Income Tax Audit for Futures and Options (F&O) Trading

Futures and Options (F&O) trading is a popular segment in the stock market, offering traders opportunities to earn profits through derivatives contracts. However, F&O transactions involve specific taxation rules, including the applicability of Income Tax Audit for Futures and Options (F&O) Trading under certain conditions. Legal Kamkaj provides expert services to ensure seamless compliance with these tax audit requirements.

An Income Tax Audit for Futures and Options (F&O) Trading, commonly referred to as an F&O Tax Audit, is required under Section 44AB of the Income Tax Act if the trader’s turnover exceeds prescribed limits or if the taxpayer opts for presumptive taxation under Section 44AD but declares a lower income than the minimum threshold. Legal Kamkaj simplifies the process, helping traders with proper record-keeping, tax computation, and audit compliance to avoid penalties and ensure smooth tax filing.

This guide by Legal Kamkaj provides an overview of Income Tax Audit for Futures and Options (F&O) Trading requirements, including turnover calculation, audit applicability, and key compliance aspects.

Register Your F&O Tax Audit ?

Futures and Options (F&O) Tax Audit

Futures and Options (F&O) trading is a popular form of derivative trading in the stock market. However, it involves specific taxation rules, including the applicability of a Futures and Options (F&O) Tax Audit under certain conditions. Ensuring compliance with tax audit requirements is crucial for traders to avoid penalties and maintain smooth financial reporting.

Legal Kamkaj specializes in Income Tax Audit for F&O Trading, helping traders navigate Section 44AB audit applicability, turnover calculation, and tax filing requirements.

When is an F&O Tax Audit Required?

A Futures and Options (F&O) Tax Audit is required under specific conditions as per the Income Tax Act, Section 44AB. Traders engaged in F&O trading must determine whether they fall under the audit criteria based on turnover, profit declarations, and presumptive taxation applicability.

An Income Tax Audit for F&O Trading is required under the following conditions:

- Turnover Exceeds the Prescribed Limit

- If your F&O trading turnover exceeds ₹10 crores (for digital transactions) or ₹1 crore (for cash transactions), a tax audit is mandatory under Section 44AB of the Income Tax Act.

- If your F&O trading turnover exceeds ₹10 crores (for digital transactions) or ₹1 crore (for cash transactions), a tax audit is mandatory under Section 44AB of the Income Tax Act.

- Profit Declared is Less Than 6% of Turnover (Section 44AD)

- If you opt for presumptive taxation under Section 44AD but report profits lower than 6% of turnover, you must undergo a tax audit.

- If you opt for presumptive taxation under Section 44AD but report profits lower than 6% of turnover, you must undergo a tax audit.

- Losses in F&O Trading with Income Above Basic Exemption Limit

- If you have incurred F&O trading losses but also have income exceeding the basic exemption limit, an audit may be required for tax adjustments and compliance.

Benefits of F&O Tax Audit

Tax Compliance

Ensures adherence to Income Tax Act regulations, avoiding penalties.

Accurate Tax Filing

Guarantees precise reporting of F&O transactions for correct tax calculations.

Legal Protection

Reduces risk of tax disputes and legal issues by maintaining proper documentation.

Deductions & Benefits

Helps identify eligible deductions, potentially reducing your tax burden.

Avoid Penalties

Timely submission of audit and ITR filings to prevent fines for late submission.

Expert Guidance

Access to professional assistance for handling complex F&O tax matters efficiently.

