12A & 80G Registration

Legal Kamkaj offers expert assistance in obtaining 12A & 80G Registration, ensuring NGOs, charitable trusts, and non-profit organizations can benefit from tax exemptions and increased donor contributions. These 12A & 80G Registration approvals, granted by the Income Tax Department, are essential for organizations seeking financial sustainability and legal compliance.

- 12A Registration: Provides tax exemption on the organization’s income, allowing funds to be used exclusively for charitable activities.

- 80G Registration: Enables donors to claim tax deductions on their contributions, making it easier for NGOs to secure funding.

At Legal Kamkaj, we streamline the entire process, from documentation to approval, ensuring quick and hassle-free registration. Our expert guidance helps organizations establish credibility, compliance, and long-term financial benefits.

Apply for 12A & 80G Registrations ?

Tax Exemption for NGOs

12A & 80G Registration is essential for NGOs, charitable trusts, and non-profit organizations in India to obtain tax exemptions and attract more donors. These registrations, granted by the Income Tax Department, help organizations operate legally while maximizing financial benefits.

- What is 12A Registration?

- 12A Registration provides tax exemption on an NGO’s income.

- It ensures that the income generated is not taxable, allowing funds to be used solely for charitable purposes.

- Once registered, the NGO can also apply for government and CSR funding.

- What is 80G Registration?

- 80G Registration allows donors to claim tax deductions on their donations.

- Donations made to an 80G-registered NGO are eligible for a tax deduction of up to 50% under Section 80G of the Income Tax Act.

This makes it easier for NGOs to attract more donors and raise funds.

Benefits of 12A & 80G Registration

Tax Benefits for NGOs

12A registration ensures the NGO’s income is completely tax-free.

Tax Benefits for Donors

80G registration allows donors to claim tax deductions, encouraging more donations.

Increases Funding Opportunities

Helps attract CSR funds, government grants, and foreign donations.

Builds Credibility & Trust

Recognized as a legal charitable organization, making fundraising easier.

Ensures Financial Stability

Tax savings allow NGOs to focus on growth and development.

Legal Compliance

Fulfils tax laws and improves eligibility for additional registrations like FCRA.

