Income Tax Return Filing in Ahmedabad

Legal Kamkaj provides easy and quick solutions for Income Tax Return Filing in Ahmedabad and across India. Our ITR Filing Services Across India make filing your income tax returns simple, accurate, and stress-free.

Navigating tax laws can be overwhelming, but our team of experienced professionals is here to guide you every step of the way. Whether you are a salaried employee, self-employed, or a business owner, we offer personalized support to ensure your return is filed correctly and on time. If you’re specifically looking for Income Tax Return Filing in Ahmedabad, we’ve got local expertise combined with national experience to serve you best.

With our secure and user-friendly online platform, you can easily upload documents and track your filing status without stepping out of your home. We stay up-to-date with the latest tax rules to ensure full compliance and help you maximize potential refunds.

Choosing Legal Kamkaj for Income Tax Return Filing in Ahmedabad means saving time, avoiding penalties, and gaining peace of mind. So, whether you’re filing for the first time or need expert help with past returns, our Income Tax Return Filing in Ahmedabad services are designed to meet your unique needs.

Contact us today to get started with our reliable, fast, and affordable tax filing services in Ahmedabad and beyond.

Get Started For Income Tax Return Filing?

Income Tax Return (ITR) Filing in Ahmedabad - Overview

Filing an Income Tax Return (ITR) means reporting your income and taxes to the government for a specific financial year. It is required for individuals and businesses earning above a certain threshold. By filing an ITR, you can claim tax benefits, refunds, and deductions if you’ve paid more tax than necessary. There are different ITR forms depending on the type of income—whether from salary, business, or investments. Filing also serves as valid proof of income, often required for loans, visas, and other financial activities.

Filing your ITR on time helps you avoid penalties and legal complications. The process can be completed online via the government’s income tax portal or, in some cases, offline. For those seeking Income Tax Return Filing in Ahmedabad, Legal Kamkaj provides professional assistance to ensure your filing is accurate and compliant. It’s crucial to report all income correctly, as errors can trigger queries from tax authorities. Thankfully, online tools and expert services now make Income Tax Return Filing in Ahmedabad and across India easier and more accessible than ever.

Benefits of Income Tax Return Filing?

Legal Compliance & Avoiding Penalties

- Filing ITR ensures you comply with tax laws.

- Late or non-filing can result in penalties and legal consequences.

Claiming Tax Refunds

- If excess tax has been deducted (TDS), filing ITR allows you to claim a refund.

- Refunds can result from investments, exemptions, or deductions.

Proof of Income & Financial Stability

A filed ITR serves as proof of income for various purposes, including:

- Visa applications

- Loan approvals (home, car, personal)

- Credit card applications

Carrying Forward Losses

Losses from businesses, stocks, or real estate can be carried forward to offset future income if you file ITR on time.

Eligibility for Loans & Credit

- Banks and financial institutions consider ITR when processing loans or credit cards.

- A higher ITR shows financial stability and increases creditworthiness.

Visa Processing

Many countries require ITR documents as proof of financial soundness for visa approvals.

Avoiding Notices & Scrutiny

Filing ITR on time helps you avoid tax notices or scrutiny from tax authorities.

Government Benefits & Subsidies

Some government schemes and subsidies require an ITR as proof of income.

Contribution to Nation-Building

Paying taxes ensures better infrastructure, public services, and economic development.

