Income Tax Audit under Section 44AB

The Income Tax Audit under Section 44AB of the Income Tax Act, 1961, is an essential compliance requirement for certain taxpayers in India. This Income Tax Audit ensures that businesses and professionals maintain proper books of accounts and adhere to tax laws, preventing tax evasion.

The main purpose of the Income Tax Audit is to verify the accuracy of financial statements and tax computations. It is carried out by a Chartered Accountant (CA), who thoroughly examines the books of accounts and issues an audit report in Form 3CA/3CB and Form 3CD. Legal Kamkaj offers expert assistance in conducting an Income Tax Audit, ensuring smooth compliance and hassle-free filing for businesses and professionals.

Income Tax Audit?

What is Income Tax Audit under Section 44AB?

The Income Tax Audit under Section 44AB of the Income Tax Act, 1961, is a mandatory audit conducted to ensure taxpayers maintain proper books of accounts and comply with tax laws. It is performed by a Chartered Accountant (CA), who examines the financial records and submits an audit report to the Income Tax Department.

Objective of Income Tax Audit

The Income Tax Audit under Section 44AB is conducted to ensure taxpayers follow tax laws and maintain accurate financial records. Its main objectives are:

✅ Ensuring Accuracy of Financial Statements – Verifies that financial records, income, and expenses are correctly reported.

✅ Preventing Tax Evasion – Helps detect any discrepancies or underreporting of income, reducing the risk of tax evasion.

✅ Standardizing Accounting – Ensures businesses follow proper accounting practices.

✅ Compliance with Income Tax Laws – Makes sure taxpayers meet legal requirements and avoid penalties.

✅ Simplifying Tax Assessment – Helps the Income Tax Department process returns faster and reduces scrutiny.

Legal Kamkaj ensures a smooth Income Tax Audit process, helping businesses stay compliant and avoid penalties.

Benefits of Income Tax Audit

Here are some simple benefits of conducting an Income Tax Audit under Section 44AB:

Ensures Tax Compliance

Helps ensure your business follows all tax laws and avoids legal issues.

Accurate Financial Reporting

Ensures your financial statements are accurate, reducing errors in your tax filings.

Avoids Penalties and Interest

Timely submission of the Income Tax Audit Report helps avoid penalties and interest for late filing.

Increases Credibility and Trust

An audit increases credibility with investors, clients, and tax authorities by showing transparency.

Financial Planning and Tax Savings

Identifies areas to optimize taxes and save on potential deductions.

Reduces Risk of Future Scrutiny

A proper audit can reduce the chance of future audits or scrutiny from tax authorities.

