Section 8 Company Registration in Ahmedabad

A Section 8 Company is a non-profit organization focused on charitable activities like education, culture, science, and social welfare. Unlike other businesses, its profits are used for these causes and not distributed as dividends. Section 8 Company Registration in Ahmedabad is done under the Companies Act, 2013, ensuring compliance with legal requirements.

Section 8 Company Registration in Ahmedabad offers a structured approach for forming a non-profit. Unlike societies, it is governed by the Ministry of Corporate Affairs (MCA). At Legal Kamkaj, we provide end-to-end services for Section 8 Company Registration in Ahmedabad, helping with documentation, approvals, and compliance to make the process seamless.

Section 8 Company Registration

Section 8 Company Registration in Ahmedabad - An Overview

A Section 8 Company is a special type of non-profit organization established with the goal of promoting charitable activities such as education, science, culture, religion, and social welfare. Unlike other businesses, the profits earned by a Section 8 Company are reinvested in these causes and not distributed among members as dividends.

Section 8 Company Registration in Ahmedabad offers non-profit organizations a credible legal structure to operate and grow. Governed by the Companies Act, 2013, the registration process is streamlined under the Ministry of Corporate Affairs (MCA). This ensures compliance with legal requirements while enabling businesses to focus on their charitable objectives.

Key features of Section 8 Company Registration in Ahmedabad include:

- Recognition as a non-profit organization.

- Tax benefits and exemptions under applicable laws.

- Increased credibility for securing grants and donations.

- No minimum share capital requirement.

Whether you’re starting a new non-profit or transitioning an existing organization, Legal Kamkaj provides expert assistance for Section 8 Company Registration in Ahmedabad. From document preparation to approvals and compliance, we ensure a hassle-free experience tailored to your needs.

Benefits of Non-Profit Company Registration in Ahmedabad

Tax Benefits

Section 8 Companies enjoy tax relief, which helps save on operational costs.

Trust and Credibility

Registration boosts your company’s reputation, making it easier to attract donations and grants.

Non-Profit Focus

Profits are reinvested in charitable purposes, ensuring the focus remains on the organization’s goals.

Limited Liability

Members have limited liability, protecting personal assets from organizational liabilities.

No Capital Requirement

There is no need for a minimum capital investment to register a Section 8 Company.

Funding Opportunities

Registered Section 8 Companies attract grants, donations, and government support.

Separate Identity

The company is a distinct legal entity, ensuring stability.

Flexible Operations

Section 8 Companies in Ahmedabad can be converted into other entities if needed, ensuring flexibility.

Local Support

Section 8 Company Registration in Ahmedabad makes it easier to collaborate with local organizations and initiatives.

