Apply for PAN Card Online

A Permanent Account Number (PAN) Card is an essential identification document issued by the Income Tax Department of India. It is mandatory for financial transactions, tax filing, and identity verification. Applying for a PAN Card Online is a quick, hassle-free, and efficient process, enabling individuals and businesses to obtain their PAN without visiting a physical office.

With the PAN Card Online application process, you can conveniently submit your details, upload documents, and track your application status. Whether you are an individual, company, or foreign entity, applying for a PAN Card Online ensures smooth compliance with taxation and financial regulations in India.

At Legal Kamkaj, we simplify the process of applying for a PAN Card Online, offering expert assistance for a seamless and error-free application experience. Trust Legal Kamkaj for a fast, reliable, and professional PAN Card Online application service.

Apply for PAN Card ?

What is a PAN Card?

A Permanent Account Number (PAN) Card is a 10-digit unique alphanumeric ID issued by the Income Tax Department of India. It is mandatory for financial transactions, tax filing, and identity verification. Whether you are an individual, business, or foreign entity, a PAN Card Online is essential for smooth financial operations.

Benefits of PAN Card Online

A PAN Card (Permanent Account Number) is an important document for financial and tax-related activities. Applying for a PAN Card Online is a quick and hassle-free way to get your PAN without visiting an office.

Easy Income Tax Filing

Required for filing ITR and tax payments.

Smooth Banking Transactions

Needed for opening bank accounts, applying for loans, and credit cards.

Essential for Business & GST Registration

Required for companies, LLPs, and GST compliance.

Mandatory for High-Value Transactions

Needed for property purchases, vehicle registration, and investments.

Valid Lifetime & Accepted Nationwide

One-time issuance, no expiry, and accepted as identity proof.

Quick & Paperless Process

Apply online with Legal Kamkaj in a few simple steps.