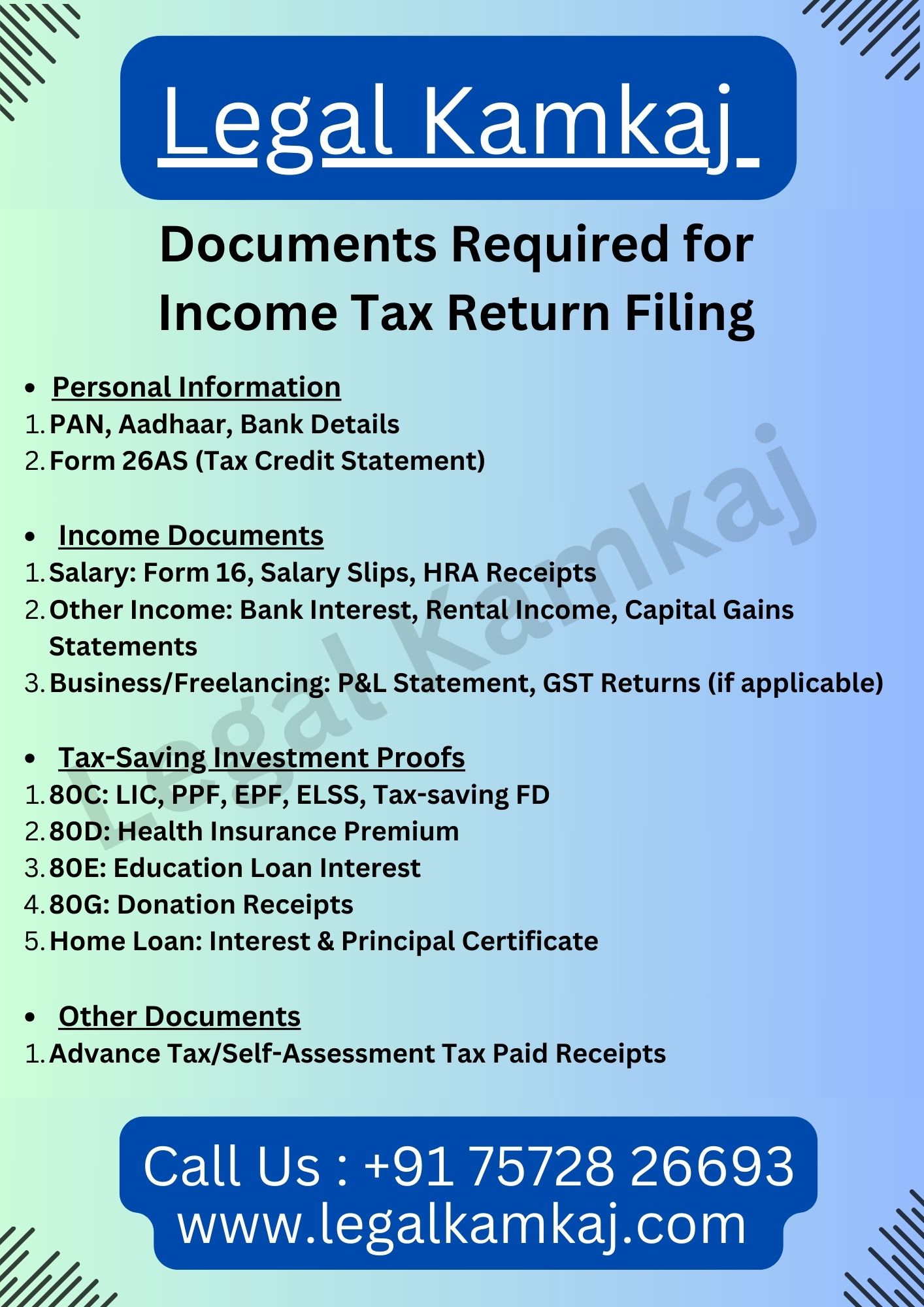

Documents Required for Income Tax Return Filing

- Personal Information

- PAN, Aadhaar, Bank Details

- Form 26AS (Tax Credit Statement)

- Income Documents

- Salary: Form 16, Salary Slips, HRA Receipts

- Other Income: Bank Interest, Rental Income, Capital Gains Statements

- Business/Freelancing: P&L Statement, GST Returns (if applicable)

- Tax-Saving Investment Proofs

- 80C: LIC, PPF, EPF, ELSS, Tax-saving FD

- 80D: Health Insurance Premium

- 80E: Education Loan Interest

- 80G: Donation Receipts

- Home Loan: Interest & Principal Certificate

- Other Documents

- Advance Tax/Self-Assessment Tax Paid Receipts

Income Tax Return (ITR) Filing Charges

Here’s a breakdown of Income Tax Return (ITR) Filing Charges:

Type of ITR Filing

Professional Fee (Approx.)

ITR for Salaried Individuals (ITR-1 & ITR-2)

Rs. 500 – Rs. 1,000

ITR for Business & Professionals (ITR-3 & ITR-4)

Rs. 1,500 – Rs. 3,000

ITR for Partnership Firms (ITR-5)

Rs. 3,000 – Rs. 5,000

ITR for Companies (ITR-6)

Rs. 4,000 – Rs. 8,000

ITR for Individuals with Capital Gains

Rs. 1,500 – Rs. 3,000

Revised / Belated ITR Filing

Rs. 1,500 – Rs. 3,000

Tax Audit & ITR Filing (For Turnover Above ₹1 Crore)

Rs. 10,000 – Rs. 20,000

Important Notes:

- Professional fees vary based on income complexity and business structure.