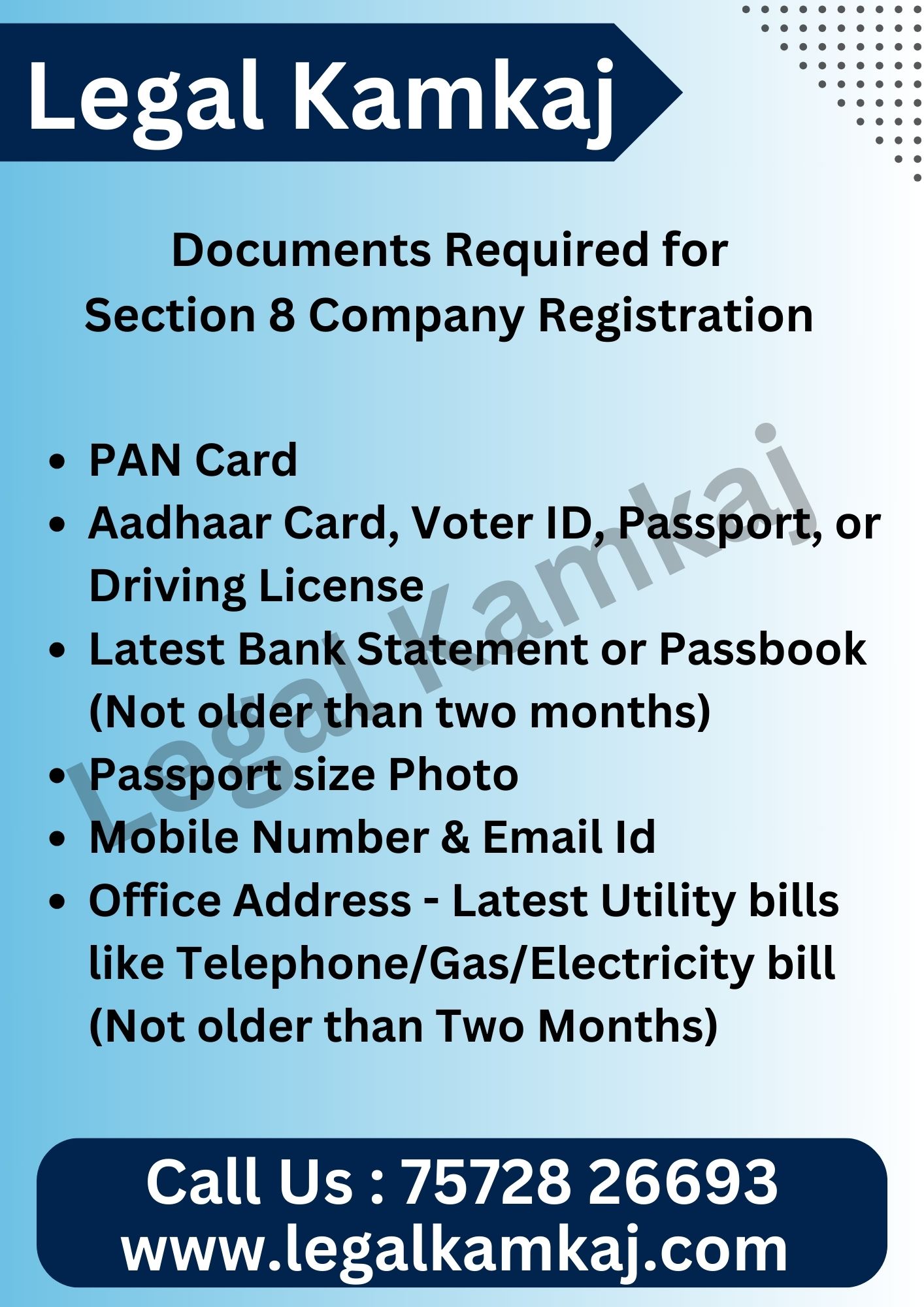

Documents Required for Section 8 Company Registration

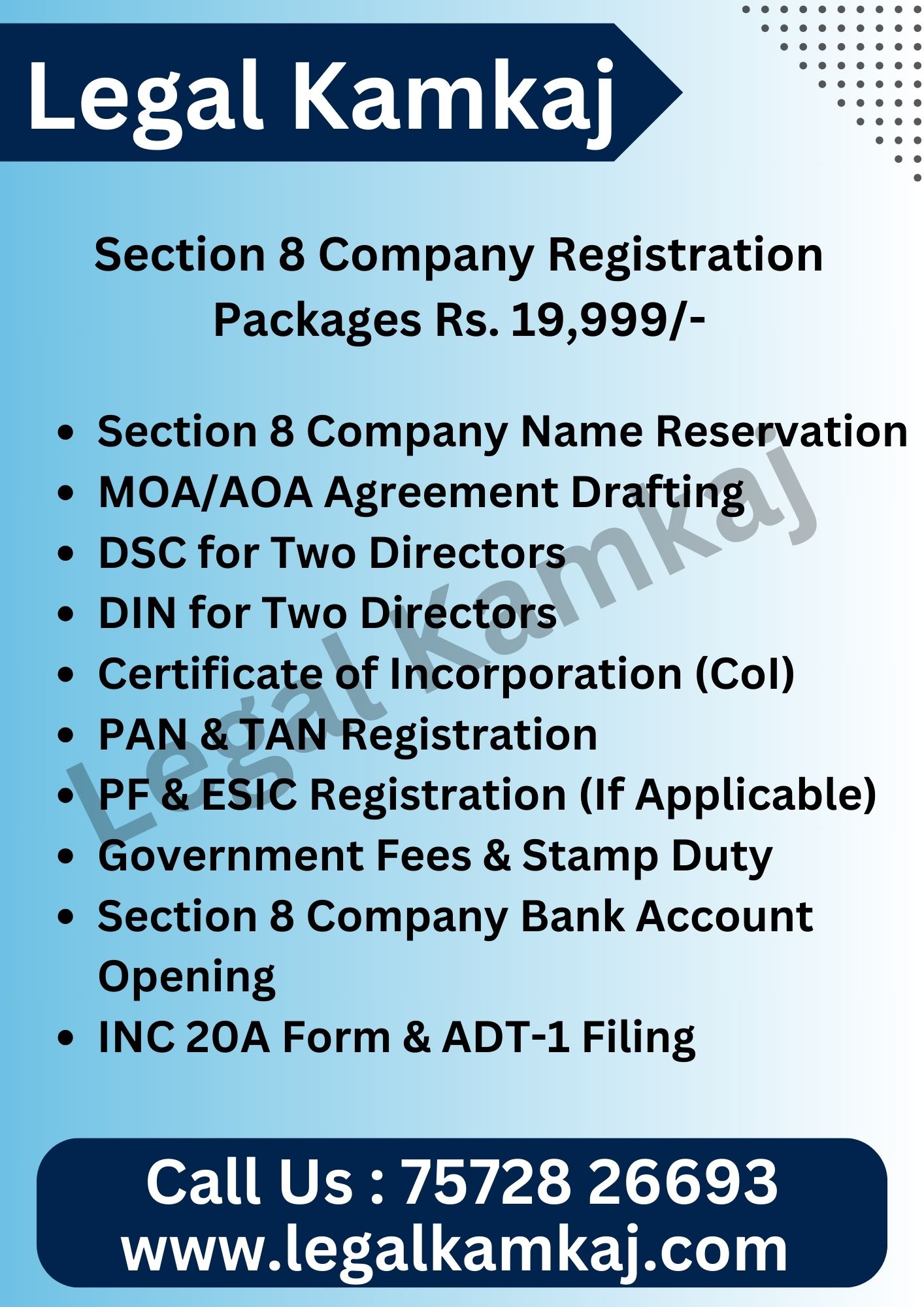

Section 8 Company Registration Services - Affordable Packages

Get your Section 8 Company registered with Legal Kamkaj. Affordable packages that include all services with no hidden fees – Start your Non-Profit now.

- Section 8 Company Name Reservation

- MOA/AOA Agreement Drafting

- DSC for Two Directors

- DIN for Two Directors

- Certificate of Incorporation (CoI)

- PAN & TAN Registration

- PF & ESIC Registration (If Applicable)

- Government Fees & Stamp Duty

- Section 8 Company Bank Account Opening

- INC 20A Form & ADT-1 Filing

Let Legal Kamkaj handle the registration process for you with a simple, transparent, and Affordable Package!

What You Need to Start a Section 8 Company Registration?

Here’s a simple breakdown of what you need to start a Section 8 Company registration:

- Purpose

- The company must be created with the goal of advancing charitable initiatives such as education, healthcare, arts, or community development.

- Non-Profit Status

- The entity should be non-commercial and must not share any profits with its members or stakeholders. Any surplus funds must be reinvested into the organization’s core mission.

- Board of Directors

- At least two board members are required, with one director being a resident of India.

- No Equity Capital

- A Section 8 company does not issue shares and does not provide any opportunities for profit distribution among its members.

- Registered Office

- The company must have a valid office address in India, which will act as its official communication point.

- Clear Mission

- The company’s foundational documents must clearly outline its social purpose, such as promoting education, environmental conservation, or providing public services.

- Legal Adherence

- The company must adhere to the regulations stipulated in the Companies Act, 2013 and receive approval from the Ministry of Corporate Affairs (MCA).

- Non-Political

- The organization must remain neutral and must not engage in political activities or support any political party.

- Public Welfare

- The organization must operate with the sole aim of benefiting the community, offering services that enhance societal well-being.

- Regulatory Approval

- The Section 8 company must secure official authorization from the Registrar of Companies (RoC) before it can be officially incorporated.

