Computation of Income (COI)

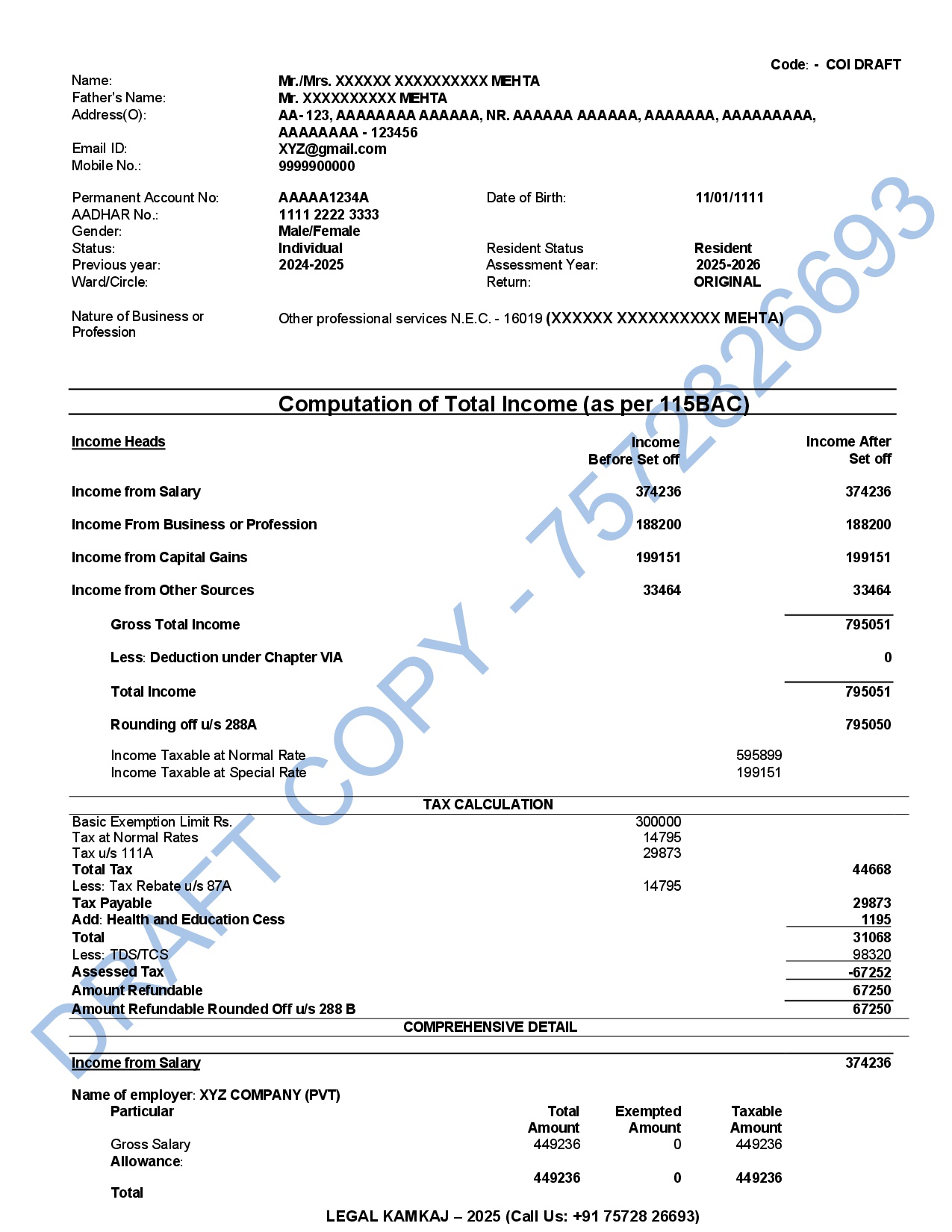

To ‘Compute’ Means to ‘Calculate.’ Computation of Income is the Process of Figuring out an Individual’s or Entity’s Total Income and the Tax Due for a Financial Year. An ITR Computation is a Summary that Shows Taxable Income, Exempt Income, Deductions, Tax Payable, and Tax Payments Made. It also Includes Personal Details like Name, Address, Email, Phone Number, Date of Birth, PAN Card, Aadhaar Card and Bank Account Information, which are Recorded in the ITR Computation Sheet.

