ESIC Return Filing

ESIC Return Filing is a crucial process for employers to report employee contributions to the Employees’ State Insurance Corporation (ESIC). Regular ESIC Return Filing ensures both employer and employee compliance with the ESIC Act, which provides social security benefits such as medical care, sickness, and maternity benefits. Employers must complete Employees’ State Insurance Corporation Return Filing on a monthly basis by the 15th of every month, detailing employee wages, contributions, and other required information. The return is filed online through the ESIC portal, and it is essential to ensure accurate deduction of employees’ salaries and correct contribution amounts. Timely and accurate ESIC Return helps avoid penalties or legal issues for the employer. Failure to comply with ESIC Return can result in fines and delayed benefits for employees. Many employers prefer outsourcing the Employees’ State Insurance Corporation Return Filing process to professionals, ensuring that the filing is handled accurately and efficiently.

Apply for ESIC Return?

ESIC Return Filing - An Overview

Employees’ State Insurance Corporation Return Filing is an essential requirement for employers to report employee contributions to the Employees’ State Insurance Corporation (ESIC). The ESIC scheme provides employees with social security benefits such as medical care, maternity benefits, and sickness benefits. Employers are required to file these returns on a monthly basis, typically by the 15th of each month, via the ESIC portal. The return includes detailed information about employee wages, deductions, and employer contributions. Ensuring timely and accurate filing is crucial for compliance and for employees to receive their benefits without any issues.

Failure to file the ESIC return on time or filing incorrect details can lead to penalties, interest charges, or legal complications for the employer. To avoid these penalties and ensure smooth operations, many businesses opt to outsource the Employees’ State Insurance Corporation Return Filing process to professionals. This ensures that all necessary deductions are made, and the correct contributions are submitted, minimizing the risk of errors or delays in the process.

Benefits of ESIC Return Filing

Compliance with Legal Requirements

Timely ESIC return ensures compliance with the Employees’ State Insurance Act, helping employers avoid legal issues or penalties.

Employee Benefits

Proper filing guarantees employees receive their entitled social security benefits, including medical care, sickness benefits, and maternity leave.

Avoiding Penalties

Timely and accurate filing prevents fines, interest charges, and legal consequences for employers due to late or incorrect submissions.

Accurate Record Keeping

Ensures that employee contributions and wages are properly documented, making it easier to manage employee records and claims.

Smooth Operations

Proper filing streamlines the entire process, reducing the chances of errors and ensuring efficient management of employee benefits.

Building Employee Trust

Regular and transparent ESIC return demonstrates an employer’s commitment to their employees’ welfare, boosting employee trust and morale.