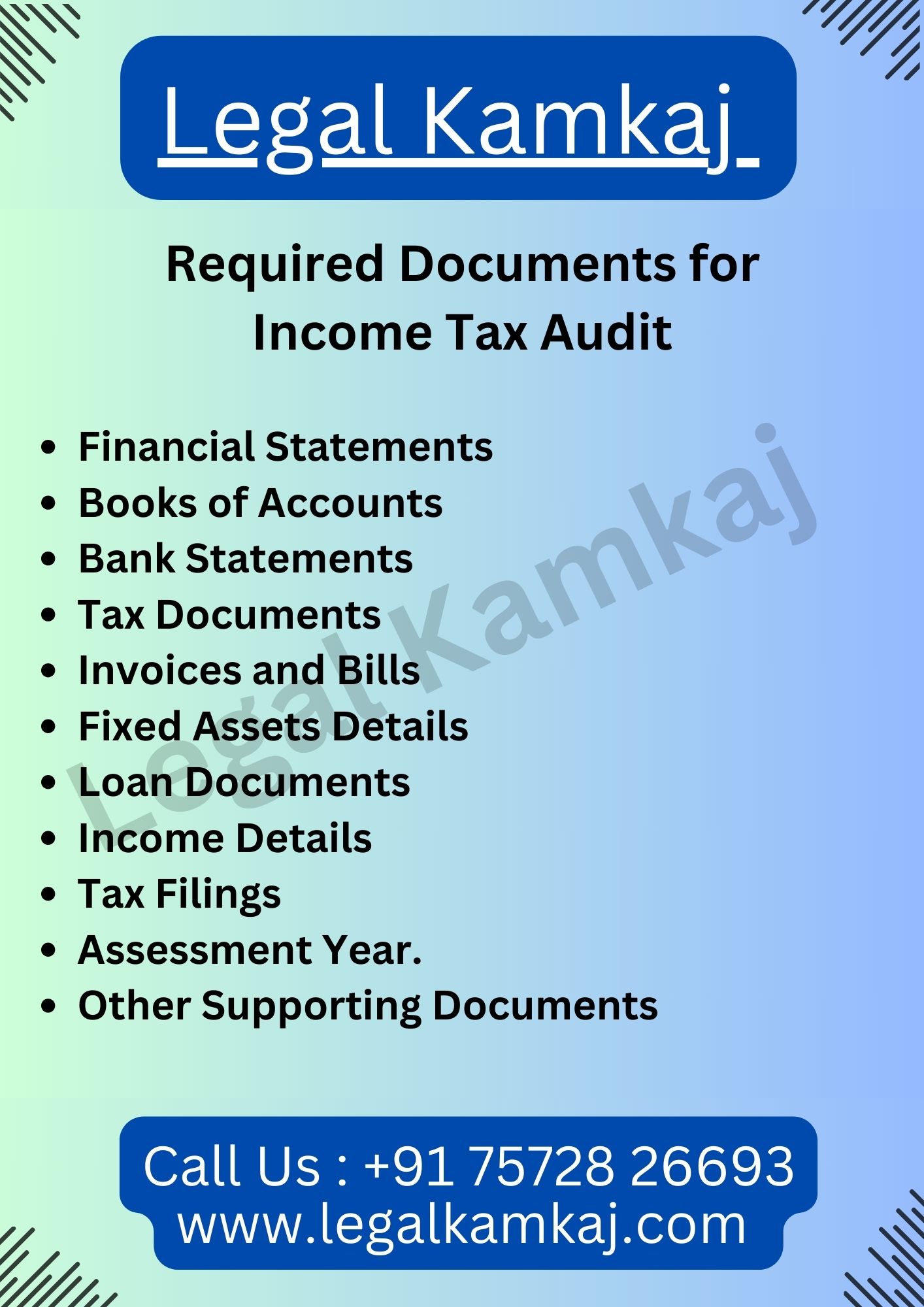

Required Documents for Income Tax Audit

To complete an Income Tax Audit under Section 44AB, you’ll need to provide the following documents:

- Financial Statements – Balance Sheet & Profit and Loss Account

- Books of Accounts – Ledger & Cashbook

- Bank Statements – Statements from all business-related bank accounts.

- Tax Documents – TDS Certificates (Form 16A, 16B, 16C) & GST Returns (If Applicable)

- Invoices and Bills – Sales and Purchase Invoices & Business Expense Receipts

- Fixed Assets Details – List of fixed assets and depreciation schedules.

- Loan Documents – Loan agreements and interest payment records.

- Income Details – Details of any other income or deductions.

- Tax Filings – GST returns (If Registered) & Tax Returns for the Relevant Assessment Year.

- Other Supporting Documents – Details of any other income or deductions claimed.