The Computation of Income Involves Calculating an Individual’s or Entity’s Total Earnings for a Financial Year to Determine the Tax Payable. It Includes Categorizing Income into Various Heads, Such as Salary, Business, Capital Gains, or Other Sources, and Reducing it by Applicable Deductions and Exemptions, like Those under Section 80C or HRA. The Result, known as Taxable Income, is then used to Calculate Tax Liability Based on the Relevant Tax Rates. Adjustments are made for Any Tax already Paid, such as TDS or Advance Tax, to Determine the Final Tax Due or Refund. This Process Ensures Accurate Tax Filing and Adherence to Legal Requirements. At Legal Kamkaj, We Ensure Your Income Computation is Accurate and Compliant with Tax Laws. Legal Kamkaj Ensures Smooth Tax Filing and Correct Income Computation Every time.

Register Your Computation of Income ?

Income Tax Computation Procedure

The Income Tax Computation Procedure involves a systematic method for calculating an individual’s or entity’s taxable income and determining the tax liability. Here’s the whole process:

- Income Classification: Begin by identifying and categorizing all sources of income under five heads:

- Salary

- House Property

- Business or Profession

- Capital Gains

- Other Sources (e.g., interest, dividends)

- Gross Income Calculation: Add up the income from each source to calculate the total gross income for the financial year.

- Apply Deductions and Exemptions: Subtract eligible deductions (e.g., under Section 80C, 80D, etc.) and exemptions (like HRA, LTA) from the gross income to reduce it.

- Net Taxable Income: The remaining amount after deductions and exemptions is the net taxable income, which is subject to tax.

- Tax Calculation: Apply the appropriate tax slabs based on the net taxable income to compute the tax liability. Additional taxes like cess and surcharge may also be added.

- Tax Credits: Account for any taxes already paid, such as TDS (Tax Deducted at Source) or advance tax. These credits are subtracted from the calculated tax liability.

- Final Tax Payable or Refund: After applying the tax credits, determine if the taxpayer owes additional tax or is eligible for a refund.

- Filing the Return: Once the computation is done, the final income and tax details are used to file the Income Tax Return (ITR) with the tax authorities.

- This procedure ensures that an individual or entity accurately computes the tax payable, claims all eligible deductions and exemptions, and complies with the tax laws.

Documents Required for Computation of Income Preparation

The following documents are needed and can be obtained from the official Income Tax Portal(https://www.incometax.gov.in/iec/foportal/).

- ITR Filing Form (Relevant Financial Year)

- ITR Acknowledgement Receipt (ITR V)

- JSON or XML Data File (Relevant Financial Year)

- For Individuals Documents:

- PAN Card

- Form 16 (If Applicable)

- Salary Slips for the Financial Year

- Bank Statements for the Financial Year

- Investment Proofs (Mutual Funds, Fixed Deposits, etc.)

- Rental Income Proofs (If Applicable)

- Other Income Proofs (If Any)

