India.

- Designated Partner Requirement: Two designated partners are necessary, with one being a resident of India.