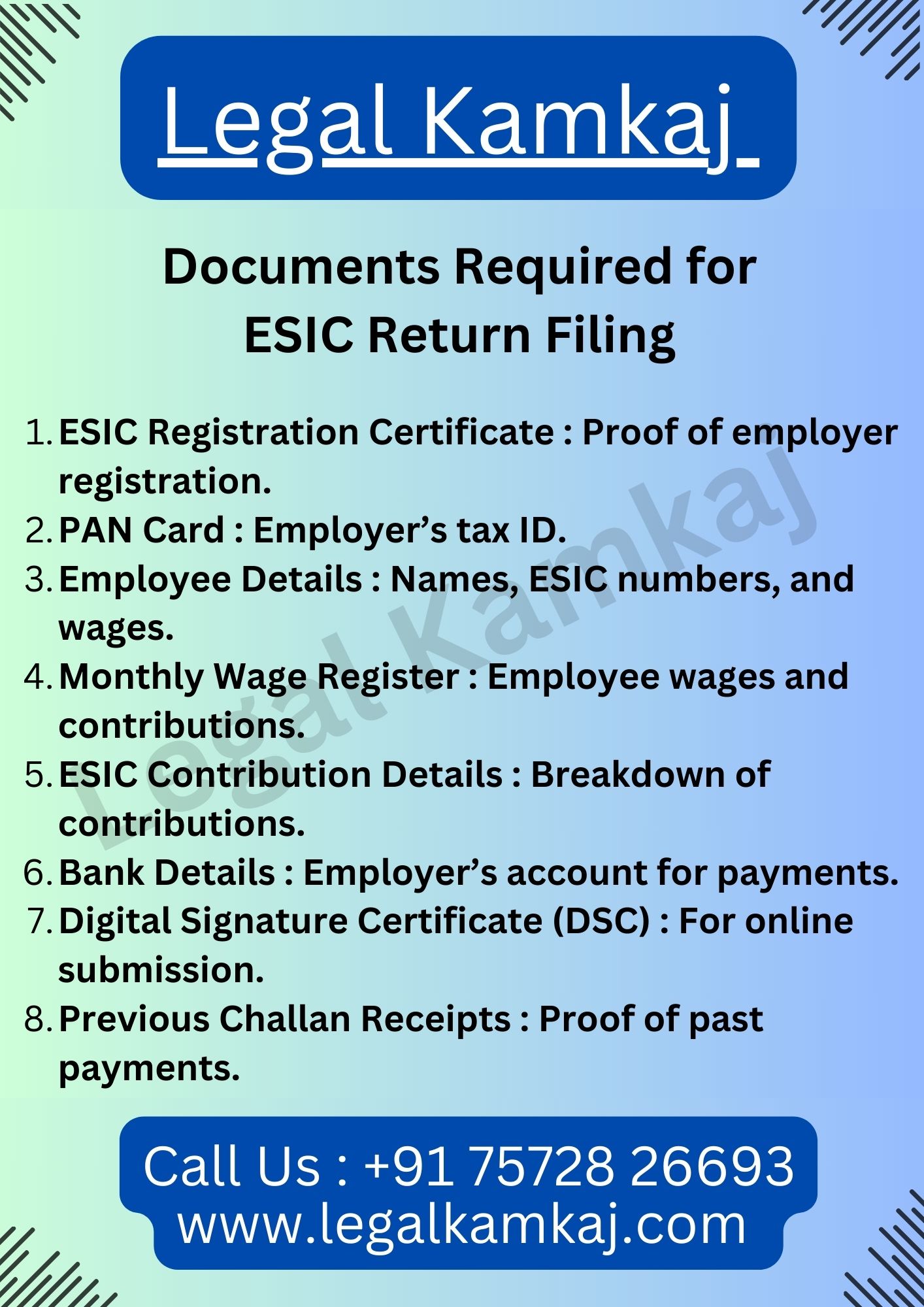

Documents Required for ESIC Return Filing

- ESIC Registration Certificate : Proof of employer registration.

- PAN Card : Employer’s tax ID.

- Employee Details : Names, ESIC numbers, and wages.

- Monthly Wage Register : Employee wages and contributions.

- ESIC Contribution Details : Breakdown of contributions.

- Bank Details : Employer’s account for payments.

- Digital Signature Certificate (DSC) : For online submission.

- Previous Challan Receipts : Proof of past payments.

ESIC Registration & Return Filing Charges in India

Here’s a breakdown for Employees’ State Insurance Corporation (ESIC) Return Filing Charges in India:

Services

Professional Fee (Approx.)

ESIC Return Filing (Monthly ESIC Return Filing)

Rs. 1,500

ESIC Registration

Rs. 2,000

Additional Charges (If Applicable):

- Late Payment Interest: 12% per annum

- Late Filing Penalty: Rs. 200 per day

- Correction in ESIC Records: Rs. 1,000

Due Dates for ESIC Return?

Monthly ESIC Payment & Return Filing – The due date for filing ESIC returns and making payments is 15th of the following month. This includes reporting employee wages, deductions, and employer contributions.

Annual Return Filing – The annual return (Form 6) must be submitted by April 30th of the following year. This includes details of all employees and contributions for the entire financial year.

Process of ESIC Return ?

- Login to ESIC Portal – Employers must log in to the ESIC portal using their employer credentials.

- Prepare Contribution Details – Gather all employee data, including wages and ESIC contributions, for the filing month.

- Generate ESI Challan – Create the ESI challan based on the total contributions (employee and employer) for the month.

- Upload Return Details – Upload the employee details and contribution data in the prescribed format.

- Submit Return – After uploading, submit the ESIC return for the month and generate a confirmation.

- Make Payment – Pay the required contributions (employee and employer share) through the available payment methods.

- Download Acknowledgment – After payment, download the acknowledgment receipt for records.

ESIC Return Filing FAQs

Employees’ State Insurance Corporation Return Filing is the process through which employers report employee contributions to the Employees’ State Insurance Corporation (ESIC) to ensure compliance with the ESIC Act and secure social security benefits for employees.

Employers with 10 or more employees earning below a specified wage limit are required to file ESIC returns.

ESIC returns must be filed monthly by the 15th of the following month and annually by April 30th.