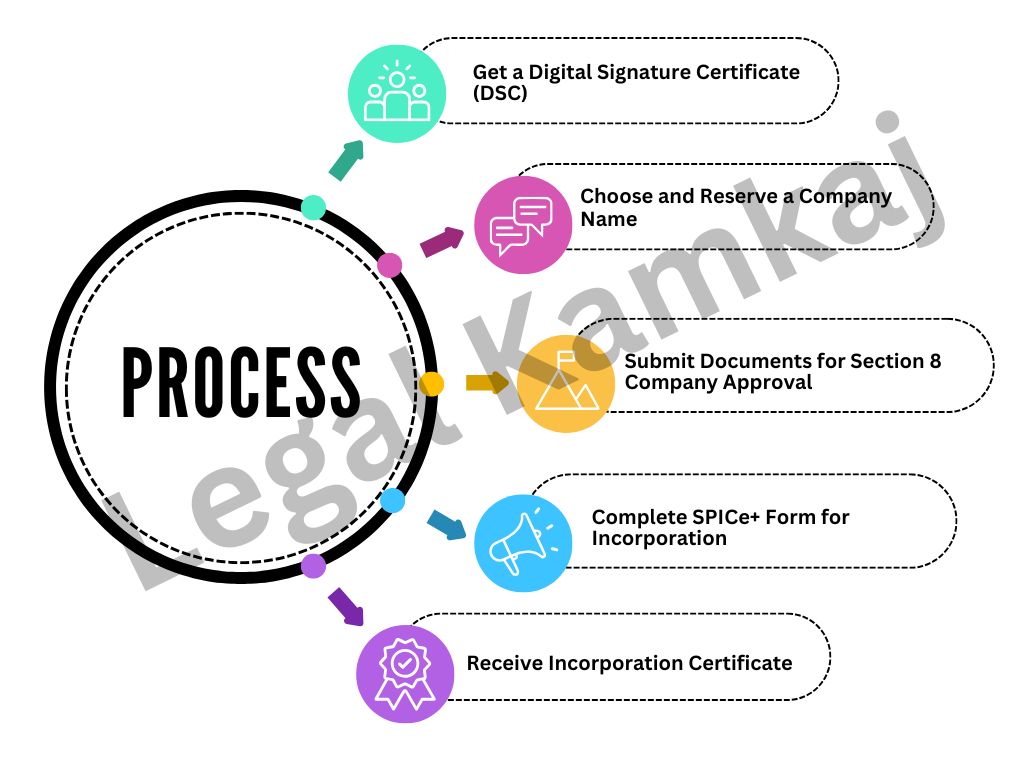

Section 8 Company Registration Process

Here’s a simplified version of the Section 8 Company Registration Process with easy steps:

Step 1: Get a Digital Signature Certificate (DSC)

- All directors must first obtain a Digital Signature Certificate (DSC). This will be used for signing all forms electronically during the registration process.

Step 2: Choose and Reserve a Company Name

- Use the RUN (Reserve Unique Name) form on the MCA portal to check and reserve a unique company name. Be sure to include terms like Foundation, Association, or Trust to reflect its non-profit nature.

Step 3: Submit Documents for Section 8 Company Approval

- File Form INC-12 with the Registrar of Companies (RoC). This form must include documents like the Draft Memorandum of Association (MOA), Draft Articles of Association (AOA), and proof of the registered office address. Once approved, you will receive the Section 8 License (Form INC-16).

Step 4: Complete SPICe+ Form for Incorporation

- Fill out the SPICe+ form (INC-32) for company registration on the MCA portal. Attach the INC-16 license, approved MOA and AOA, and documents like PAN, Aadhaar, and photographs of the directors.

Step 5: Receive Incorporation Certificate

- Finally, after document verification, the Registrar of Companies (RoC) will issue the Certificate of Incorporation, marking your company’s legal existence.

Regulatory Requirements for Section 8 Company

- A Section 8 Company must hold an AGM every year to discuss the company’s financials, elect directors, and handle other business matters.

- The company must maintain accurate financial records and get them audited by a certified auditor every year.

- The company must file Annual Returns with the Registrar of Companies (RoC), including financial statements, every year.

- Even though it’s a non-profit, the Section 8 Company must file Income Tax Returns (ITR) annually.

- All profits must be used for the company’s charitable purposes and cannot be distributed to directors or members.

- The company must file necessary forms like Form MGT-7 (Annual Return) and Form AOC-4 (Financial Statements) with the RoC on time.

- If the company receives donations and claims tax exemptions, it must maintain proper records to prove its charitable nature.

- As a Section 8 Company, it must comply with the relevant provisions of the Companies Act, 2013, including those related to governance, operations, and Reporting.

Section 8 Company Registration FAQ's

A Section 8 Company is a non-profit organization established for charitable, educational, or social purposes under the Companies Act, 2013.

An individual, Hindu Undivided Family (HUF), or a limited company can initiate the registration of a Section 8 Company.

The objectives should include promoting sports, social welfare, advancing science and art, providing education, and offering financial support to lower-income groups.

No, there is no minimum capital requirement for a Section 8 Company.

No, profits cannot be distributed directly or indirectly to the company’s directors or members. They must be used to further the company’s objectives.