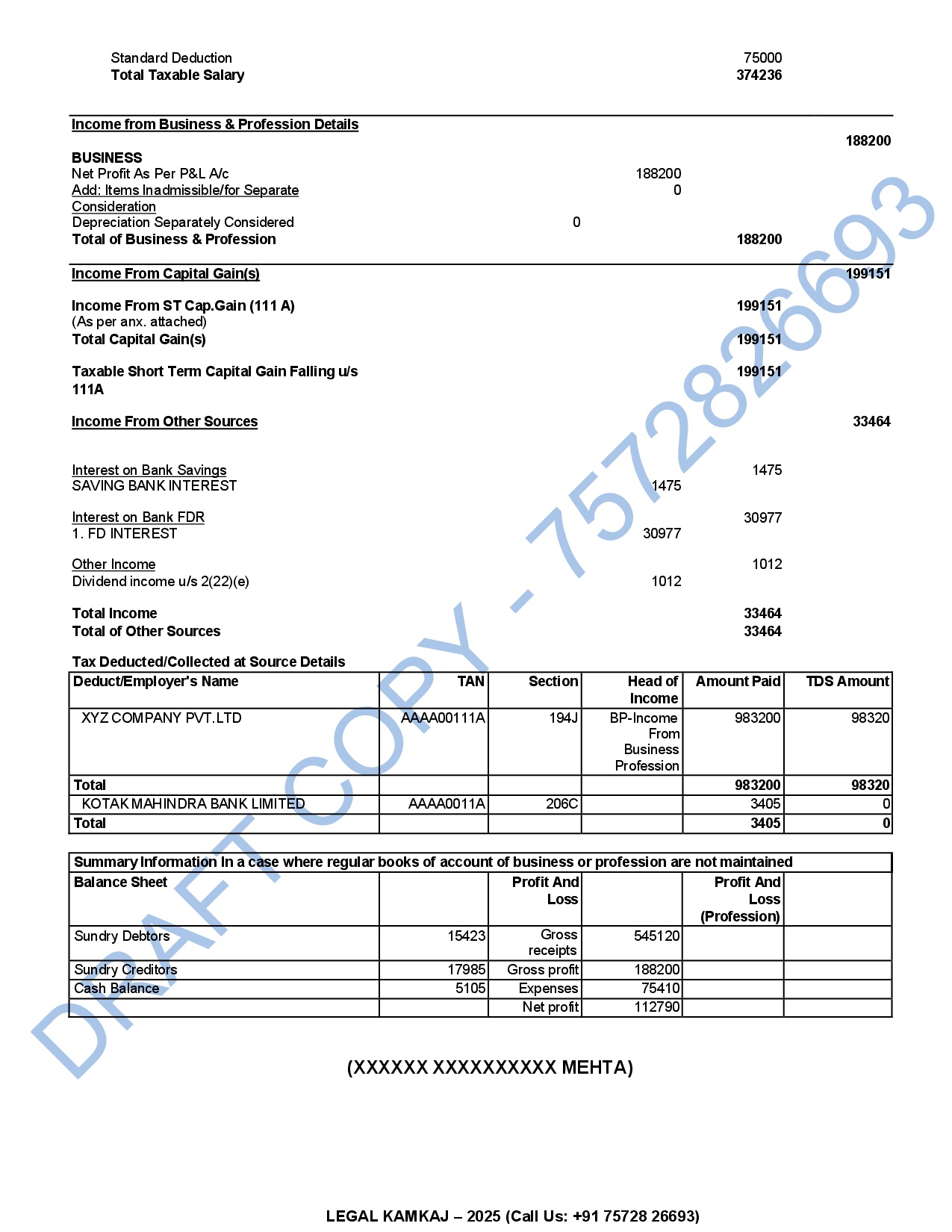

- For Businesses:

- PAN Card

- GST Registration (If Applicable)

