ESIC Registration

Are you searching for an ESIC Registration? Look no further! An ESIC Registration plays a crucial role in helping businesses register for the Employees’ State Insurance Corporation (ESIC) scheme, which provides essential medical and financial benefits to employees. Specifically, the actively guides companies through the registration process, ensuring they meet all legal requirements while assisting with paperwork and document submission.

Furthermore, these s stay updated on the latest ESIC regulations and policies, delivering accurate advice that helps companies remain compliant. Additionally, they explain the benefits of ESIC to both employers and employees, emphasizing how the scheme offers health coverage and financial assistance during times of sickness, maternity, and workplace injuries.

In summary, an ESIC Registration significantly simplifies the enrollment process, thereby enabling businesses to provide vital benefits to their employees. By leveraging their expertise, companies can confidently navigate the complexities of the ESIC scheme, ultimately creating a secure and supportive environment for all employees. Thus, partnering with an ESIC Registration not only ensures compliance but also enhances the overall well-being of the workforce.

Needing ESIC Registration Details?

ESIC Registration – Overview

The Government of India initiated the Employee State Insurance (ESI) program to provide essential medical, financial, and other benefits to workers. Furthermore, the Employee State Insurance Corporation, which operates as an autonomous body under the Ministry of Labour and Employment, oversees this critical scheme.

By law, businesses with more than 10 employees must enroll in ESIC; however, it’s worth noting that certain states set this threshold at 20 employees. Consequently, employers must deduct contributions from the wages of employees who earn above ₹21,000 per month. This deduction includes the basic salary and dearness allowance, ensuring that employees benefit from the program.

In addition to these requirements, businesses with a turnover of less than ₹1.5 crore can choose the composition scheme. This option not only simplifies the compliance process but also allows them to avoid complex GST procedures, enabling them to pay GST at a fixed rate based on their turnover. Overall, this structure aims to create a more straightforward and beneficial experience for both employers and employees within the framework of the ESI program.

To elaborate, the ESI program not only addresses immediate healthcare needs but also provides long-term financial security for workers and their families. Moreover, it fosters a sense of responsibility among employers to contribute positively to their employees’ welfare. Therefore, as companies navigate these requirements, they should remain aware of their obligations and the potential benefits of compliance. Ultimately, this framework encourages a healthier workforce, which, in turn, contributes to increased productivity and a more robust economy. Thus, by participating in the ESI program, businesses take proactive steps toward creating a supportive work environment while also adhering to legal mandates.

Benefits of ESI Registration

Medical Aid

ESIC-registered members and their families become eligible to receive comprehensive medical care and insurance benefits from the first day of employment.

Maternity Aid

Pregnant women can receive maternity benefits for up to 26 weeks, with an extension of 30 days possible upon medical advice. To qualify, employers must contribute wages for 70 days during the two preceding contribution periods.

Disablement Benefits

Disabled employees can get 90% of their monthly salaries as disablement benefits.

Sickness Benefits

Employees can take up to 91 days of sick leave per year, with 70% of their monthly wages covered during this period.

Dependent Benefits

In the event of an employee’s death while employed, the dependents of the deceased will receive 90% of the employee’s monthly salary.

Funeral Expenses

The family of the deceased employee is eligible for an additional ₹10,000 to cover funeral expenses.

Confinement Expenses

If an insured woman or the wife of an employee gives birth in an area without medical facilities covered by the ESI scheme, she can claim confinement expenses.

Vocational Rehabilitation

Insured employees who are permanently physically challenged are eligible for vocational rehabilitation training through VRS.

Physical Rehabilitation

Provided to employees in the event of physical disability resulting from work-related injuries or occupational hazards.

Old Age Medical Care

An annual fee of ₹120 secures medical care benefits for retiring ESI employees or those opting for VRS/ERS.

Extended Sickness Benefits

ESI members with chronic illnesses can receive extended sickness benefits for up to 2 years after exhausting the standard 91-day sick leave.

Enhanced Sickness Benefit

ESI provides registered members who undergo sterilization procedures with 100% of their daily average wages as enhanced sickness benefits, allowing for a recovery period of 7 days for vasectomy and 14 days for tubectomy.

