LLP Annual Compliance

LLP (Limited Liability Partnership) annual compliance refers to the yearly legal requirements that LLPs must fulfill to stay active and compliant with government regulations. Specifically, LLP Annual Compliance includes filing the Annual Return (Form 11) and the Statement of Accounts and Solvency (Form 8) with the Ministry of Corporate Affairs (MCA). Importantly, both forms are mandatory, even if the LLP has no business activity. Consequently, timely submission of these forms is crucial, as failure to file them on time can result in penalties. Additionally, LLPs must ensure they comply with any tax filings or other regulatory obligations required by law to avoid fines or legal issues. Therefore, regular LLP Annual Compliance not only helps avoid legal complications but also keeps the LLP in good standing with the authorities. Ultimately, prioritizing compliance fosters a healthy business environment and promotes long-term success for the LLP.

Easy LLP Annual Compliance?

Annual Compliance Filing for LLP

Every Limited Liability Partnership (LLP) in India must comply with annual filing requirements to ensure transparency and legal compliance. The two main filings with the Ministry of Corporate Affairs (MCA) are Form 11 (Annual Return) and Form 8 (Statement of Accounts & Solvency). Form 11, due by May 30 each year, provides details of the LLP’s partners and activities. Form 8, due by October 30, includes financial statements and a solvency declaration. Additionally, LLPs must file an Income Tax Return (ITR-5) with the Income Tax Department by July 31 (if not audited) or October 31 (if audited).

If an LLP’s turnover exceeds ₹40 lakh or capital contribution exceeds ₹25 lakh, a statutory audit by a Chartered Accountant is required. Non-compliance with these filings can lead to hefty penalties, including late fees of ₹100 per day for MCA forms. Filing on time ensures smooth business operations and avoids legal complications.

Benefits of LLP Annual Filing Compliances

Legal Compliance & Avoidance of Penalties

- Regular filing ensures the LLP follows legal regulations.

- Non-compliance attracts heavy penalties from the Ministry of Corporate Affairs (MCA).

Better Business Credibility

- Timely compliance builds trust with banks, investors, and clients.

- It improves the LLP’s reputation in the industry.

Ease of Raising Funds

- Compliant LLPs have higher chances of securing loans and investments.

- Financial records provide transparency to potential investors.

Limited Liability Protection

- Proper filing keeps partners’ liability separate from the LLP.

- Non-compliance can lead to legal issues affecting personal assets.

Smooth Business Operations

- Filing annual returns and financial statements ensures proper financial tracking.

- Helps in planning future business growth and decision-making.

Avoiding LLP Strike-Off by MCA

- Continuous non-compliance may lead to LLP being marked as inactive.

- MCA can take action to strike off the LLP from its records.

Tax Benefits & Compliance

- Proper record-keeping helps in claiming deductions and avoiding tax penalties.

- Reduces risks of scrutiny from tax authorities.

Easy Exit or Conversion

- If an LLP wants to convert into a company or close down, compliance history helps.

- Non-compliance complicates the process of closure or transition.

