Provident Fund Return Filing

Provident Fund Return Filing is a crucial responsibility for employers to report employee contributions to the government. Timely Provident Fund Return Filing ensures compliance with labor laws and prevents penalties. Employers must submit monthly and annual Provident Fund Return Filing through the Employees’ Provident Fund Organization (EPFO) portal. The filing process requires details such as employee salaries, PF deductions, and contributions. Any delays or errors in Provident Fund Return Filing can result in fines or legal issues. Maintaining accurate records and meeting deadlines is essential for smooth processing. Many businesses rely on professional services to handle PF Return Filing efficiently. Proper filing allows employees to access their PF savings without complications when needed. Ensuring compliance with PF regulations not only benefits employees but also helps businesses maintain a good reputation and avoid unnecessary financial liabilities.

Apply for PF Return Filing?

Provident Fund Return - An Overview

Provident Fund Return is a mandatory filing process where employers report employee and employer contributions to the Provident Fund (PF) authorities. It ensures compliance with government regulations and secures employee retirement benefits. Employers must submit monthly and annual Provident Fund Returns through the Employees’ Provident Fund Organization (EPFO) portal, detailing salaries, deductions, and contributions.

Timely Provident Fund Return filing helps businesses avoid penalties and maintain a good reputation. Errors or delays in submission can lead to fines and legal complications. Proper record-keeping and adherence to deadlines are essential for smooth processing.

Many organizations use professional services to handle PF Return filing efficiently. By ensuring accurate and timely submission, employees can access their PF savings without issues. Following PF regulations benefits both employees and employers, ensuring financial security and legal compliance.

Benefits of PF Return Filing

Legal Compliance

Filing Provident Fund (PF) returns ensures that businesses comply with labor laws and EPFO regulations, avoiding legal issues and penalties.

Avoiding Penalties

Timely PF return filing helps employers prevent fines and legal consequences due to delays or incorrect submissions.

Employee Benefits

Proper filing ensures that employees’ PF contributions are recorded accurately, allowing them to access their savings, loans, or withdrawals without issues.

Smooth Business Operations

Maintaining up-to-date PF records helps businesses avoid disputes, audits, and unnecessary financial liabilities.

Improved Employee Trust

Regular and transparent PF return filing builds employee confidence, showing that the employer values their financial security and future.

Easy Loan and Claim Processing

A well-maintained PF account makes it easier for employees to apply for loans or withdrawals when needed.

