IEC Registration

Are you currently seeking an IEC Registration? In fact, an IEC Registration plays a vital role in guiding businesses through the intricate process of obtaining an Importer Exporter Code (IEC), which is essential for international trade. Not only do they offer expert support in completing the necessary documentation, but they also ensure compliance with government regulations, making the application process much smoother. Moreover, with their assistance, you can avoid potential delays and errors, allowing you to focus on expanding your business globally.

Additionally, their expertise helps you efficiently obtain your IEC, thereby enabling your business to import and export goods seamlessly. Furthermore, partnering with an IEC Registration opens doors to exciting opportunities in the global market, ultimately enhancing your trading potential. In short, with their guidance, you can navigate international trade with confidence and ease, positioning your business for success on the global stage.

Get IEC Registration

IEC Code Registration

An Import Export Code (IEC) is an absolutely vital 10-digit number that every business must acquire if they wish to engage in importing or exporting within India. In fact, the Directorate General of Foreign Trade (DGFT) is the authority that issues this essential code, which plays a critical role in facilitating smooth international trade operations. Importantly, importers depend on the IEC to clear customs efficiently and make payments to foreign banks, while, on the other hand, exporters utilize it to ship their goods and receive payments. Clearly, without a valid IEC, no individual or company can participate in import or export activities, which further underscores its significance in global commerce.

Additionally, service providers who are looking to avail benefits under the foreign trade policy must also obtain this code. What’s more, every manufacturer and merchant exporter requires an IEC to sell their products outside India, and, conversely, importers must possess it to purchase goods from abroad. Furthermore, apart from its indispensable role in facilitating trade, the government offers a variety of subsidies and tax rebate schemes, which means that IEC registration becomes crucial for exporters looking to claim these benefits.

Therefore, in light of these numerous factors, obtaining an IEC is not only a regulatory requirement but also a strategic move for businesses aiming to thrive in international markets. Thus, we offer instant IEC registration services, ensuring a smooth, efficient, and hassle-free process for our clients. Moreover, our team of IEC Registration Consultants is fully equipped and ready to assist you in obtaining your IEC certificate quickly and easily, allowing you to focus on the important aspects of your business operations without unnecessary delay. So, connect with us today to streamline your IEC registration process and unlock your business’s true potential for engaging in global trade successfully!

Benefits of IEC Code

Legal Requirement for Import/Export

An IEC code is mandatory for any business to engage in international trade. It is required to clear shipments from customs and to send or receive goods across international borders.

Access to Government Schemes

Businesses with an IEC Code can avail themselves of various government schemes and incentives related to exports, such as Duty Drawback and Export Promotion Capital Goods (EPCG).

Smooth Customs Clearance

The IEC code allows businesses to register with customs and facilitates smooth customs clearance for both import and export transactions.

Opportunities for International Growth

With the IEC code, businesses can expand their reach globally and explore new markets for their products and services.

Financial Transactions in Foreign Trade

It allows businesses to open a current bank account with foreign trade transactions, enabling smooth transactions between international clients and partners.

No Need for Renewal

The IEC code once obtained does not require renewal, making it a one-time investment for businesses looking to engage in cross-border trade.

Trade Benefits

Regardless of tax liability, all businesses registered under the GST Act are required to submit their GST returns online. Failure to file returns within the due date may lead to penalties and interest charges of up to 18% annually. Additionally, late filing incurs fees ranging from ₹100 to ₹5000.

Credibility and Trust

Having an IEC code establishes the legitimacy of your business in the eyes of international buyers, helping to build trust and credibility.

Customs and Excise Benefits

Some customs and excise duties may be reduced or waived off for businesses with an IEC code, helping to lower the cost of importing and exporting.