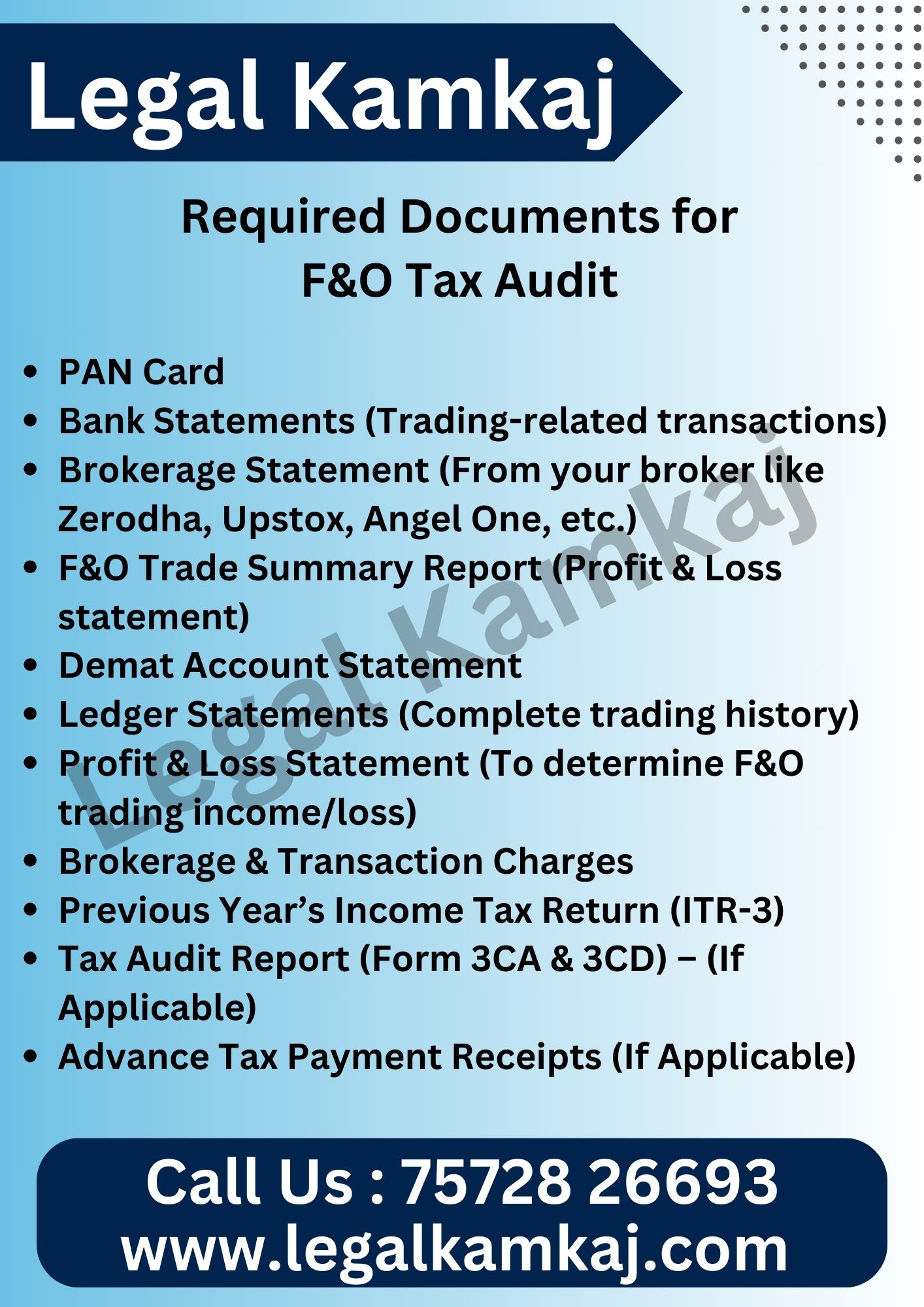

Required Documents for F&O Tax Audit

To ensure smooth tax filing and compliance for Futures and Options (F&O) Tax Audit, traders must prepare the following documents:

- PAN Card

- Bank Statements (Trading-related transactions)

- Brokerage Statement (From your broker like Zerodha, Upstox, Angel One, etc.)