- Sales and Purchase Invoices

- Bank Statements for the Financial Year

- P&L and BS for the Financial Year

- Other Relevant Financial Documents

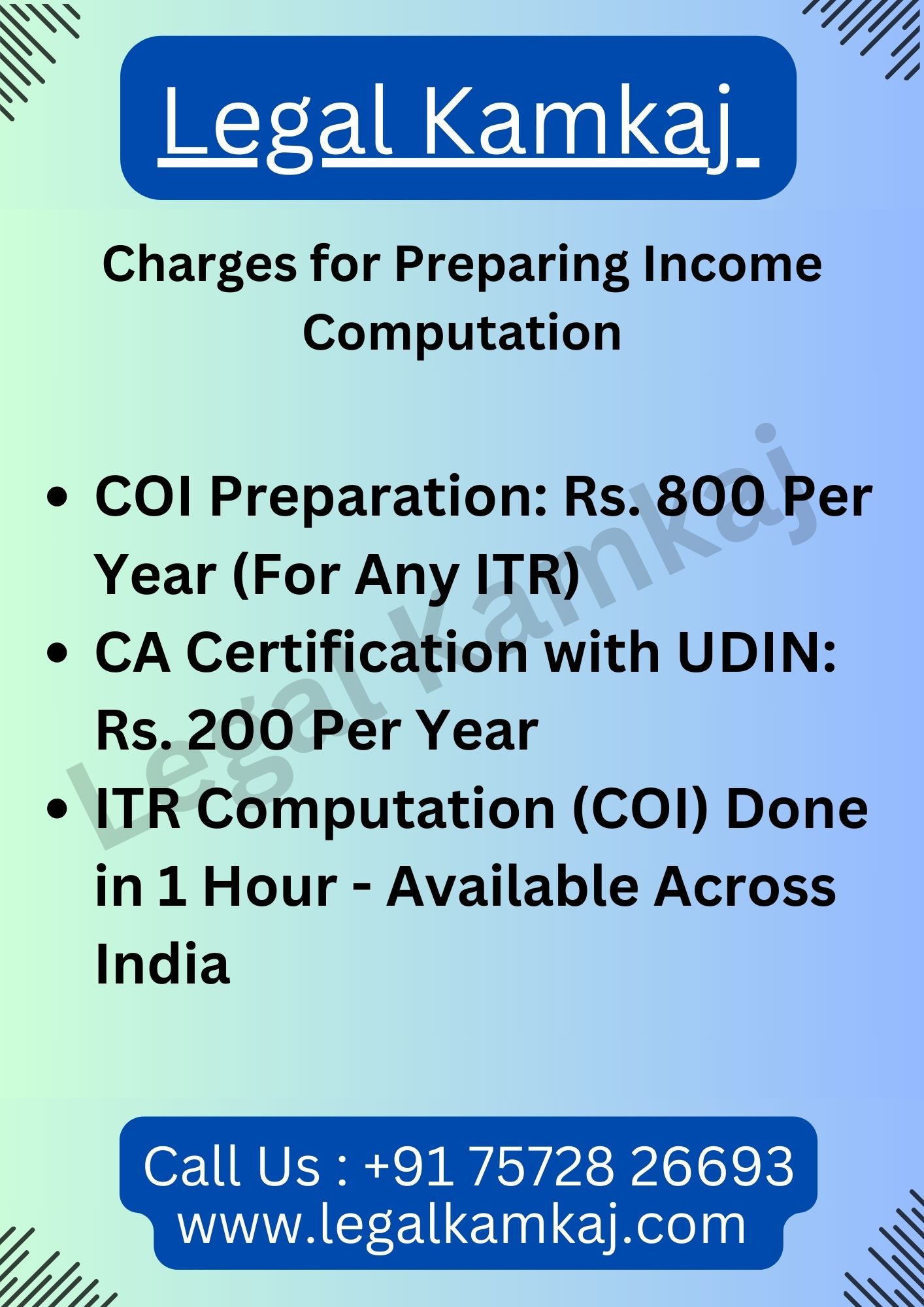

Charges for Preparing Income Computation

Importance of ITR Computation of Income

The ITR COI is essential for both individuals and businesses to ensure accurate tax filing and compliance. Here’s why it’s important:

- Correct Tax Calculation: It Helps Determine the Right Taxable Income, Deductions, Exemptions, and Tax Liabilities, Preventing Errors in Tax Payments.

- Loan and Credit Applications: Banks and Financial institutions often ask for ITR Computation Summaries to Evaluate an Applicant’s Financial Situation for Loans or Credit Cards.

- Visa and Immigration: Many Countries Require ITR filing Proof, including the Computation Summary, as Part of Visa or Immigration Applications.

- Tax Planning: It Helps Identify Deductions and Exemptions, Allowing Individuals and Businesses to Save on Taxes Effectively.

- Legal Compliance: Filing Accurate ITR with a Clear Income Computation Ensures Adherence to Tax Laws and Helps Avoid Penalties.

- Refund Claims: It Helps Determine if You’re Eligible for a Tax Refund and Ensures the Process is Completed Smoothly.

In short, The ITR Computation is a vital Document for Financial Record-Keeping, Loan Processing, Visa Applications, and Tax Compliance.

The Heads of ITR Computation of Income - Simplified

Understanding The Heads of ITR Computation of Income is Essential for Smooth Tax Filing. These Categories Help classify Income into Specific Sections, Ensuring Accuracy and Compliance.

What are the Heads of ITR Computation of Income?

- Income from Salaries: Includes Your Monthly Salary or Wages, Bonuses, and Other Employment Benefits.

- Income from House Property: Covers Rent Earned or Deemed Income from Properties.

- Profits and Gains of Business or Profession: Applicable for Business Earnings or Professional Fees.

- Capital Gains: Profits from Selling Assets like Property, Stocks, or Mutual Funds.

- Income from Other Sources: Includes Interest, Dividends, Lottery Winnings and Other Miscellaneous Earnings.

Why are the Heads of ITR Computation of Income Important?

How to Use the Heads of ITR Computation of Income?

- Start by Identifying Your Income Sources.

- Allocate Each Income to the Relevant Head under The Heads of ITR Computation of Income.

- Maintain Records to Support Your Declared Income.

Benefits of Understanding the Heads of ITR Computation of Income

- Simplifies Tax Filing and Reduces Errors.

- Helps Optimize Tax Liabilities with Deductions.

- Ensures Compliance with Income Tax Rules.

Make Tax Filing Easy

Mastering The Heads of ITR Computation of Income is key to Accurate and Smooth Tax Filing. Whether Your Income is From Salary, Business Income, or Capital Gains, Correctly Categorizing it under The Heads of ITR COI Ensures Everything is Clear and Compliant with Tax Rules.

Computation of Income Draft Template

Complete Your COI in Just 1 Hour – Available Across Every State in India

ITR Form and ITR Computation: Simple Explanation

- ITR Form:

- An ITR form is a Structured Document Provided by the Income Tax Department that Taxpayers use to File their Tax Returns.

- It Includes Sections to Report Various Types of Income, Deductions, and Tax Paid, and it Helps Calculate the Total Tax Liability.

- Different ITR Forms are used Depending on the Type of Income and Taxpayer (E.g., ITR-1 For Salaried Individuals, ITR-3 For Business Income).

- ITR Computation of Income:

- ITR Computation of Income Refers to the Process of Calculating the Total Income Based on the Heads of Income (Salary, Business, Capital gains, etc.).

- It Involves Adding up All Sources of Income, Applying Deductions, Exemptions, and Arriving at the Taxable Income.

- This Computation is an Essential Part of Filling Out the ITR Form, as it Determines How Much Tax is Payable.