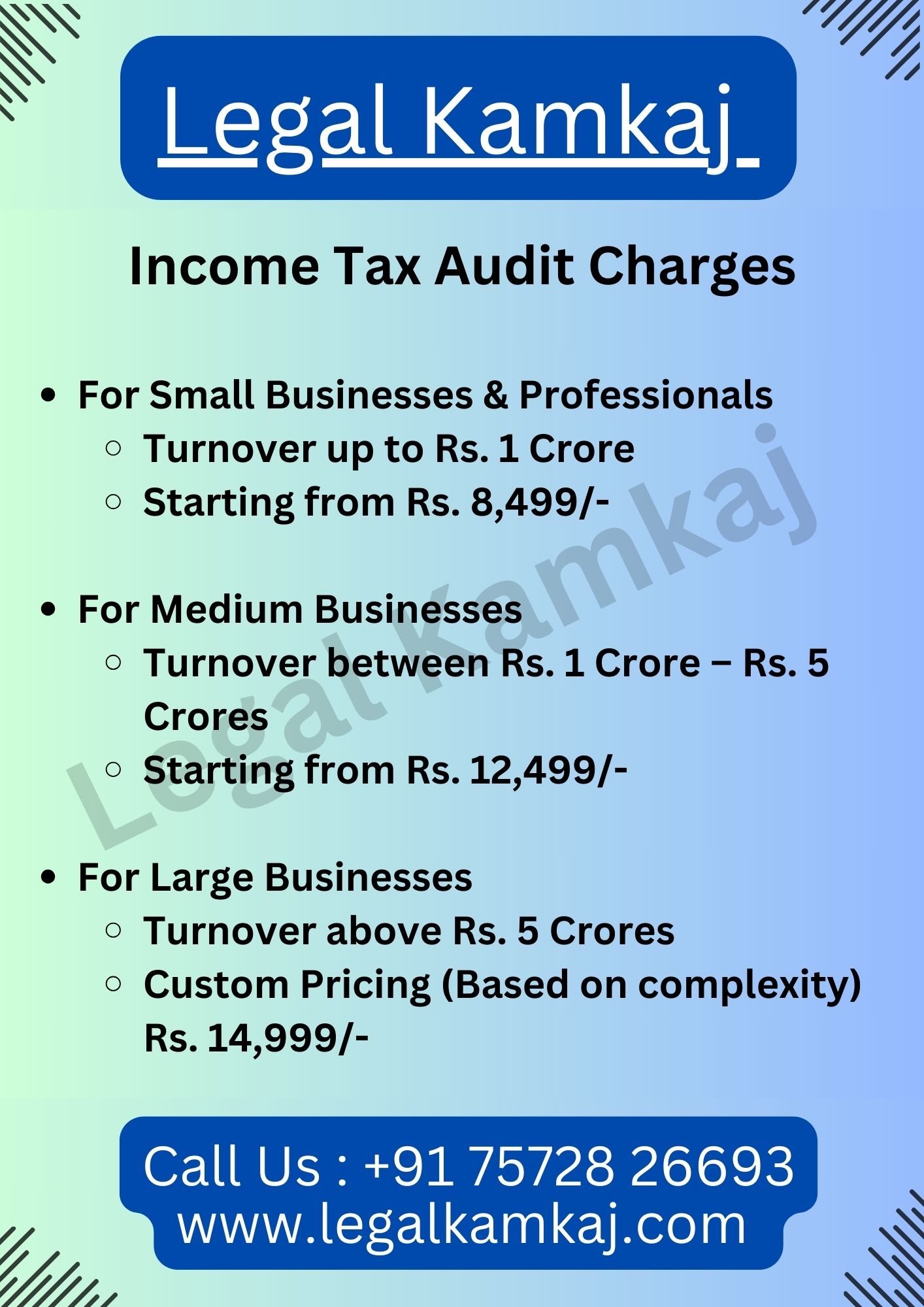

Income Tax Audit Charges

The cost of an Income Tax Audit under Section 44AB depends on your business size and financial transactions. Here’s a simple pricing breakdown:

- For Small Businesses & Professionals

- Turnover up to Rs. 1 Crore

- Starting from Rs. 8,499/-

- For Medium Businesses

- Turnover between Rs. 1 Crore – Rs. 5 Crores

- Starting from Rs. 12,499/-

- For Large Businesses

- Turnover above Rs. 5 Crores

- Custom Pricing (Based on complexity) Rs. 14,999/-

Applicability of Income Tax Audit

An Income Tax Audit under Section 44AB is mandatory for certain taxpayers based on their income, turnover, and nature of business. Here’s when an Income Tax Audit is applicable:

1. For Businesses

- Turnover exceeds ₹1 crore in a financial year (₹10 crore if 95% or more of transactions are digital).