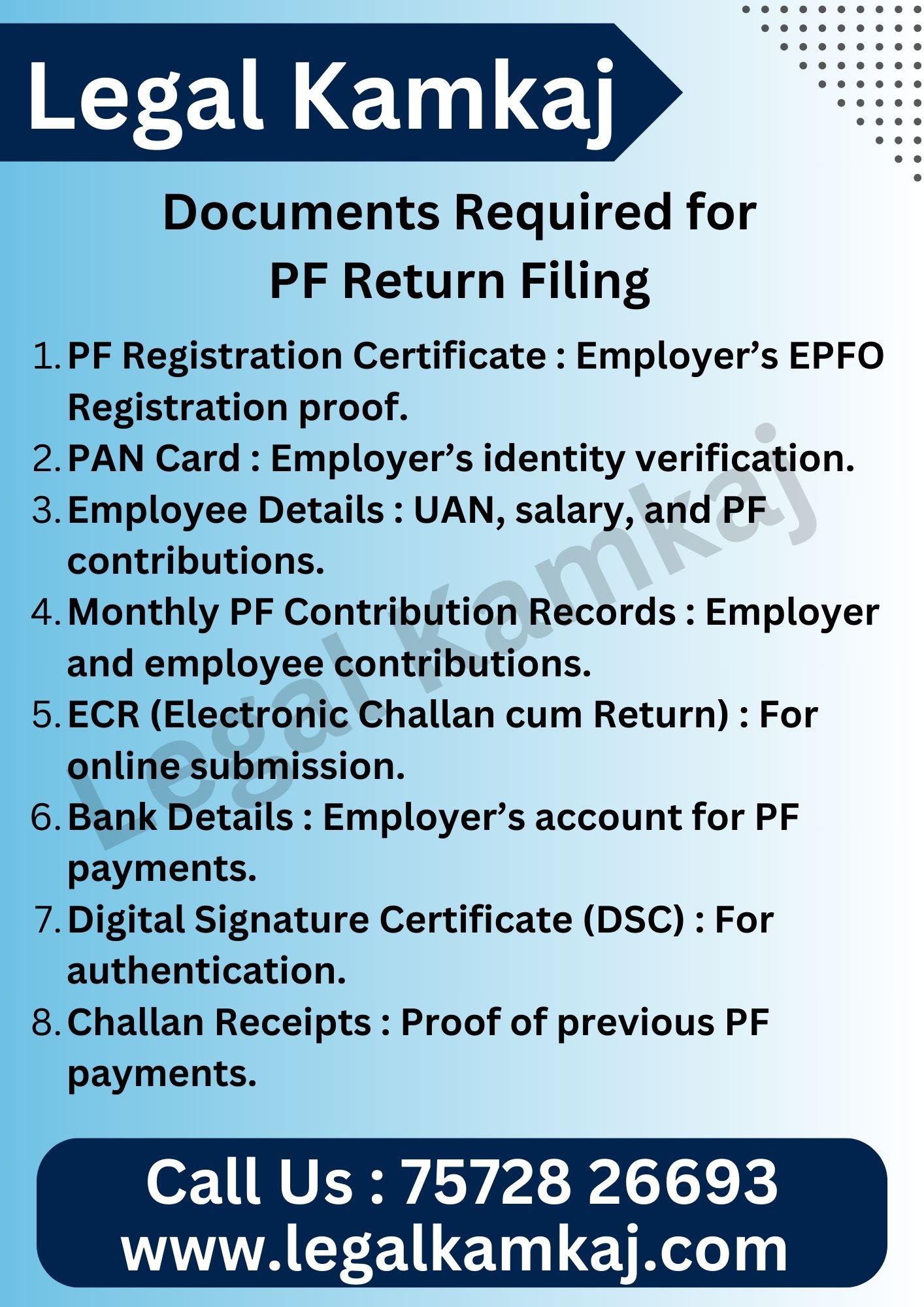

Documents Required for PF Return Filing

- PF Registration Certificate : Employer’s EPFO Registration proof.

- PAN Card : Employer’s identity verification.

- Employee Details : UAN, salary, and PF contributions.

- Monthly PF Contribution Records : Employer and employee contributions.

- ECR (Electronic Challan cum Return) : For online submission.

- Bank Details : Employer’s account for PF payments.

- Digital Signature Certificate (DSC) : For authentication.

- Challan Receipts : Proof of previous PF payments.

Provident Fund (PF) Registration & Return Filing Charges in India

Here’s a breakdown for Provident Fund (PF) & Employees’ State Insurance Corporation (ESIC) Return Filing Charges in India:

Services

Professional Fee (Approx.)

PF Return Filing (Monthly – ECR Generation & Filing)

Rs. 1,500

PF Registration

Rs. 3,000

Additional Charges (If Applicable):

- Late PF Payment Interest: 12% per annum

- Late Filing Penalty: Rs. 200 per day

- Correction in PF Records: Rs. 1,000

Due Dates for Provident Fund Return Filing?

- Monthly PF Payment – 15th of the following month. Employers must deposit PF contributions by this date.

- Monthly PF Return (ECR Filing) – 15th of the following month. Employers must file the Electronic Challan cum Return (ECR) online.

- Annual PF Return (Form 3A & 6A) – 30th April of the following financial year. This includes details of annual contributions for all employees.