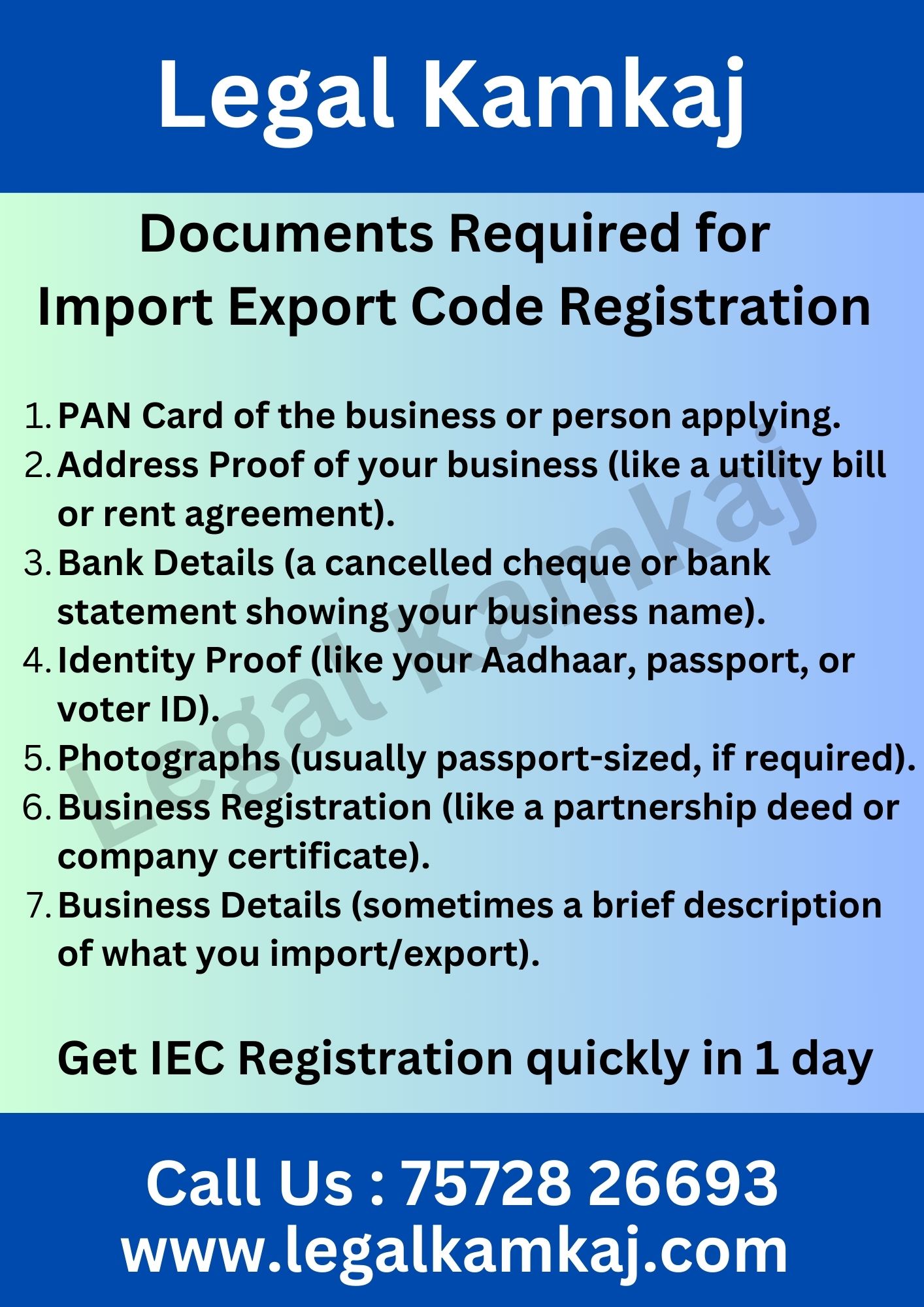

Documents Required for Import Export Code Registration

- PAN Card of the business or person applying.

- Address Proof of your business (like a utility bill or rent agreement).

- Bank Details (a cancelled cheque or bank statement showing your business name).

- Identity Proof (like your Aadhaar, passport, or voter ID).

- Photographs (usually passport-sized, if required).

- Business Registration (like a partnership deed or company certificate).

- Business Details (sometimes a brief description of what you import/export).

Import Export Code (IEC) Registration Charges

Here’s a summary of Import Export Code (IEC) Registration Charges, including government fees and professional fees:

Service

Govt. Fee

Professional Fee

Total Cost

New IEC Registration

Rs. 500

Rs. 1,999

Rs. 2,499

Modification of IEC

Rs. 200

Rs. 999

Rs. 1,199

IEC Renewal (Every Year)

Rs. 500

Rs. 1,999

Rs. 2,499

Reactivation of IEC

Rs. 500

Rs. 2,499

Rs. 2,999

Who Needs an IEC?

- Importers – Anyone who wants to import goods into India for commercial purposes.

- Exporters – Anyone who wants to export goods from India.

- Service Exporters – Businesses providing services outside India and claiming benefits under the Foreign Trade Policy (FTP).

- E-commerce Sellers – Individuals or businesses selling on international platforms like Amazon, eBay, or Alibaba.

- Manufacturers/Traders – Those who export/import raw materials or finished goods.

- Businesses Seeking Government Benefits – Companies applying for export incentives or subsidies under FTP.