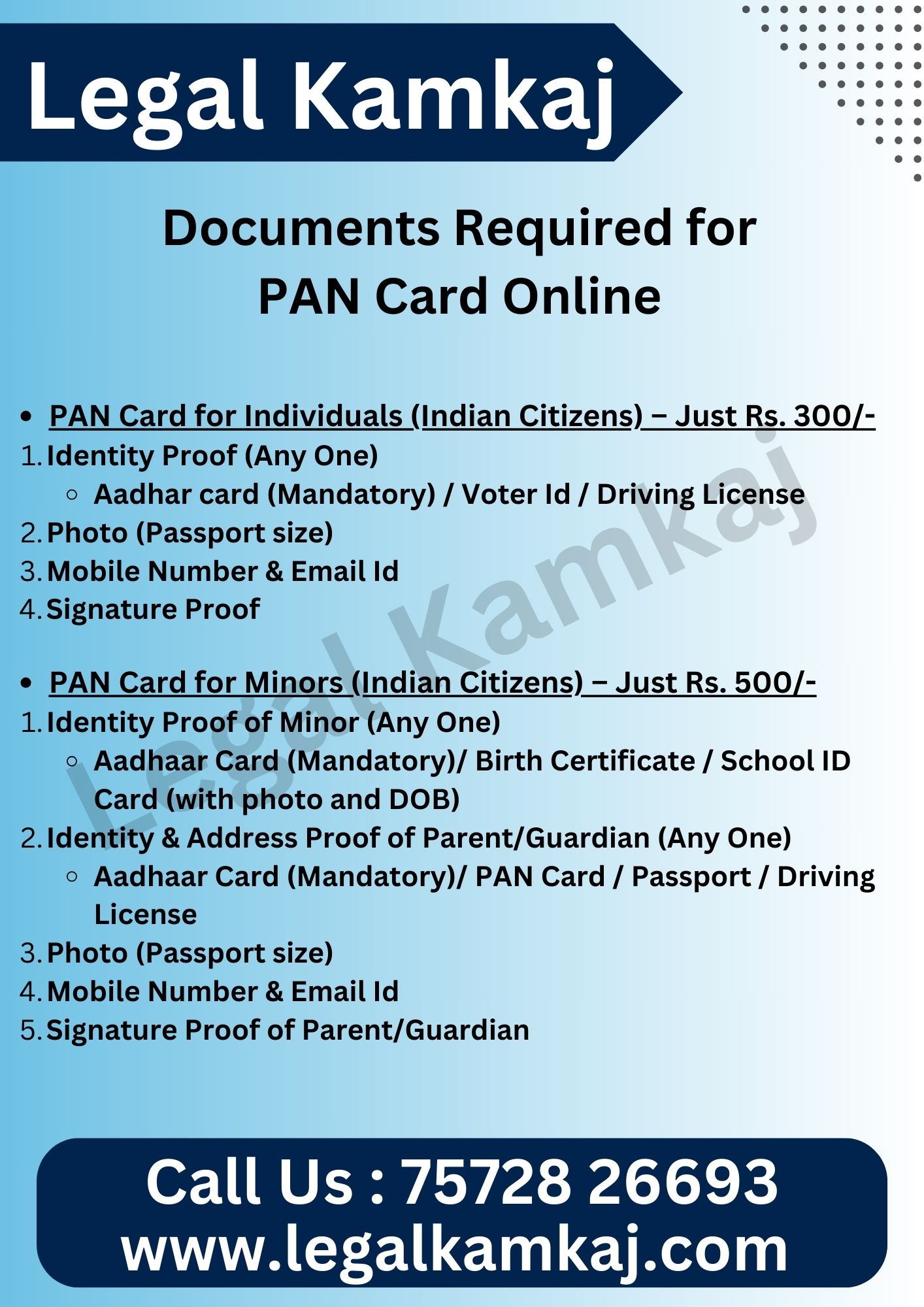

Documents Required for PAN Card Online

To apply for a PAN Card Online, you need to submit valid identity, address, and date of birth proofs. Below is the list of required documents:

Get Your PAN Card in Just 3 to 4 Days – Apply Today

- PAN Card for Individuals (Indian Citizens) – Just Rs. 300/-

- Identity Proof (Any One)

- Aadhar card (Mandatory) / Voter Id / Driving License

- Photo (Passport size)

- Mobile Number & Email Id

- Signature Proof

- PAN Card for Minors (Indian Citizens) – Just Rs. 500/-

- Identity Proof of Minor (Any One)

- Aadhaar Card (Mandatory)/ Birth Certificate / School ID Card (with photo and DOB)

- Identity & Address Proof of Parent/Guardian (Any One)

- Aadhaar Card (Mandatory)/ PAN Card / Passport / Driving License

- Photo (Passport size)