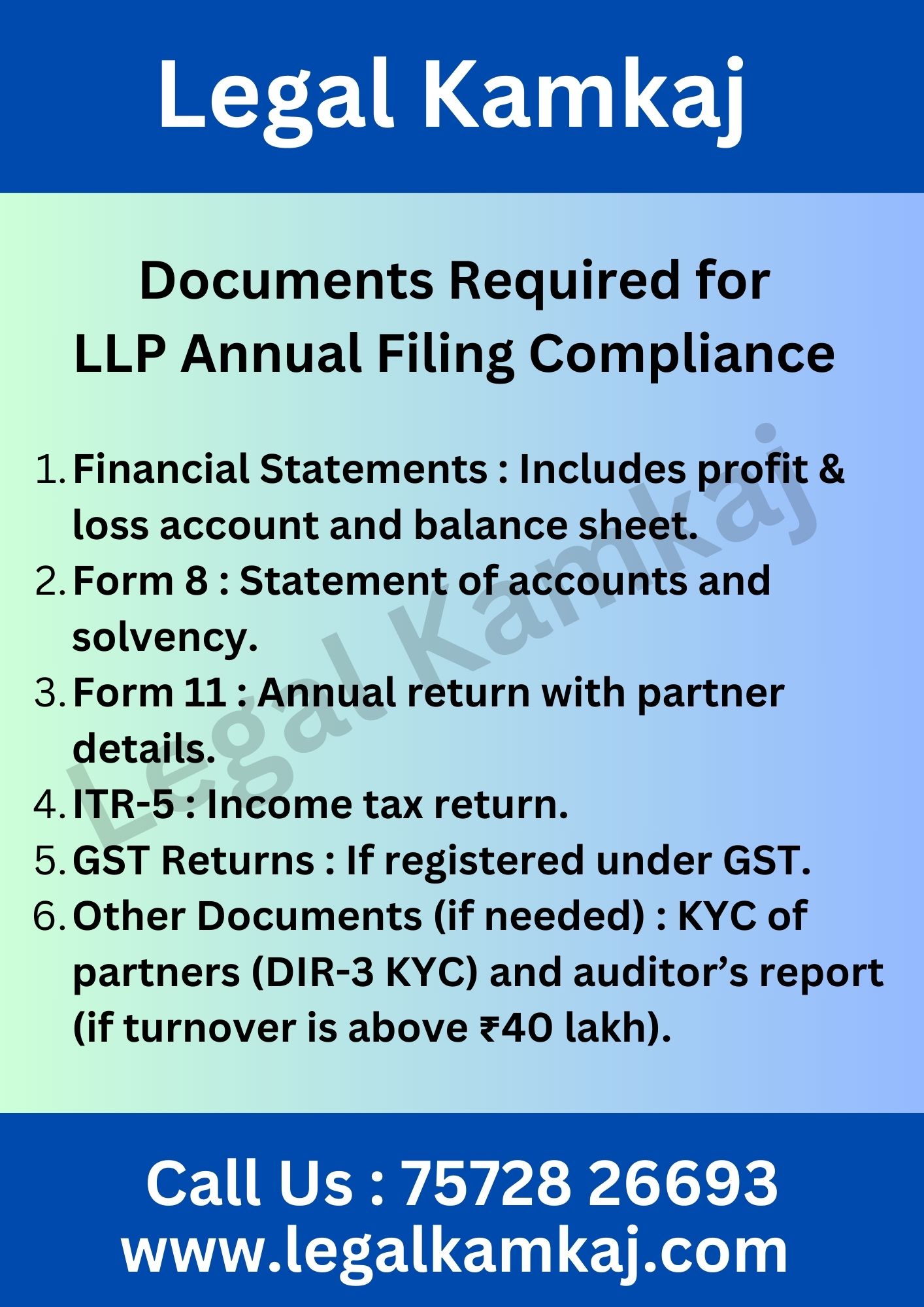

Documents Required for LLP Annual Filing Compliance

- Financial Statements : Includes profit & loss account and balance sheet.

- Form 8 : Statement of accounts and solvency.

- Form 11 : Annual return with partner details.

- ITR-5 : Income tax return.

- GST Returns : If registered under GST.

- Other Documents (if needed) : KYC of partners (DIR-3 KYC) and auditor’s report (if turnover is above ₹40 lakh).

LLP Annual Compliance Charges in India

Here’s a breakdown of LLP Annual Compliance Charges, including ROC filing, tax compliance, and audit requirements:

Compliance Requirement

Govt. Fee (Approx.)

Professional Fee (Approx.)

Total Cost (Approx.)

LLP Form 8 (Statement of Accounts & Solvency)

Rs. 50 – Rs. 200

Rs. 2,500 – Rs. 5,000

Rs. 2,550 – Rs. 5,200

LLP Form 11 (Annual Return Filing)

Rs. 50 – Rs. 200

Rs. 2,500 – Rs. 5,000

Rs. 2,550 – Rs. 5,200

Income Tax Return (ITR) Filing

No Govt. Fee

Rs. 3,000 – Rs. 7,000

Rs. 3,000 – Rs. 7,000

GST Return Filing (if applicable)

No Govt. Fee

Rs. 500 – Rs. 2,000 Per Return

Rs. 500 – Rs. 2,000 Per Return

TDS Return Filing (if applicable)

No Govt. Fee

Rs. 1,000 – Rs. 5,000 Per Quarter

Rs. 1,000 – Rs. 5,000 Per Quarter

Audit Fees (If Turnover > Rs. 40 Lakh)

No Govt. Fee

Rs. 10,000 – Rs. 20,000

Rs. 10,000 – Rs. 20,000

Total LLP Compliance Cost (Estimated)

- For Small LLPs (Turnover < Rs. 40 Lakh): Rs. 8,000 – Rs. 15,000 Annually

- For Large LLPs (Turnover > Rs. 40 Lakh with Audit Requirement): Rs. 20,000 – Rs. 50,000 Annually

Key Notes:

✔ Late Fees for LLP Form 8 & 11: Rs. 100 per day per form if delayed.