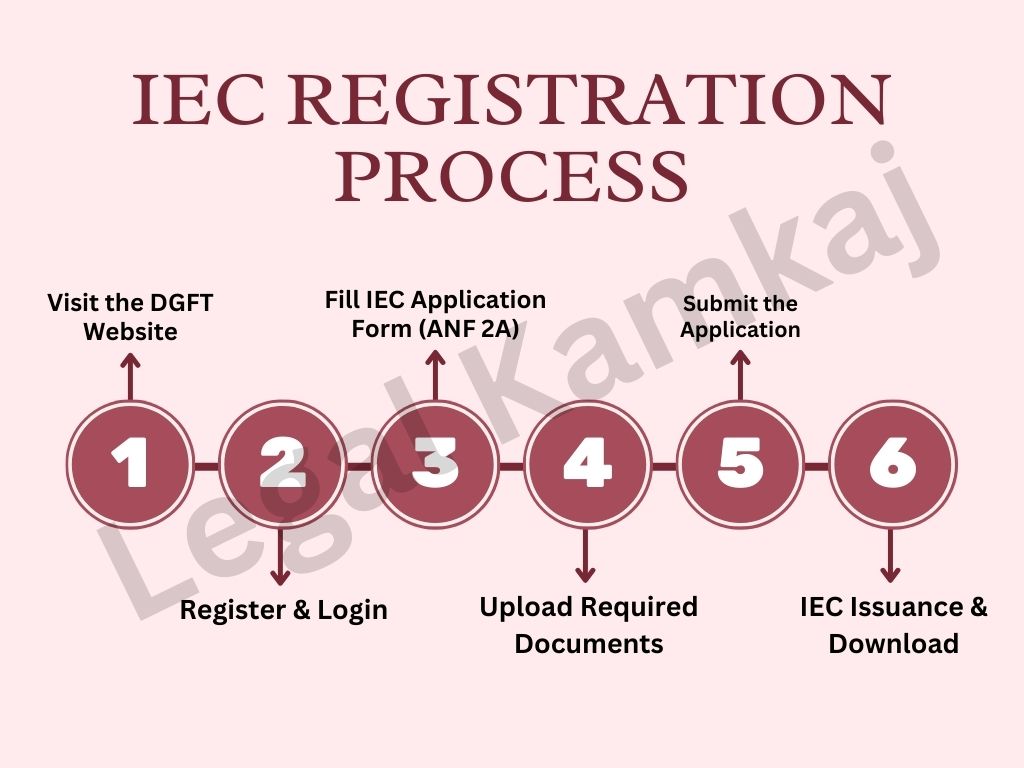

IEC Registration Process

Step 1: Visit the DGFT Website

Go to https://dgft.gov.in and click on “Apply for IEC” under the Services section.

Step 2: Register & Login

- Create a new user account using PAN, email, and mobile number.

- Verify via OTP and set a password.

- Log in to your account.

Step 3: Fill IEC Application Form (ANF 2A)

- Enter business details (name, type, address, PAN).

- Provide bank details (canceled cheque or bank certificate).

- Add owner/director/partner details (PAN & Aadhaar).

Step 4: Upload Required Documents

- PAN Card (Individual/Company/LLP).

- Address Proof (Electricity bill, Rent Agreement, Sale Deed).

- Bank Certificate or Canceled Cheque.

- Aadhaar/Passport/Voter ID (for Proprietor/Directors/Partners).

- Digital Signature Certificate (if applicable).

Step 5: Submit the Application

- Review details and submit the form.

- A reference number will be generated for tracking.

Step 6: IEC Issuance & Download

- Get IEC Registration quickly in 1 day.

- Download the IEC Certificate from the DGFT portal.

Why is IEC Important for Businesses?

The Importer Exporter Code (IEC) is a unique identification number required for any business that wants to import or export goods and services. It is issued by the Directorate General of Foreign Trade (DGFT) and is mandatory for all businesses involved in international trade. Without an IEC, businesses cannot clear their shipments through customs or receive payments from foreign clients. It acts as a key to accessing the global market, making it essential for businesses aiming to grow internationally.

Getting an IEC is a simple, one-time process that involves filling out an application online and submitting necessary documents like PAN card, address proof, and bank details. Once registered, the IEC is valid for life and doesn’t need to be renewed. Having an IEC also allows businesses to benefit from government schemes and incentives for exporters, making it a valuable tool for companies looking to expand their operations and take part in global trade.

FAQs on Import Export Code

Individuals and businesses engaged in importing and exporting goods in India require a unique 10-digit code known as an IEC. This code is crucial because it facilitates smooth transactions and compliance with regulations. Moreover, obtaining the IEC allows entities to access various benefits related to international trade.

Any business or individual intending to import or export products must proactively obtain an Importer Exporter Code (IEC). By doing so, they ensure compliance with regulations and facilitate smoother transactions. Ultimately, acquiring the IEC significantly enhances their ability to engage in international trade effectively.

You can easily apply online through the Directorate General of Foreign Trade (DGFT) website. First, fill out the application form, ensuring all required information is complete. Next, gather and submit the necessary documents. By following these steps, you will streamline your application process and enhance your chances of success.

Typically, applicants must submit several commonly required documents, including a PAN card, a bank account statement, proof of identity, and proof of address. To ensure a smooth process, it is crucial that applicants gather and present these documents promptly and accurately.