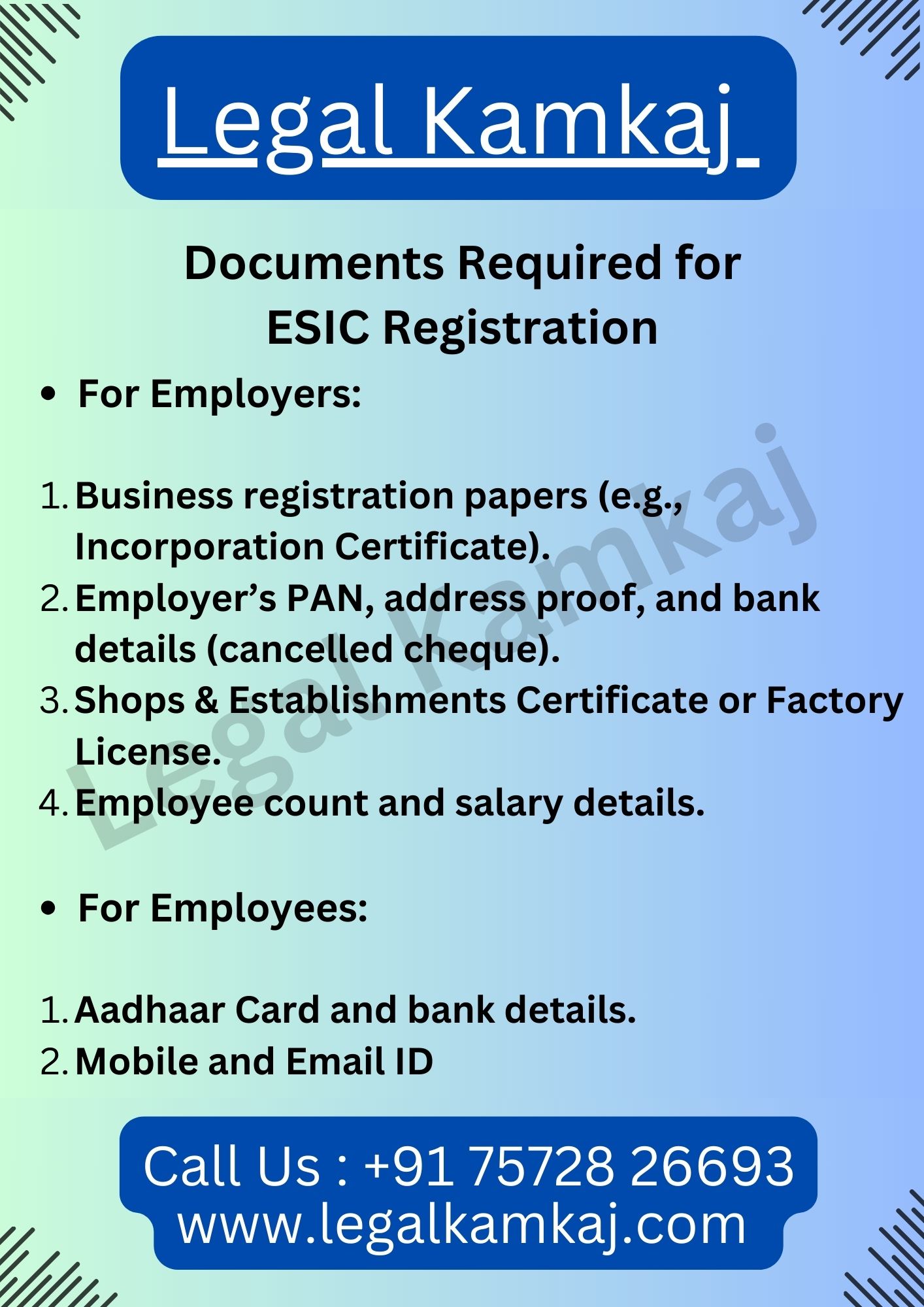

Documents Required for ESIC Registration?

ESIC Registration Charges

Employer ESIC Registration: Rs. 2,000

Definition of Establishment under the ESI Act

The Employees’ State Insurance Act, 1948 (ESI Act) defines an establishment as any premises, along with its surrounding areas, where ten or more employees are engaged for wages. In other words, this definition encompasses not only the main workplace but also the adjacent locations where employees may perform their duties. Therefore, if an organization employs ten or more individuals, it falls under this definition. Consequently, such establishments must comply with the provisions set forth in the ESI Act, which aims to provide financial security and health benefits to employees. This inclusion underscores the importance of understanding the broader implications of what constitutes an establishment, as it directly affects both employer responsibilities and employee rights within the framework of the ESI Act. Thus, businesses should carefully assess their operations to ensure compliance with the ESI Act and to promote a supportive work environment for their employees.