✔ Audit is mandatory if turnover exceeds Rs. 40 lakh or contribution exceeds Rs. 25 lakh.

✔ GST & TDS filing charges depend on transaction volume.

LLP Annual Return Due Date

Form 11 (Annual Return)

- Due Date: May 30 of every year

- Applies To: All LLPs, regardless of turnover

- Details Required: Partners’ details, contributions, etc.

Form 8 (Statement of Accounts & Solvency)

- Due Date: October 30 of every year

- Applies To: LLPs with financial transactions

- Details Required: Financial statements, profit/loss, solvency declaration

Income Tax Return (ITR-5 for LLPs)

- Due Date: July 31 (if no audit is required)

- Due Date: October 31 (if audit is required)

Tax Audit Report (if applicable)

- Due Date: September 30 (if turnover exceeds ₹1 crore or professional receipts exceed ₹50 lakh)

LLP Audit Obligations

When is an Audit Mandatory for LLPs?

An LLP must get its accounts audited if:

- Turnover exceeds ₹40 lakh in a financial year, or

- Capital contribution exceeds ₹25 lakh

Other Audit Requirements

- Income Tax Audit (under Section 44AB of the Income Tax Act)

- Required if turnover exceeds ₹1 crore for business or ₹50 lakh for professionals.

- Due date for tax audit report submission: September 30 of the assessment year.

- GST Audit

- Required if annual turnover exceeds ₹5 crore.

- Required if annual turnover exceeds ₹5 crore.

Key Benefits of Audit for LLPs

- Ensures financial transparency and compliance.

- Helps in securing loans or investments.

- Avoids penalties and legal issues.

Audit and Tax Filing Requirements for LLP

- Audit Requirements for LLP

- Audit requirements vary based on turnover and capital contribution. Typically:

- LLPs with a turnover below a certain threshold (e.g., ₹40 lakh in India, £10.2 million in the UK) and capital contribution below a threshold (e.g., ₹25 lakh in India) are exempt from mandatory audits.

- LLPs exceeding these limits must get their accounts audited by a Chartered Accountant (CA) or a certified auditor.

- If the LLP has taken a bank loan, financial institutions may require an audit regardless of turnover.

- Tax Filing Requirements for LLP

(a) Income Tax Return (ITR)

- LLPs must file annual income tax returns with the tax authorities, regardless of turnover or profit/loss.

- The due date varies (e.g., July 31st or October 31st if audit applicable in India).

(b) GST/VAT Returns (if applicable)

- If the LLP is registered under GST/VAT, periodic returns must be filed (monthly/quarterly/annually).

- If the LLP is registered under GST/VAT, periodic returns must be filed (monthly/quarterly/annually).

(c) Annual Filing with Registrar of Companies (ROC)

- Many jurisdictions require LLPs to file annual returns with the corporate registry (e.g., MCA in India, Companies House in the UK).

- LLPs may need to submit Statement of Accounts and Solvency.

- Additional Compliance

- Tax Deducted at Source (TDS): If an LLP is making payments subject to TDS, it must deduct and deposit the tax and file TDS returns.

- Foreign Transactions: If the LLP has international dealings, transfer pricing documentation may be needed.

LLP Compliance FAQ's

An LLP (Limited Liability Partnership) is a business structure that combines elements of partnerships and corporations. It offers limited liability protection to its partners, ensuring their personal assets are safe from business debts. Additionally, partners can manage the business directly, enhancing flexibility while maintaining operational credibility.

Common annual compliance requirements include:

- Filing of annual returns.

- Financial statements or accounts audit, if applicable.

- Payment of any applicable fees.

Yes, failure to comply with statutory requirements can indeed result in significant penalties. For instance, organizations may face fines that can strain their financial resources. Additionally, non-compliance may lead to legal action, which not only consumes time and money but also damages the company’s reputation. Furthermore, in severe cases, it can even result in the potential dissolution of the LLP. Therefore, it is crucial to prioritize compliance to avoid these serious consequences and ensure the smooth operation of the business.

Changes such as address, partners, or business activities usually require filing specific forms with the relevant authority. Additionally, you must pay any associated fees to complete the process. Therefore, staying informed about these requirements is crucial to ensure compliance and avoid potential penalties. Taking timely action helps maintain accurate records and contributes to the smooth operation of your business.

Yes, an LLP can typically convert to a different structure, such as a corporation or sole proprietorship. However, this process involves specific legal procedures and compliance with local laws. Seeking legal advice is advisable to ensure a smooth transition and to minimize potential disruptions to your business operations.