- Late fees (if applicable): ₹1,000 – ₹5,000 (under Income Tax Act).

- Expert tax planning & fast processing available for businesses & high-income individuals.

Checklist for Income Tax Return Filing

🔹 Personal Details

☐ PAN Card

☐ Aadhaar Card (if needed)

☐ Bank Account Details

☐ Form 26AS (Tax Summary)

🔹 Income Documents

☐ Salaried? Get Form 16 or Salary Slips

☐ Earn Interest? Get Bank/Post Office Interest Certificates

☐ Invest in Stocks/Mutual Funds? Get Capital Gains Statements

☐ Rental Income? Keep Rent Receipts & Property Details

☐ Own a Business/Freelance? Keep Income & Expense Records

🔹 Tax-Saving Proofs

☐ Insurance, PPF, ELSS, FDs? Keep Payment Receipts (80C)

☐ Health Insurance? Keep Premium Receipts (80D)

☐ Education Loan? Keep Interest Certificate (80E)

☐ Donations? Keep Donation Receipts (80G)

☐ Home Loan? Keep Interest & EMI Statements

🔹 Other Important Papers

☐ Proof of Advance Tax or Self-Assessment Tax Paid

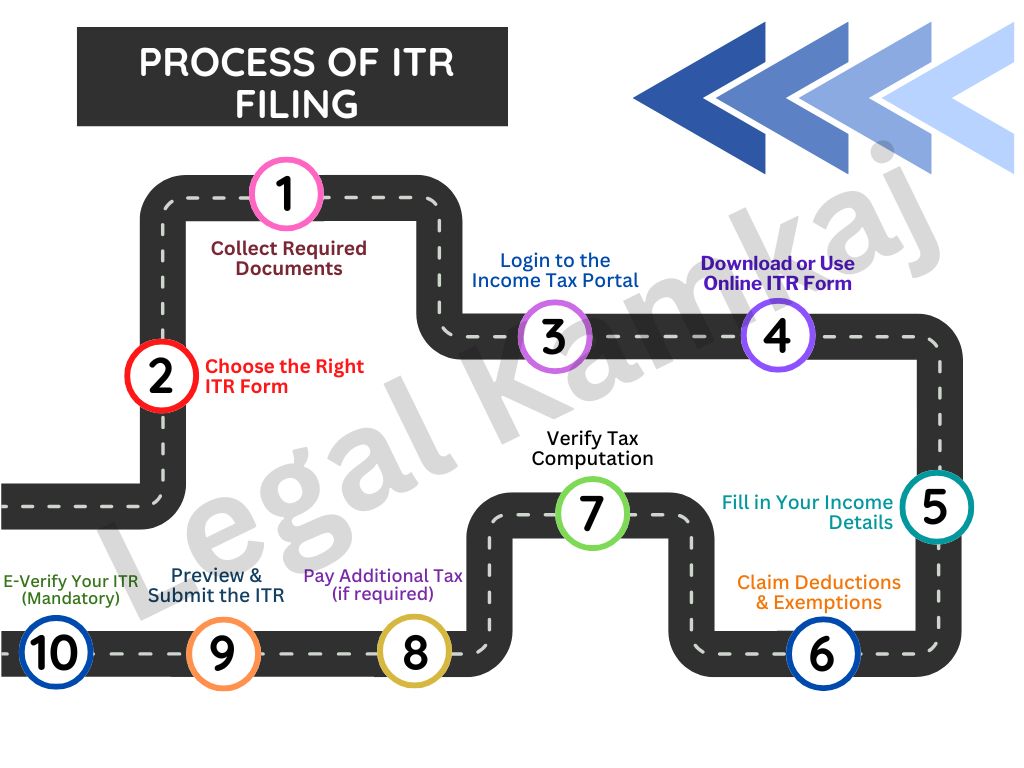

Process of Income Tax Return Filing

1. Collect Required Documents

- Gather all necessary documents like PAN, Aadhaar, Form 16, Bank Statements, Investment Proofs, and Form 26AS (Tax Credit Statement).