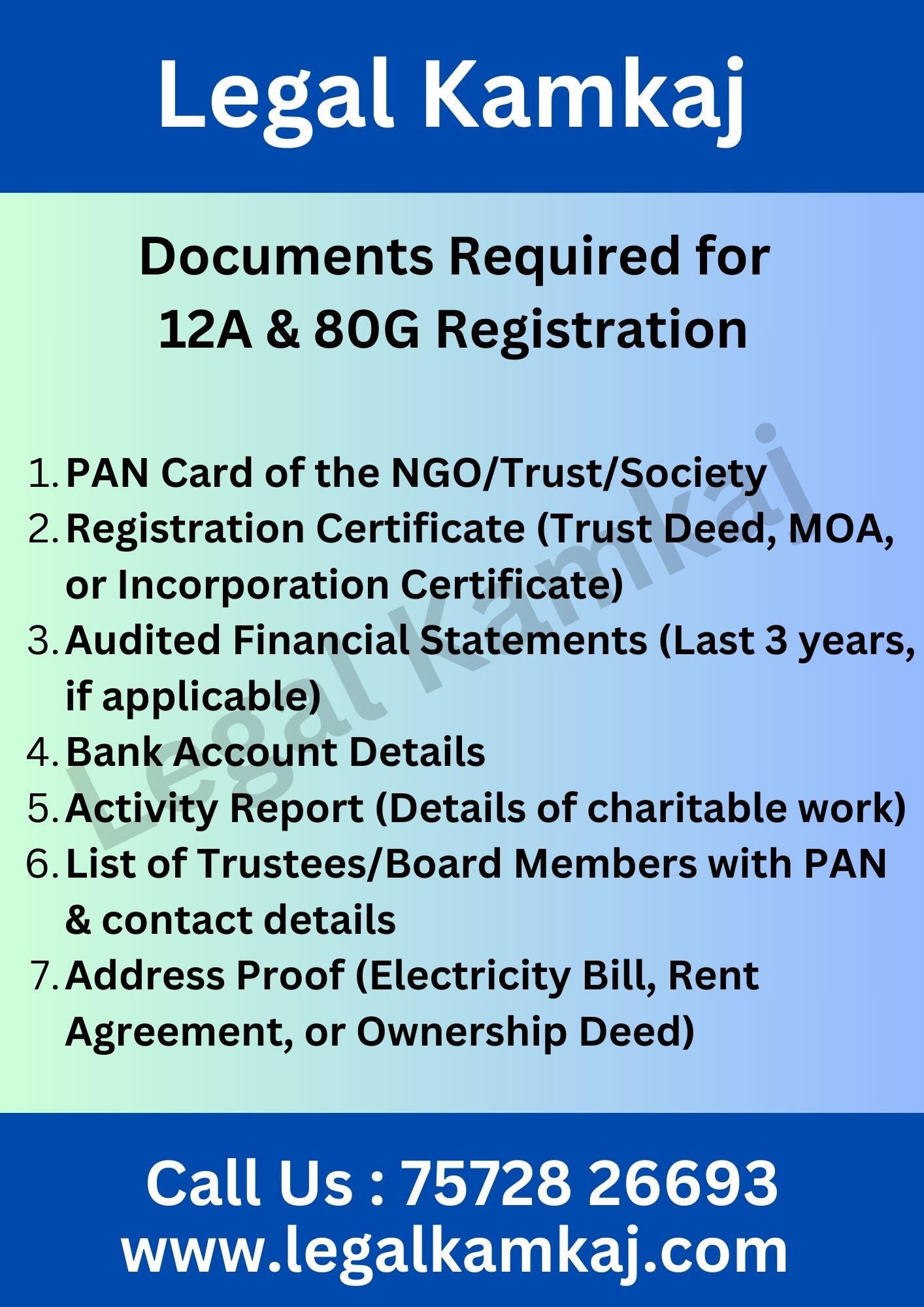

Documents Required for 12A & 80G Registration

To apply for 12A & 80G Registrations, NGOs, charitable trusts, and non-profit organizations need to submit the following documents:

✅ PAN Card of the NGO/Trust/Society

✅ Registration Certificate (Trust Deed, MOA, or Incorporation Certificate)

✅ Audited Financial Statements (Last 3 years, if applicable)

✅ Bank Account Details

✅ Activity Report (Details of charitable work)

✅ List of Trustees/Board Members with PAN & contact details

✅ Address Proof (Electricity Bill, Rent Agreement, or Ownership Deed)

12A & 80G Registration Charges

- Registration Charges for 12A & 80G

Service

Form Name

Professional Fee

12A Registration (Tax Exemption for NGO/Trust)

Form 10A

Rs. 10,000

80G Registration (Tax Deduction for Donors)

Form 10A

Rs. 10,000

12A & 80G (Both Together)

Form 10A

Rs. 15,000

2. Renewal & Compliance Charges

Service

Form Name

Due Date

Professional Fee

Renewal of 12A & 80G

(If Already Registered Before 2021)

Form 10AB

Within 6 months before expiry

Rs. 12,000

Annual Compliance & Filing

Income Tax Return (ITR-7)

Every Year (Before Sep 30th)

Rs. 5,000

- Key Points:

✅ No Government Fee for 12A & 80G registration, but professional charges apply.

✅ Validity: Once registered after 2021, it is valid for 5 years (renewal required).

✅ Mandatory for NGOs, Trusts & Section 8 Companies seeking tax benefits & donor exemptions.

Eligibility Criteria for 12A & 80G Registration

Organizations applying for 12A & 80G registrations must meet the following criteria:

✔️ Registered NGOs : Trusts, Societies, or Section 8 Companies

✔️ Non-Profit Purpose : Must work for charity, education, or social welfare

✔️ Valid Documents : PAN card, registration certificate, and financial records

✔️ No Profit Distribution : Funds must be used only for charitable activities

✔️ Active Operations : NGO should be engaged in social work

12A & 80G Registration Process

✔️ Step 1: Collect necessary documents (PAN, registration certificate, financial statements, etc.).

✔️ Step 2: File the online application with the Income Tax Department using Form 10A (for 12A) and Form 10G (for 80G).

✔️ Step 3: Authorities review and verify documents. Additional information may be requested.

✔️ Step 4: If approved, the 12A & 80G certificates are issued.

✔️ Step 5: NGOs can now enjoy tax exemptions and offer donors tax benefits.

At Legal Kamkaj, we provide expert assistance for a quick and hassle-free 12A & 80G registration process.

Why Choose Legal Kamkaj for 12A & 80G Registration?

At Legal Kamkaj, we make 12A & 80G registration simple, fast, and stress-free for NGOs, Trusts, and Societies. Our expert team ensures a seamless process so you can focus on your charitable mission.

✅ Expert Assistance : Our team handles the entire process, from document preparation to approval.

✅ Fast Processing : We ensure quick submission and follow-ups for speedy approval.

✅ 100% Compliance : Get legally compliant 12A & 80G certificates without any stress.

✅ Affordable & Transparent Pricing : No hidden charges, just reliable services.

✅ Dedicated Support : Get step-by-step guidance from our experts.