- F&O Trade Summary Report (Profit & Loss statement)

- Demat Account Statement

- Ledger Statements (Complete trading history)

- Profit & Loss Statement (To determine F&O trading income/loss)

- Brokerage & Transaction Charges

- Previous Year’s Income Tax Return (ITR-3)

- Tax Audit Report (Form 3CA & 3CD) – (If Applicable)

- Advance Tax Payment Receipts (If Applicable)

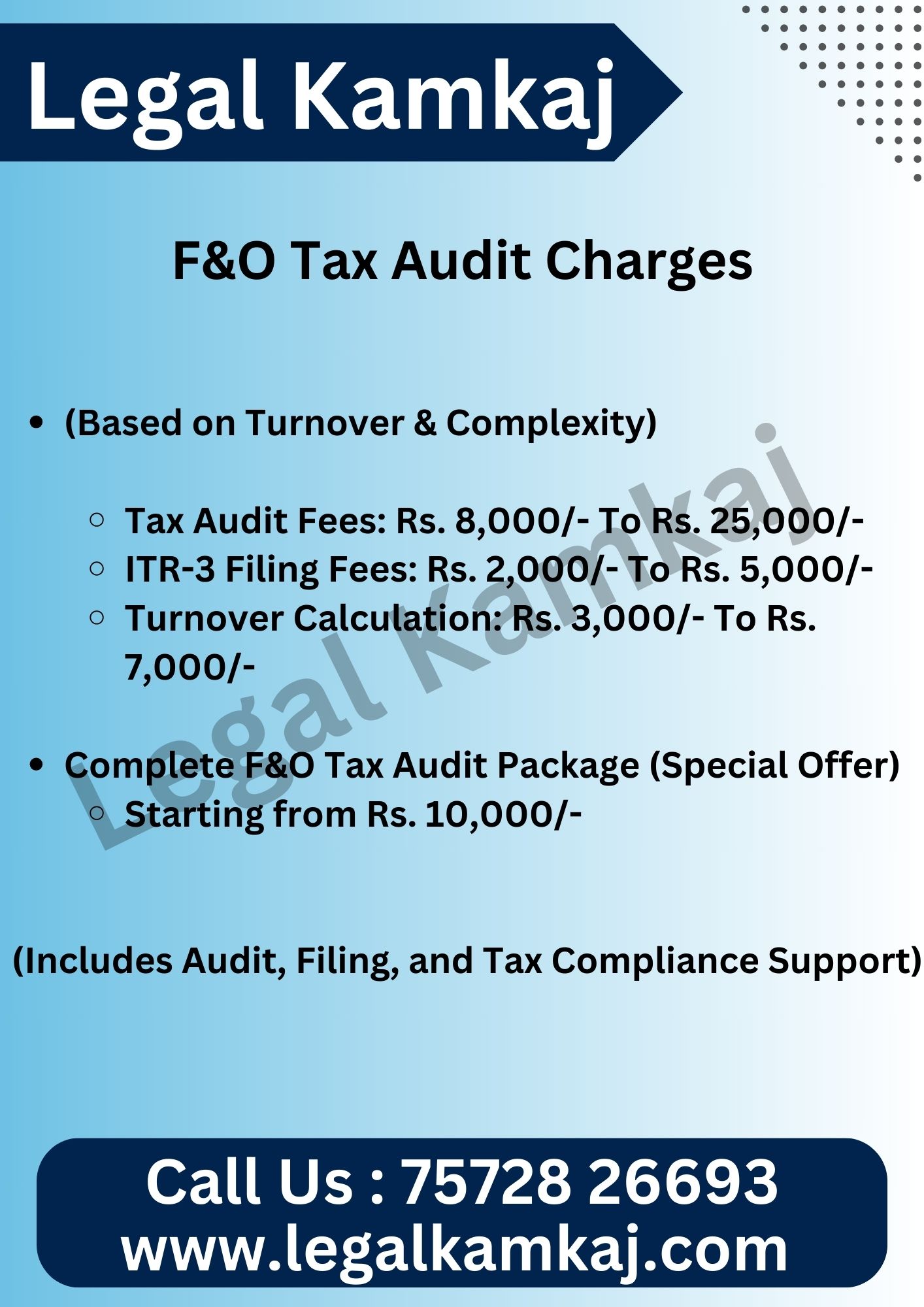

F&O Tax Audit Charges

Legal Kamkaj offers affordable and transparent pricing for Futures and Options (F&O) Tax Audit services. Below is a general breakdown of charges:

- (Based on Turnover & Complexity)

- Tax Audit Fees: Rs. 8,000/- To Rs. 25,000/-

- ITR-3 Filing Fees: Rs. 2,000/- To Rs. 5,000/-

- Turnover Calculation: Rs. 3,000/- To Rs. 7,000/-

- Complete F&O Tax Audit Package (Special Offer)

- Starting from Rs. 10,000/-

(Includes Audit, Filing, and Tax Compliance Support)

- Starting from Rs. 10,000/-

- Legal Kamkaj offers expert F&O Tax Audit services at the best prices!

Types of F&O Tax Audits

✅ Mandatory Tax Audit (Section 44AB) – If turnover exceeds ₹10 Cr (digital) or ₹1 Cr (cash-based), an audit is required.

✅ Presumptive Tax Audit (Section 44AD) – If a trader opts for presumptive taxation but reports profits below 6% of turnover, an audit is needed.

✅ Loss Reporting Audit – If F&O losses are reported and total income is above the exemption limit, audit may apply.

✅ Opting Out of Presumptive Taxation – If a trader chooses presumptive taxation but opts out within five years, a tax audit is required.

Key Compliance Steps for F&O Traders

Futures and Options (F&O) traders must follow proper tax compliance to avoid penalties and ensure smooth financial reporting. Below are the key compliance steps every F&O trader should follow:

- Maintain Proper Books of Accounts

- F&O trading is considered business income under the Income Tax Act.

- Traders must maintain records of:

✔ Trade-wise profit/loss details

✔ Brokerage statements

✔ Bank statements for trading transactions

✔ Business-related expenses (internet, advisory fees, etc.) - Tip: Digital record-keeping helps in accurate tax computation and audit compliance.

- Calculate Turnover for F&O Tax Audit

- Turnover Calculation Includes:

✅ Absolute sum of profits and losses from all trades

✅ Premium received from options trading

✅ Difference from reversed trades - If turnover exceeds ₹10 crores (digital transactions) or ₹1 crore (non-digital transactions), a Futures and Options (F&O) Tax Audit is required under Section 44AB.

- Tip: Legal Kamkaj helps in precise turnover calculation for tax audit applicability.

- File the Correct Income Tax Return (ITR)

- F&O traders must file ITR-3, as F&O income is treated as business income.

- Losses from F&O trading can be carried forward for 8 years and adjusted against future business income.

- The due date for tax filing:

✅ July 31st (if audit is not required)

✅ October 31st (if audit is required) - Tip: Ensure timely ITR filing to avoid penalties and interest charges.

- Pay Advance Tax (If Applicable)

- If total tax liability exceeds ₹10,000 in a financial year, F&O traders must pay advance tax in instalments:

✅ 15% by June 15

✅ 45% by September 15

✅ 75% by December 15

✅ 100% by March 15 - Tip: Advance tax payments prevent interest penalties under Sections 234B & 234C.

- Get F&O Tax Audit Done (If Required)

- If your turnover exceeds limits or audit is applicable due to other conditions, F&O Tax Audit must be completed before the deadline.

- Legal Kamkaj assists traders in filing the Tax Audit Report (Form 3CA & 3CD) and ensuring 100% compliance.

- Tip: Avoid last-minute rush—start the tax audit process early!