2. For Professionals

- Gross receipts exceed ₹50 lakh in a financial year.

3. For Presumptive Taxation Schemes

- If a taxpayer declares income lower than the prescribed rate under:

- Section 44AD (Small businesses).

- Section 44ADA (Professionals).

- Section 44AE (Transport businesses).

4. For Businesses or Professionals with Losses

- If claiming losses and not opting for the presumptive taxation scheme.

5. For Companies and Other Taxpayers

- If required by law, such as Section 92E for transfer pricing documentation.

Legal Kamkaj provides expert Income Tax Audit services to ensure compliance and avoid penalties.

Forms Used for Income Tax Audit

In the Income Tax Audit process under Section 44AB, specific forms are required to be submitted to the Income Tax Department. These forms help ensure accurate reporting and compliance.

1. Form 3CA

- Used when the taxpayer is already required to get their accounts audited under any other law (e.g., Companies Act).

- This form is filed along with Form 3CD.

2. Form 3CB

- Used when the taxpayer is not required to get their accounts audited under any other law but needs an Income Tax Audit under Section 44AB.

- This form is also submitted with Form 3CD.

3. Form 3CD

- A detailed statement of financial and tax-related information.

- Must be filed along with either Form 3CA or Form 3CB to complete the audit report.

- Legal Kamkaj ensures accurate and timely filing of the necessary Income Tax Audit Forms, making the process smooth and hassle-free.

Due Date for Filing Income Tax Audit Report

The Income Tax Audit Report under Section 44AB must be filed within the prescribed deadline to avoid penalties. Here’s the key information:

Due Date:

- 30th September of the relevant assessment year.

- If the taxpayer is required to file a Transfer Pricing Report (Section 92E), the due date is 31st October.

The due date may be extended by the government in specific cases, such as exceptional circumstances or technical issues.

Penalty for Non-Compliance with Income Tax Audit

If a taxpayer fails to comply with the Income Tax Audit requirements under Section 44AB, they may face penalties. The penalties are as follows:

- Penalty under Section 271B

- Amount: 0.5% of the total turnover or ₹1,50,000, whichever is lower.

- This penalty applies if the Income Tax Audit is not conducted.

- Late Filing Penalty

- If the Income Tax Audit Report is filed after the due date, penalties may apply under Section 234A, including interest on the late payment of taxes.

- If the Income Tax Audit Report is filed after the due date, penalties may apply under Section 234A, including interest on the late payment of taxes.

To avoid penalties, it’s crucial to ensure timely completion and submission of the Income Tax Audit. Legal Kamkaj can help you file on time and stay compliant with tax laws.

Process of Income Tax Audit

Here’s a simplified and easy-to-understand version of the Income Tax Audit Process under Section 44AB:

Step 1: Gather Documents

- Collect all necessary documents like financial statements, books of accounts, bank statements, invoices, and tax-related papers.

Step 2: Verify Records

- A Chartered Accountant (CA) reviews your financial records to ensure everything is accurate and follows the Income Tax rules.

Step 3: Prepare Audit Report

- The CA prepares an Income Tax Audit Report (Form 3CA/3CB and Form 3CD), including all required details.

Step 4: File the Report

- Submit the audit report online through the Income Tax e-filing portal before the due date.

Step 5: Receive Acknowledgment

- Once submitted, you’ll get an acknowledgment confirming the successful filing of the report.

- This report is used for tax assessments and financial planning.

Frequently Asked Questions on Tax Audit by CA

A tax audit is an examination of a company’s financial records and statements to ensure accuracy and compliance with tax laws and regulations.

Tax audits are required to verify that tax returns are filed accurately and in accordance with the law, helping to prevent fraud and ensure proper reporting.

A tax audit is conducted by a Chartered Accountant (CA) who is qualified to review and assess financial statements and tax returns.