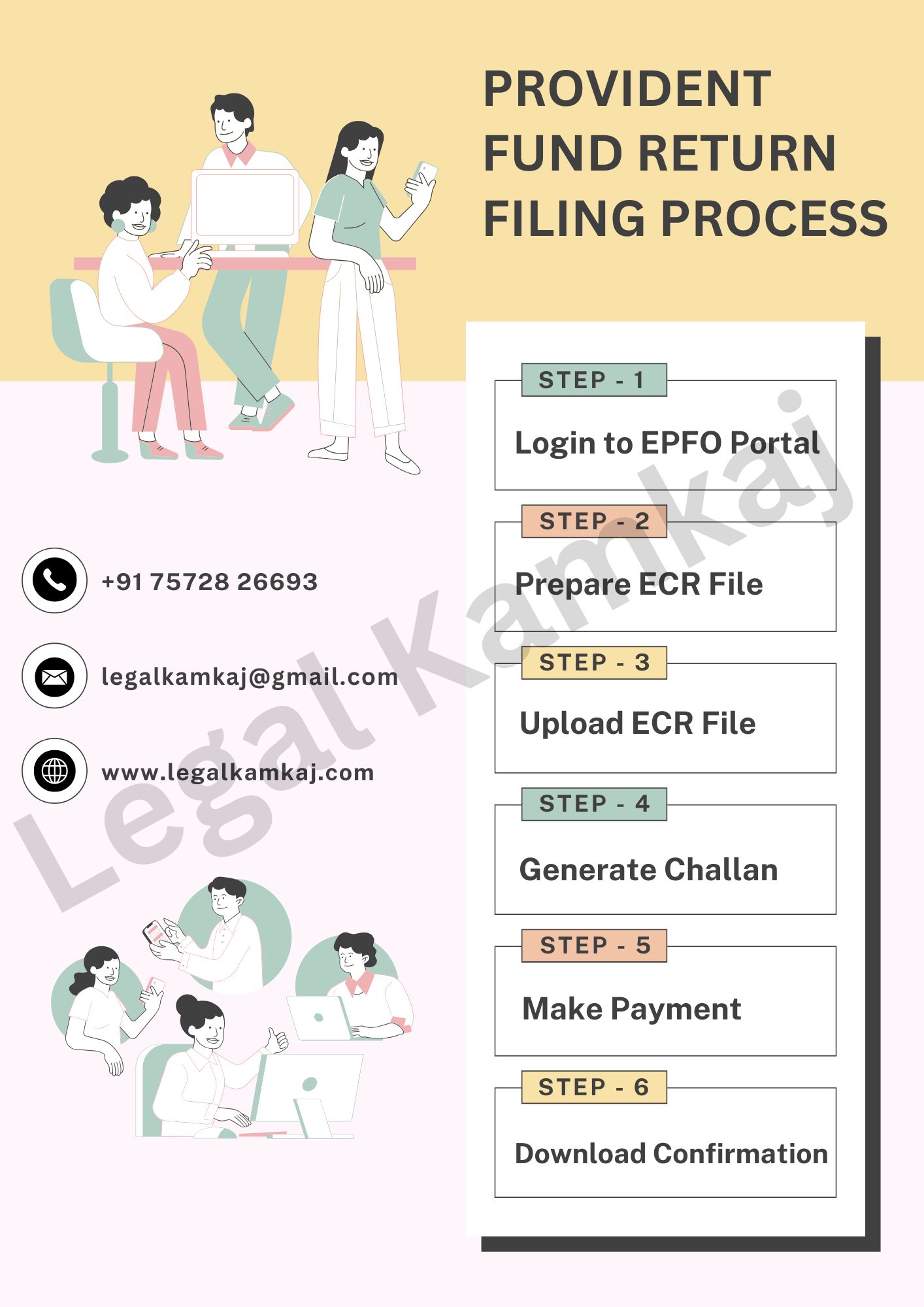

Process of Provident Fund Return Filing?

- Login to EPFO Portal – Visit the EPFO Unified Portal and log in using employer credentials.

- Prepare ECR File – Generate the Electronic Challan cum Return (ECR) with employee details, salaries, and PF contributions.

- Upload ECR File – Submit the ECR file on the EPFO portal for verification.

- Generate Challan – After successful verification, generate the challan for payment.

- Make Payment – Pay the PF contribution online through net banking or other available payment modes.

- Download Confirmation – After payment, download the acknowledgment receipt for records.

Provident Fund Return FAQs

A PF return is a mandatory filing where employers report monthly and annual employee PF contributions to EPFO.

All businesses registered under the EPF Act with 20 or more employees must file PF returns.

- Monthly PF Payment & ECR Filing – 15th of the following month

- Annual Return (Form 3A & 6A) – 30th April of the next financial year