2. Choose the Right ITR Form

- ITR-1 (Sahaj): For salaried individuals with income up to ₹50 lakh

- ITR-2: For individuals with capital gains, rental income, or foreign assets

- ITR-3: For business/professional income

- ITR-4 (Sugam): For presumptive income from business/profession

3. Login to the Income Tax Portal

- Visit https://www.incometax.gov.in and log in using PAN, Aadhaar, and OTP verification.

4. Download or Use Online ITR Form

- For online filing: Click on “File Income Tax Return” → Select Assessment Year & ITR Form

- For offline filing: Download the relevant ITR utility, fill the details, and upload the JSON file

5. Fill in Your Income Details

- Enter details of salary, interest income, rental income, capital gains, and business income.

6. Claim Deductions & Exemptions

- Add details of tax-saving investments like LIC, PPF, Home Loan, Medical Insurance, Education Loan, Donations, etc.

7. Verify Tax Computation

- The system will auto-calculate your tax liability after deductions. Ensure all details are correct.

8. Pay Additional Tax (if required)

- If you owe any tax, pay via challan (Challan 280) and enter the payment details.

9. Preview & Submit the ITR

Check all details, verify them, and submit your return online.

10. E-Verify Your ITR (Mandatory)

After submission, verify using:

- Aadhaar OTP

- Net Banking

- Bank Account EVC

- Sending signed ITR-V to CPC, Bengaluru (if not e-verifying)

Who Should File an Income Tax Return?

According to the Income :

- Salaried individuals whose gross income surpasses the exemption limit before deductions under Sections 80C to 80U

- All businesses, including private limited companies, LLPs, and partnerships, must file an income tax return, regardless of profit or loss.

- Individuals serving as Directors in a Private Limited Company or as Partners in a Limited Liability Partnership.

- Individuals who receive income from dividends, mutual funds, bonds, equities, fixed deposits, interest, and other sources

- Individuals who receive income from charity or religious trusts, as well as from voluntary contributions

- Individuals and businesses looking to claim tax refunds

- NRIs and technology professionals.

Types of Income Tax Return Filing

- ITR-1 (Sahaj) – Salaried individuals with income up to ₹50 lakh (No business income).

- ITR-2 – Individuals with salary, capital gains, foreign assets, or multiple house properties.

- ITR-3 – Business owners, professionals, stock traders, company directors.

- ITR-4 (Sugam) – Small businesses & professionals under presumptive taxation.

- ITR-5 – Partnership firms, LLPs, trusts, and associations.

- ITR-6 – Companies (except tax-exempt ones).

- ITR-7 – Trusts, NGOs, political parties, and religious institutions.

Why Legal kamkaj?

Legal Kamkaj provides an easy and hassle-free way to file your income tax returns in India. Our team of tax experts and chartered accountants ensures accurate filing while helping you maximize your tax savings. We simplify the process so you can stay tax-compliant without any stress.

Whether you are an individual or a business, we offer customized solutions to meet your tax needs. Let our experts handle the complexities while you enjoy a smooth and error-free tax filing experience. Get in touch with us today and file your ITR effortlessly!

FAQs on e-Filing of Income Tax Return

Submitting a complete income tax return by the deadline is the easiest way to receive your tax refund. Moreover, while filing, you can review total advance tax payments on Form 26AS. Thus, ensuring accuracy and timely submission minimizes errors, ultimately leading to a smooth and efficient tax refund process.

For users who have filed their Income Tax Return (ITR) through our platform, you can now easily check your e-filing status on our website. Alternatively, if you need assistance, feel free to contact our experts, who are ready to help you navigate the process smoothly and efficiently.

You can submit a revised return as often as needed. However, when filing an updated Income Tax Return (ITR), it’s crucial to include details from your initial ITR with each revised submission. This ensures consistency and accuracy, facilitating smoother processing by tax authorities and helping you avoid potential issues in the future.

According to the Income Tax Act, you must file an income tax return in India if your total income exceeds ₹2.5 lakh for the financial year. Moreover, filing is essential for compliance and offers benefits like loss carryforward and potential refunds, ensuring you meet your responsibilities as a taxpayer.

E-filing is the process of electronically submitting an income tax return online via verified portals. Moreover, it streamlines the tax filing process, allowing for convenience and accuracy. Additionally, e-filing often results in faster refunds, making it a smart choice for taxpayers looking to efficiently manage their tax obligations.