- Mobile Number & Email Id

- Signature Proof of Parent/Guardian

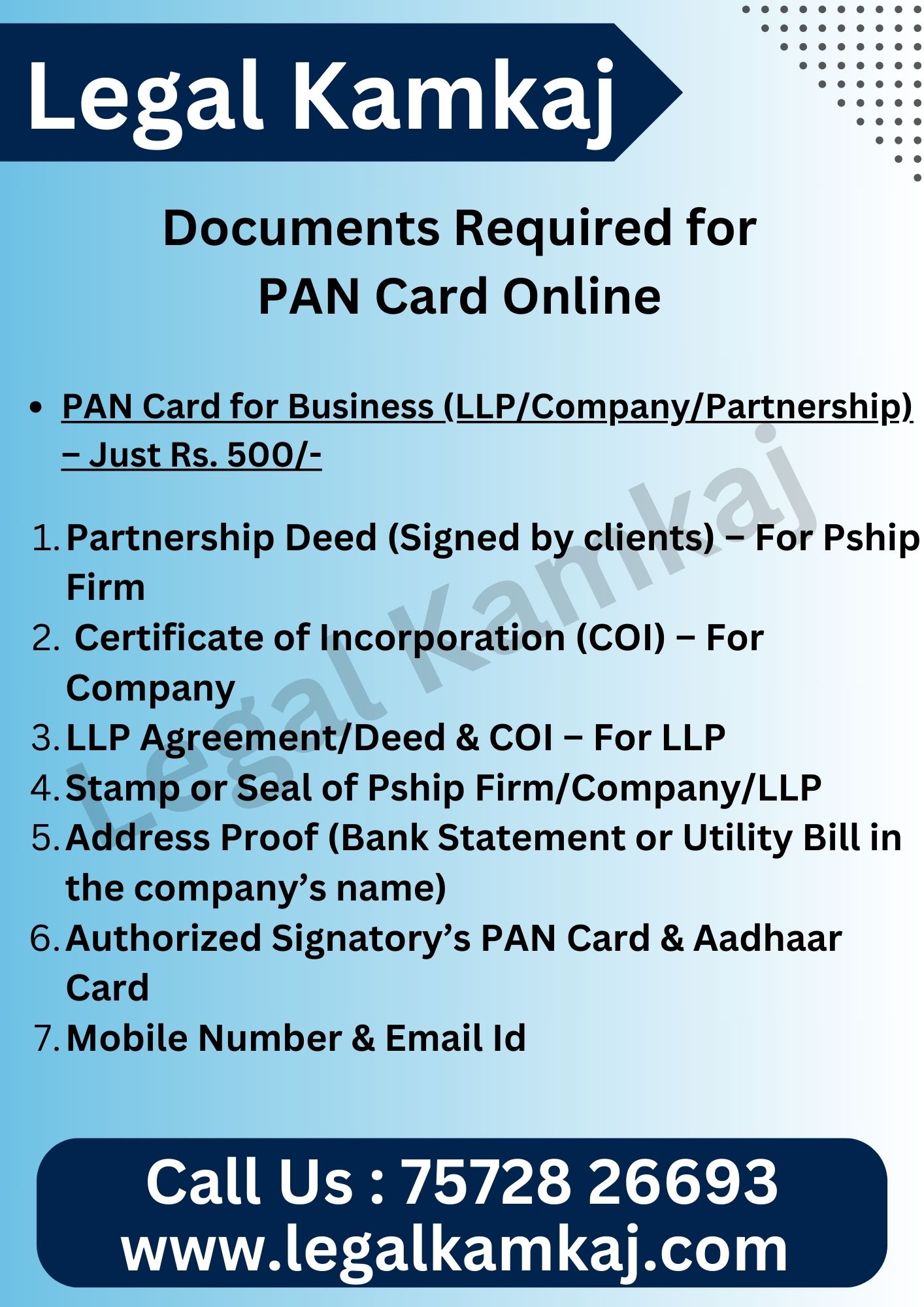

- PAN Card for Business (LLP/Company/Partnership) – Just Rs. 500/-

- Partnership Deed (Signed by clients) – For Pship Firm

- Certificate of Incorporation (COI) – For Company

- LLP Agreement/Deed & COI – For LLP

- Stamp or Seal of Pship Firm/Company/LLP

- Address Proof (Bank Statement or Utility Bill in the company’s name)

- Authorized Signatory’s PAN Card & Aadhaar Card

- Mobile Number & Email Id

How to Apply for PAN Card Online?

- Visit the Legal Kamkaj Website – Start your PAN Card Online application.

- Fill in Your Details – Enter personal and financial information accurately.

- Upload Required Documents – Submit ID proof, address proof & photographs.

- Make Payment Securely – Use safe online payment options.

- Track Application Status – Get real-time updates on your PAN Card Online progress.

Key Features of a PAN Card

- Unique Identification: Each PAN is unique and remains valid for a lifetime.

- Mandatory for Financial Transactions: Required for opening bank accounts, buying property, high-value transactions, and filing income tax returns.

- Issued by the Government: PAN is issued by the Income Tax Department under the supervision of the Central Board of Direct Taxes (CBDT).

- Applicable to Individuals & Entities: Not just for individuals, companies, firms, and foreign entities also need a PAN.

Explore the Three Different PAN Application Types

Click Below to Download PAN Application Forms:

1. PAN card application form 49A

2. PAN card correction form

3. Foreigner PAN apply Form 49AA

- The new application form is for applicants who need a new PAN and haven’t been issued one yet. Simply fill out and sign the form, attach the required documents, and submit it at any TIN-FC or PAN Center managed by the Income Tax Department.

New PAN Card or PAN Card Correction/Change

- New PAN Card: Apply if you are applying for a fresh PAN and have never been allotted one before.

- PAN Card Correction/Change: Apply if you need to update or correct details on your existing PAN, such as name, address, or date of birth.

Why Apply for PAN Card Online with Legal Kamkaj?

- Quick PAN Card Online Application – Apply from anywhere in India

- Hassle-Free Process – No physical visits required

- Track PAN Card Online Application Status easily

- Secure & Reliable Services by Legal Kamkaj

FAQs on PAN Card

A PAN (Permanent Account Number) is a unique 10-digit alphanumeric identifier issued by the Income Tax Department of India. It is used for tax-related and financial transactions.

- Filing income tax returns

- Opening a bank account

- Buying or selling property

- Making high-value transactions

- Investing in stocks, mutual funds, or fixed deposits

For individuals:

- Proof of Identity: Aadhaar, Voter ID, Passport, or Driving License

- Proof of Address: Aadhaar, Utility Bill, Rent Agreement, or Passport

- Proof of Date of Birth: Birth Certificate, Matriculation Certificate, or Passport

- It usually takes 10-15 working days after applying and submitting the required documents.