This includes factories but also other types of establishments, such as:

- Hotels, restaurants, and boarding houses

- Cinemas, theatres, and other places of public amusement

- Shops, commercial establishments, and places of business

- Educational institutions

- Medical institutions

- Transport undertakings

- Warehousing establishments

Here are key points to consider regarding the definition of an establishment under the ESI Act:

- The premises must be used to carry on some economic activity.

- There must be ten or more employees working on the premises for wages.

- The employees must work on the premises for at least 240 days in the preceding 12 months.

Premises that meet specific criteria will be classified as an establishment under the ESI Act. Additionally, the Act allows coverage extension to establishments with fewer than ten employees through notifications issued by the Central or State Government in the Official Gazette. Thus, businesses should stay informed about these updates to ensure compliance and navigate the regulatory landscape effectively.

ESI Registration Online Process

When you choose Legal KamKaj for ESI New Registration, we complete it in three simple steps that take the minimum possible time.

Form Completion: To effectively initiate the ESI registration process, you must first complete the ESI Online Registration form thoroughly. Subsequently, submit the necessary documents to facilitate a quick review. Additionally, ensure that all information is accurate, as this significantly impacts the outcome. Furthermore, keep track of your submissions to enhance your chances of achieving a successful and efficient registration process. By following these steps diligently, you will create a smoother experience, ultimately paving the way for a seamless registration journey.

Verification: We meticulously check all the details you provide to ensure both accuracy and completeness. Moreover, please note that this thorough process may take up to 12 days to complete. We truly appreciate your patience during this time, as we work diligently to deliver precise and comprehensive results. By allowing us this necessary time, you contribute to the overall quality and reliability of the final outcome, ensuring that every detail meets your expectations and requirements. Rest assured, we prioritize your needs and strive to provide the best service possible. Thank you for your understanding as we navigate this important process together!

Submission: We quickly submit the ESI registration application and all required paperwork within two working days, ensuring compliance. By managing the submission process, we handle every detail, allowing you to focus on your core business operations while we take care of the ESI registration seamlessly.

At this stage, your part of the ESI Online Registration is complete. The government will review and process your application. Once approved, Legal KamKaj will send you:

- The 17-digit identification code number

- Employee insurance number

- Temporary identity card

ESI Obligations After Registration

- Initial Status: Initially, when the registration under the Employees’ State Insurance Act of 1948 becomes active, the company must take proactive measures to ensure compliance with the ESI Act, 1948 within six months of its establishment. Consequently, this step is critical for maintaining legal standing.

- Dormant Status: Conversely, if the company finds itself not immediately subject to the Employees’ State Insurance Act, 1948, it has the option to make its registration dormant within six months. By logging into the system, the company can proactively avoid penalties for non-compliance, which ultimately safeguards its interests. Importantly, the company can maintain dormant status for a maximum of six months at a time, which allows flexibility in managing its obligations.

- Extension: Moreover, to extend the dormant period further, the company must log in to the ESI website before the 180-day dormant status period ends. By taking this timely action, the company ensures continued compliance and effectively avoids any potential penalties associated with inaction. Overall, understanding these statuses and the associated requirements is crucial for businesses to navigate their obligations under the ESI Act effectively. By being informed and prepared, companies can better manage their responsibilities and ensure smooth operations in line with regulatory expectations.

Returns To Be Filed After ESI Registration

ESI returns must be submitted biannually following ESI registration. To file these returns, you will need the following documents:

- Employee attendance register

- Form 6 register

- Wages register

- Accidents register (for any incidents that may have occurred on the business premises)

- Monthly returns and challans.

FAQs on ESI Registration

To download an ESI pehchan card, you can follow these steps:

- Go to the ESI Corporation website.

- Click on the ‘ESIC Pehchan Card’ tab.

- Enter your registration number and date of birth.

- Click on the ‘Download’ button.

To register for ESI, your establishment must have a minimum of 10 employees. Therefore, all businesses with ten or more employees are required to register with the ESI Corporation, fulfilling legal obligations while providing essential benefits to their workforce.

To check the ESI registration of an employee online, you can follow these steps:

- Go to the ESI Corporation website.

- Click on the ‘ESI Registration’ tab.

- Enter the employee’s registration number.

- Click on the ‘Check’ button.

Yes, ESI is calculated based on the basic salary, which is the part of an employee’s pay before deductions like taxes or provident funds. Understanding this helps employers ensure correct ESI contributions and allows employees to see how their basic salary affects their take-home pay.

The ESI scheme is self-financed through monthly contributions from employers and employees, based on a fixed percentage of wages. This funding ensures financial sustainability and promotes active participation, creating a robust social security system that provides essential support to workers and their families.