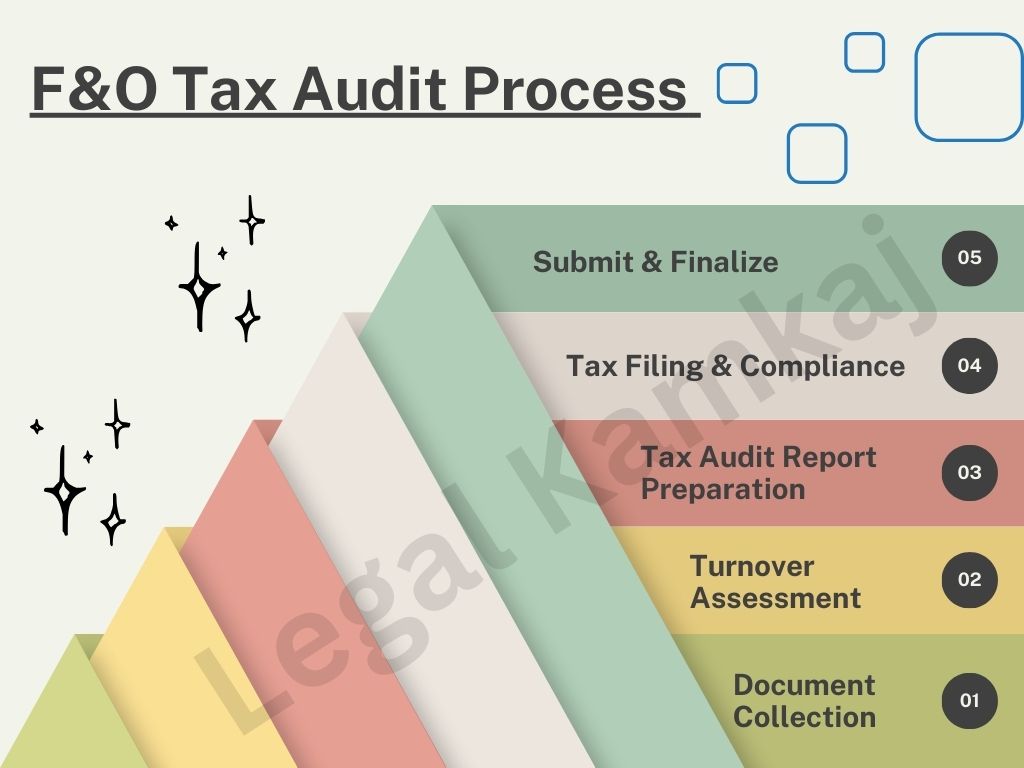

F&O Tax Audit Process – Simplified

- Document Collection

- Gather key documents, like brokerage statements, contract notes, and bank statements related to trading.

- Turnover Assessment

- Calculate your F&O turnover to check if you meet the audit criteria under Section 44AB.

- Tax Audit Report Preparation

- Prepare the audit report (Form 3CA/3CD) and complete ITR-3 filing for tax calculations.

- Tax Filing & Compliance

- File the tax return with accurate deductions and payments, ensuring compliance with tax laws.

- Submit & Finalize

- Submit the tax audit report and ITR to the Income Tax Department on time.

Get Your F&O Tax Audit in Just 2 Days

(Fast & Reliable F&O Tax Audit Services Across India)

Submit Documents & Review

Share your records and check if your turnover meets the audit criteria.

Audit Report Preparation & Filing

Complete the report and submit the ITR-3 for tax filing.

Submit & Finalize

Submit the audit report and ITR to the Income Tax Department.

Why Legal Kamkaj is the Best Choice for Your F&O Tax Audit?

- F&O Audit Expertise : Professionals with deep knowledge of F&O taxes.

- Quick Service : F&O tax audit completed in just 2 days.

- Full Support : We handle everything from paperwork to filing.

- Affordable & Clear Pricing : No hidden fees, just fair rates.

- Easy Filing : We take care of turnover calculations and ITR submissions.

FAQs on F&O Tax Audit

- An F&O Tax Audit is an audit required under Section 44AB of the Income Tax Act, 1961, when a trader’s turnover exceeds specified limits or if profits are lower than the prescribed percentage under Section 44AD.

An F&O trader must get a tax audit if:

- Turnover exceeds ₹10 crore (as per the updated limit for digital transactions).

- Turnover exceeds ₹2 crore, and the trader is not opting for presumptive taxation under Section 44AD.

- The trader shows profits less than 6% of turnover (or 8% for cash transactions) and has total income above the basic exemption limit.

- The due date is 30th September of the relevant assessment year. If a tax audit is applicable, the trader must also file Tax Audit Report (Form 3CA/3CB & Form 3CD).